Evaluating Eisai (TSE:4523) After New CTAD Alzheimer’s Data and Pipeline Updates

Reviewed by Simply Wall St

Eisai (TSE:4523) just put its Alzheimer’s program back in the spotlight at the CTAD conference, with fresh lecanemab and etalanetug data that sharpen the long term commercial picture around its neurology pipeline.

See our latest analysis for Eisai.

Those CTAD updates land after a choppy stretch for investors, with the 1 year total shareholder return at 10.27% but a 3 year total shareholder return still deeply negative, so near term momentum looks tentative while the long term rebuilds.

If these Alzheimer advances have your attention, it could be a good time to scan other specialist names using our healthcare stocks and see what else fits your strategy.

With shares still trading below some valuation models despite a modest discount to analyst targets, the real question now is whether Eisai represents underappreciated Alzheimer upside or if the market is already discounting that future growth.

Most Popular Narrative Narrative: 7.6% Undervalued

With Eisai last closing at ¥4,633 against a narrative fair value near ¥5,012, the current share price sits below the storytellers view of upside.

The analysts have a consensus price target of ¥4715.385 for Eisai based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥6000.0, and the most bearish reporting a price target of just ¥3600.0.

Want to see what kind of earnings path and profit profile justify that gap between bear and bull targets, plus a higher future multiple than the sector, all under a single cohesive story? Dive in to see which long term revenue runway, margin upgrades and discount rate choice are doing the heavy lifting in this fair value math.

Result: Fair Value of ¥5012 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global drug price pressure and overreliance on LEQEMBI mean that any pricing reset or safety scare could quickly compress that implied upside.

Find out about the key risks to this Eisai narrative.

Another Angle on Valuation

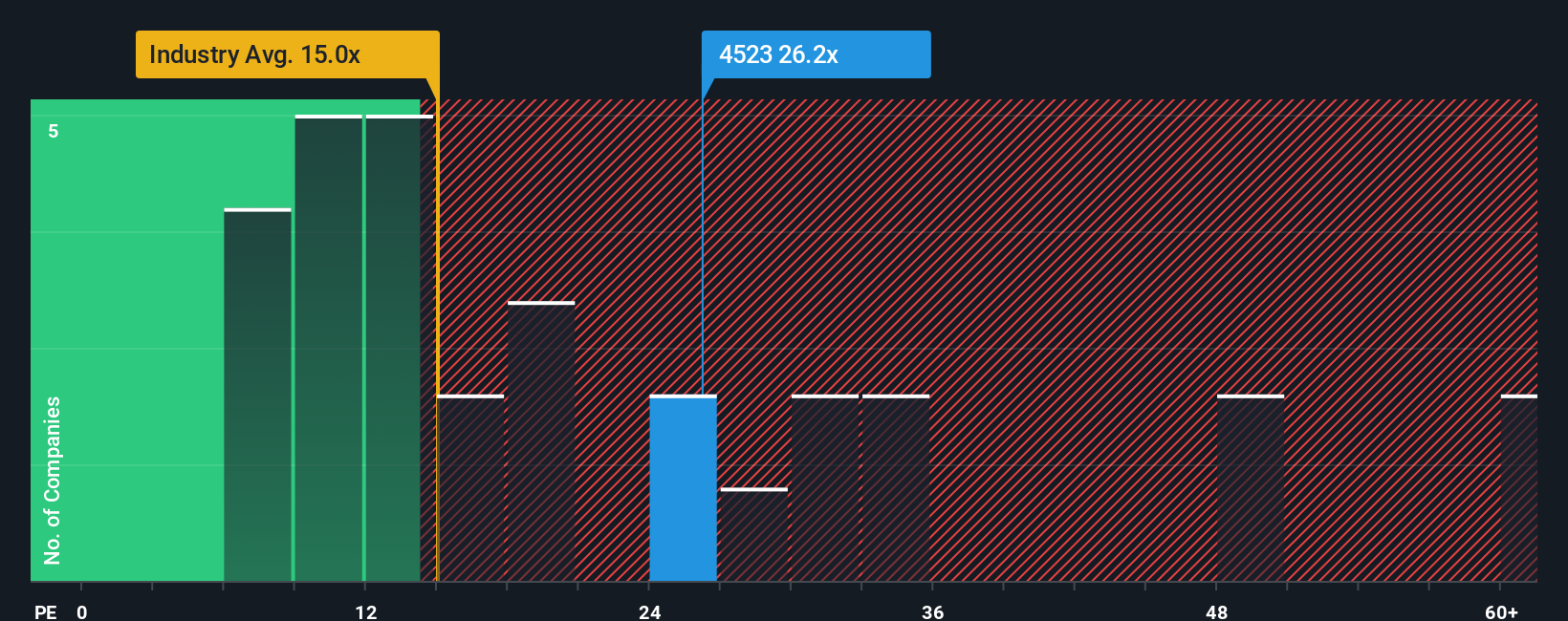

On earnings, Eisai looks far less forgiving. The shares change hands at about 26.5 times earnings, versus 19.4 times for peers and a fair ratio nearer 22.9 times. That premium narrows the margin of safety. How confident are you that Alzheimer upside will fully materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eisai Narrative

If this framing does not quite match your view, or you prefer digging into the numbers yourself, you can shape a fresh narrative in just minutes: Do it your way.

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning new opportunities on the Simply Wall Street Screener so you are never stuck reacting late.

- Target dependable income streams by scanning these 13 dividend stocks with yields > 3%. These can help anchor your portfolio through volatile markets.

- Capitalize on mispriced potential with these 907 undervalued stocks based on cash flows. These may offer outsized upside relative to their cash flow strength.

- Position yourself ahead of the next wave of technology by tracking these 26 AI penny stocks, which are shaping AI driven transformations across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)