- Japan

- /

- Retail Distributors

- /

- TSE:8117

Undiscovered Gems In Japan To Watch This August 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown a robust rebound recently, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%. This resurgence is driven by better-than-expected U.S. economic data and Japan’s own stronger-than-anticipated GDP growth in the second quarter. In this favorable environment, identifying stocks with solid fundamentals and growth potential can be particularly rewarding for investors looking to capitalize on Japan's market momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

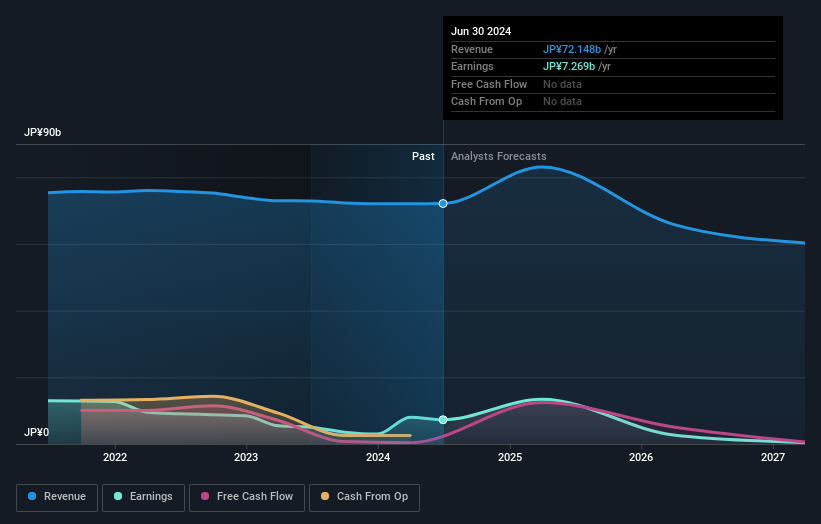

Kaken Pharmaceutical (TSE:4521)

Simply Wall St Value Rating: ★★★★★★

Overview: Kaken Pharmaceutical Co., Ltd. produces, markets, and sells medical products, medical devices, and agrochemicals in Japan and internationally with a market cap of ¥148.41 billion.

Operations: Kaken Pharmaceutical generates revenue primarily from its pharmaceutical business, which accounts for ¥69.61 billion, while its real estate segment contributes ¥2.43 billion.

Kaken Pharmaceutical, a small cap Japanese stock, has seen impressive earnings growth of 47.5% over the past year, significantly outpacing the pharmaceutical industry’s 8.6%. The company boasts high-quality earnings and sufficient interest coverage. Despite this growth, forecasts indicate a potential average annual decline in earnings by 43.7% over the next three years. Over five years, Kaken's debt-to-equity ratio improved from 3.2 to 2.7, showcasing prudent financial management amidst profitability concerns.

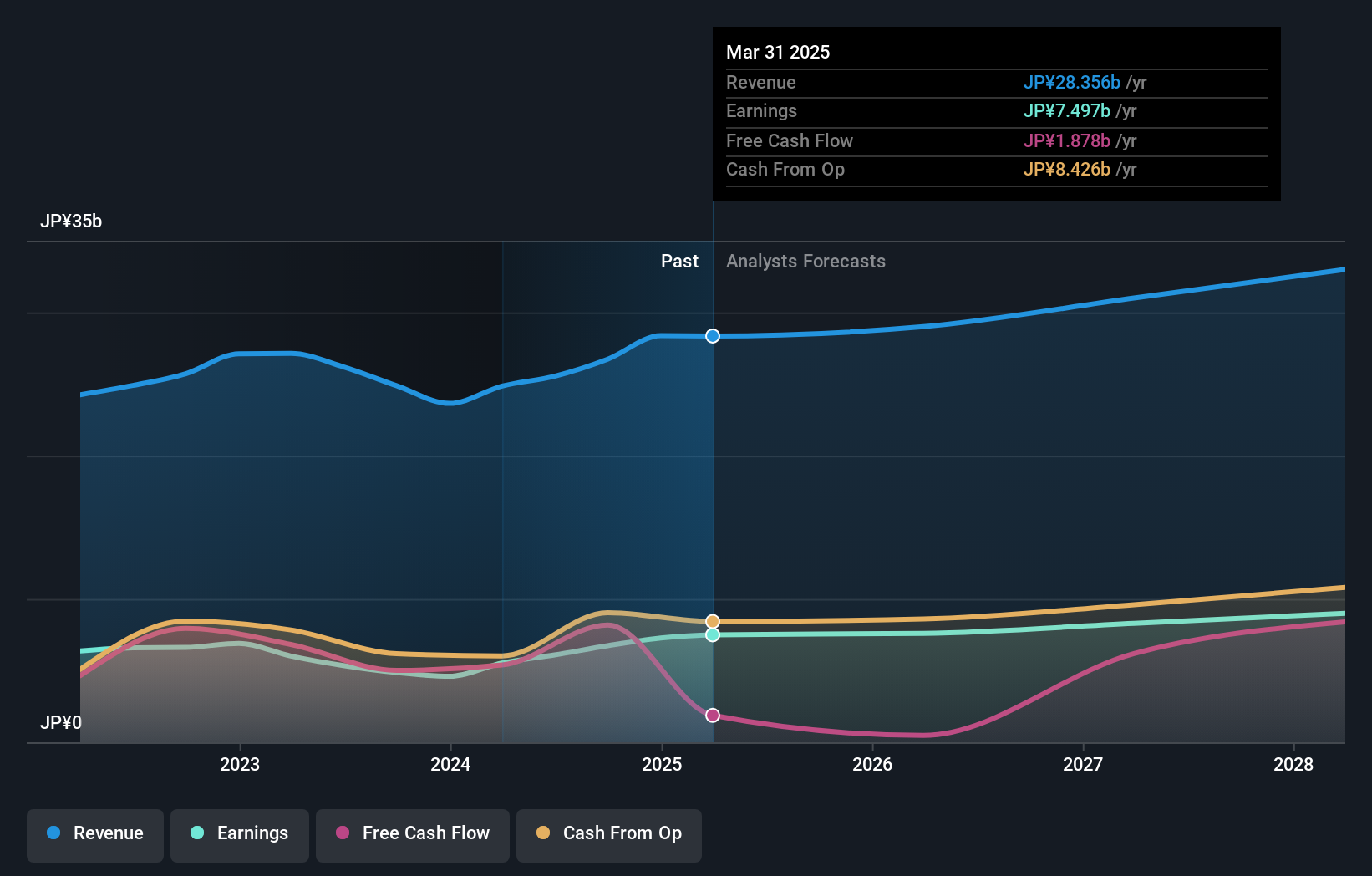

JCU (TSE:4975)

Simply Wall St Value Rating: ★★★★★★

Overview: JCU Corporation produces and sells chemicals, machines, and auxiliary equipment for surface treatment in Japan with a market cap of ¥88.82 billion.

Operations: JCU Corporation generates revenue primarily from the sale of chemicals, machines, and auxiliary equipment for surface treatment. The company's net profit margin is 12.34%.

JCU Corporation, a niche player in the chemicals industry, has been trading at 53.6% below its estimated fair value. Over the past year, earnings grew by 13.9%, outpacing the industry's 9.9%. The company’s debt to equity ratio improved significantly from 4.5% to 1.2% in five years, showing prudent financial management. Recently, JCU announced a share repurchase program worth ¥1,500 million for up to 700,000 shares aimed at flexible capital policy and cancellation of treasury stock.

- Dive into the specifics of JCU here with our thorough health report.

Assess JCU's past performance with our detailed historical performance reports.

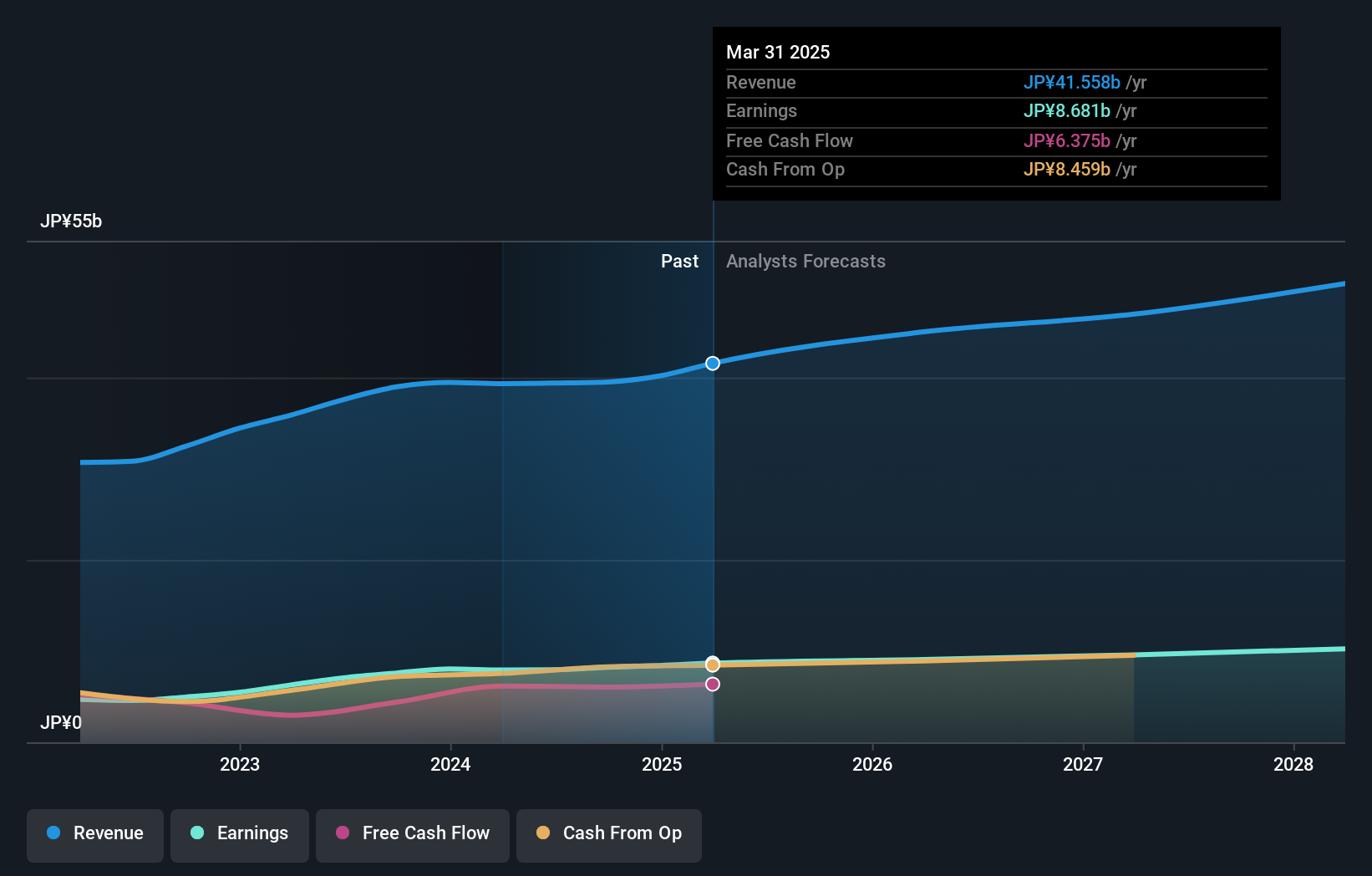

Central Automotive Products (TSE:8117)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Automotive Products Ltd. engages in the import, export, and wholesale of automotive parts and accessories, with a market cap of ¥89.97 billion.

Operations: Central Automotive Products Ltd. generates revenue primarily from the import, export, and wholesale of automotive parts and accessories. The company reported a market cap of ¥89.97 billion.

Central Automotive Products has shown impressive financial health, with earnings growing by 12.5% over the past year, outpacing the Retail Distributors industry’s 6.9%. The company is trading at 40.3% below its estimated fair value, suggesting significant upside potential. Additionally, it remains debt-free and boasts high-quality earnings. Forecasts indicate a steady annual growth rate of 7.16%, positioning it well for future expansion in the automotive sector.

Seize The Opportunity

- Click this link to deep-dive into the 753 companies within our Japanese Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8117

Central Automotive Products

Engages in the import, export, and wholesale of automotive parts and accessories.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives