- China

- /

- Communications

- /

- SZSE:301600

Exploring High Growth Tech Stocks In Asia For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience fluctuations, with the S&P 500 and Nasdaq reaching new records amid solid corporate earnings, Asian tech stocks are drawing attention for their potential high growth opportunities. In this dynamic environment, a good stock often demonstrates resilience to economic pressures and possesses innovative capabilities that align with current technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 29.99% | 37.03% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market cap of HK$86.39 billion.

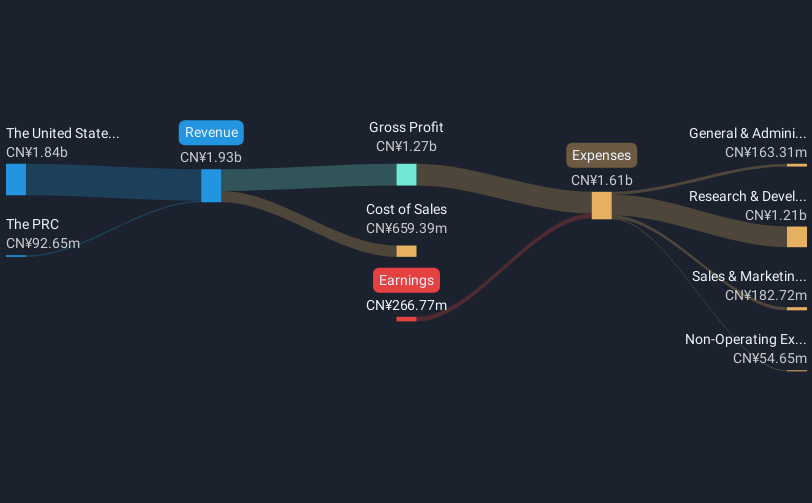

Operations: Kelun-Biotech specializes in developing and commercializing innovative drugs, primarily targeting oncology and immunology. The company generated CN¥1.93 billion in revenue from its pharmaceuticals segment.

Sichuan Kelun-Biotech Biopharmaceutical's strategic focus on innovative antibody-drug conjugates (ADCs) like SKB315 and sac-TMT highlights its commitment to addressing unmet medical needs in oncology, particularly in gastric and non-small cell lung cancers. Recent regulatory approvals and breakthrough therapy designations underscore the potential of these therapies to improve treatment paradigms. The company's recent follow-on equity offering of HKD 1.96 billion supports its robust R&D initiatives, ensuring sustained investment in clinical trials and new drug development. With a revenue growth forecast at 28.4% per year and earnings expected to surge by 37% annually, Sichuan Kelun-Biotech is strategically positioned to capitalize on significant market opportunities within the high-growth biopharmaceutical sector in Asia.

- Click here and access our complete health analysis report to understand the dynamics of Sichuan Kelun-Biotech Biopharmaceutical.

Learn about Sichuan Kelun-Biotech Biopharmaceutical's historical performance.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥11.16 billion.

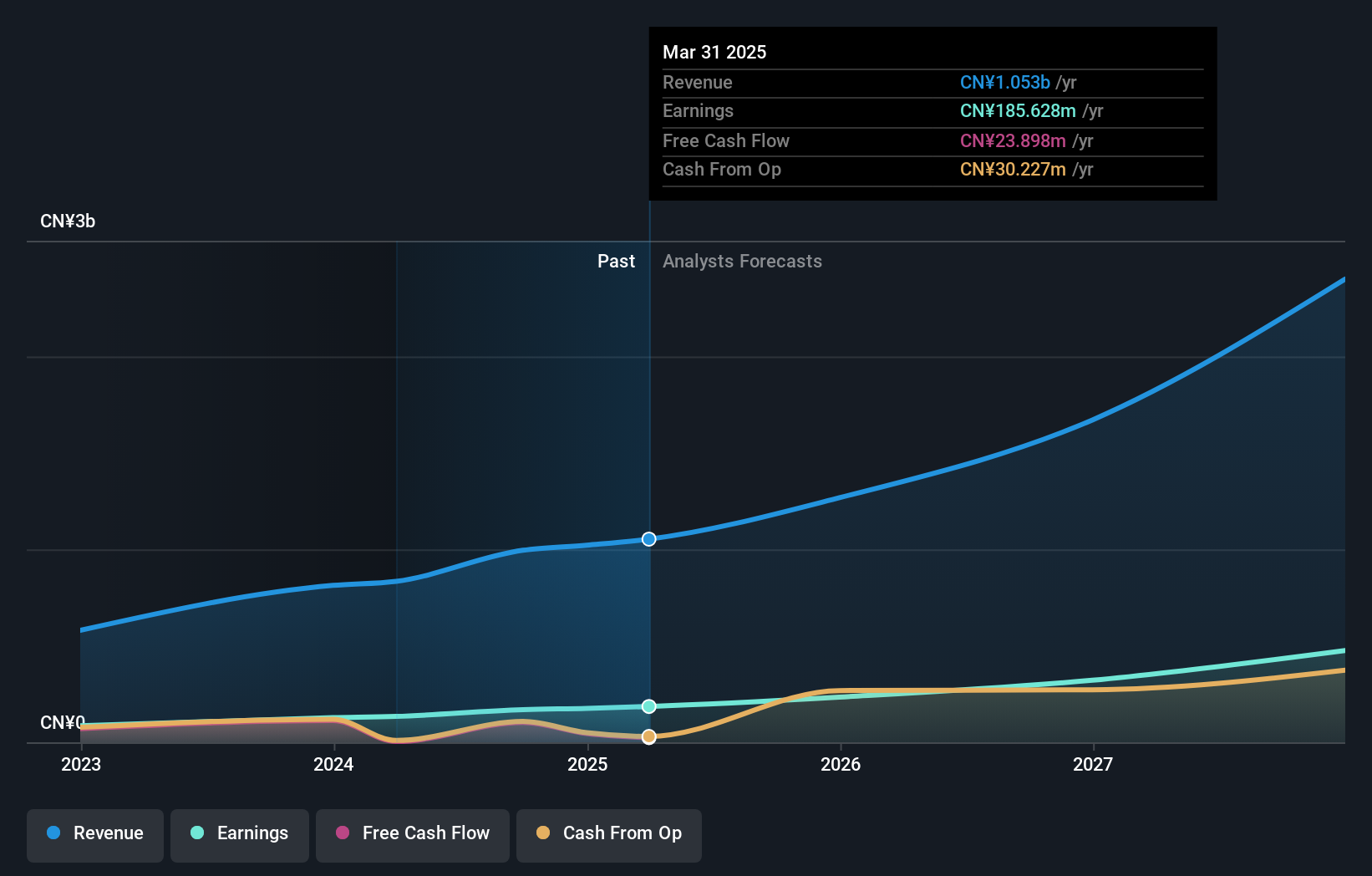

Operations: Flaircomm generates revenue primarily from wireless communications equipment, amounting to CN¥1.05 billion. The company's focus is on the automotive and M2M sectors within China.

Flaircomm Microelectronics has demonstrated robust growth with a notable 30.4% annual revenue increase and an even more impressive 34.4% rise in earnings, outpacing the broader Chinese market's performance. Recent governance enhancements and shareholder meetings suggest proactive management, aligning with its strategic expansions and R&D commitment—R&D spending has been substantial, fostering innovations crucial for staying ahead in competitive tech landscapes. These factors collectively underscore Flaircomm's potential to leverage technological advancements and market dynamics, enhancing its positioning in Asia's tech sector.

- Click here to discover the nuances of Flaircomm Microelectronics with our detailed analytical health report.

Understand Flaircomm Microelectronics' track record by examining our Past report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company engaged in the planning, development, manufacturing, sale, and distribution of home video games, online games, mobile games, and arcade games with a market capitalization of ¥1.84 trillion.

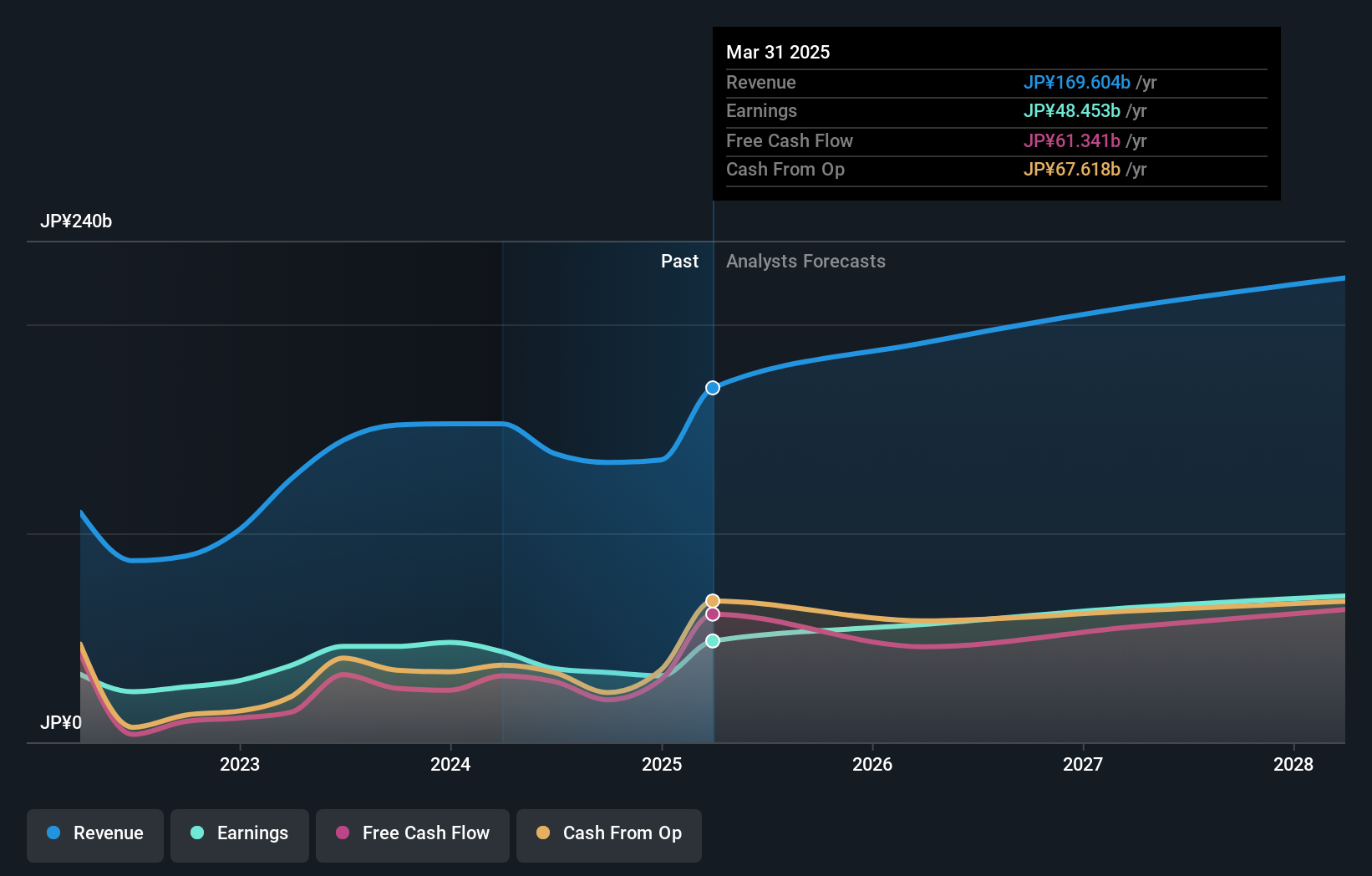

Operations: Capcom generates significant revenue from its Digital Content segment, amounting to ¥125.13 billion, which includes home video games and online games. The company also earns from Amusement Facilities and Amusement Equipment segments, contributing ¥22.75 billion and ¥15.61 billion respectively.

Capcom's strategic focus on developing new IPs like PRAGMATA, alongside the evolution of its flagship series with Resident Evil Requiem, highlights its innovative drive within the gaming industry. With an 8.4% annual revenue growth and an 11.1% rise in earnings forecast, Capcom is outpacing the Japanese market significantly. The company has allocated JPY 73 billion for operating income in FY2026, underlining its robust financial planning and commitment to reinvesting in groundbreaking technologies and game development. These initiatives are set to enhance Capcom's competitive edge by not only retaining a loyal customer base but also attracting new segments of gamers globally.

- Delve into the full analysis health report here for a deeper understanding of Capcom.

Gain insights into Capcom's past trends and performance with our Past report.

Key Takeaways

- Reveal the 479 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives