Companies Like RaQualia Pharma (TYO:4579) Can Afford To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should RaQualia Pharma (TYO:4579) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for RaQualia Pharma

When Might RaQualia Pharma Run Out Of Money?

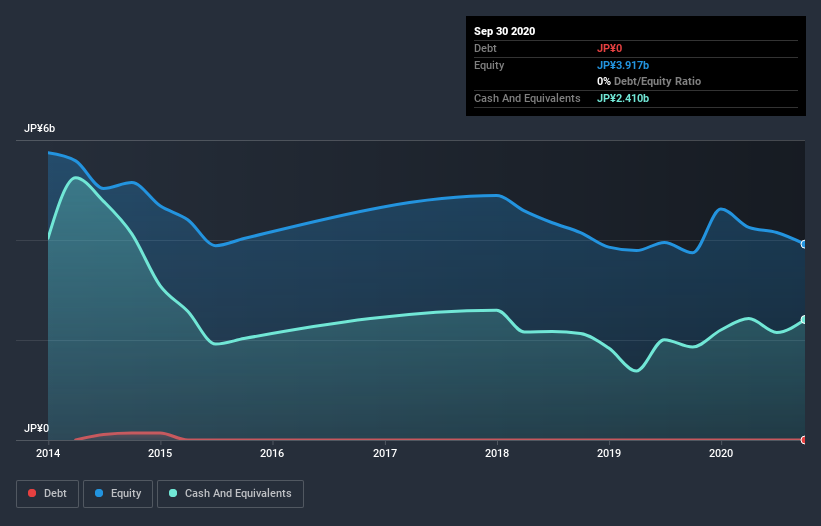

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at September 2020, RaQualia Pharma had cash of JP¥2.4b and no debt. Looking at the last year, the company burnt through JP¥178m. That means it had a cash runway of very many years as of September 2020. Notably, however, the one analyst we see covering the stock thinks that RaQualia Pharma will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. Depicted below, you can see how its cash holdings have changed over time.

How Well Is RaQualia Pharma Growing?

RaQualia Pharma managed to reduce its cash burn by 79% over the last twelve months, which suggests it's on the right flight path. And there's no doubt that the inspiriting revenue growth of 70% assisted in that improvement. Overall, we'd say its growth is rather impressive. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can RaQualia Pharma Raise More Cash Easily?

We are certainly impressed with the progress RaQualia Pharma has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of JP¥21b, RaQualia Pharma's JP¥178m in cash burn equates to about 0.8% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About RaQualia Pharma's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way RaQualia Pharma is burning through its cash. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. It's clearly very positive to see that at least one analyst is forecasting the company will break even fairly soon. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. While we always like to monitor cash burn for early stage companies, qualitative factors such as the CEO pay can also shed light on the situation. Click here to see free what the RaQualia Pharma CEO is paid..

Of course RaQualia Pharma may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade RaQualia Pharma, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:4579

RaQualia Pharma

Engages in the research and development of pharmaceutical compounds worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives