- China

- /

- Electronic Equipment and Components

- /

- SHSE:688600

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic indicators. With major indexes experiencing slight declines, investors are closely watching the impact of U.S. trade policies and labor market fluctuations on small-cap stocks. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovative solutions and adaptability to changing economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 115.81% | 125.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.21% | 57.07% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1209 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

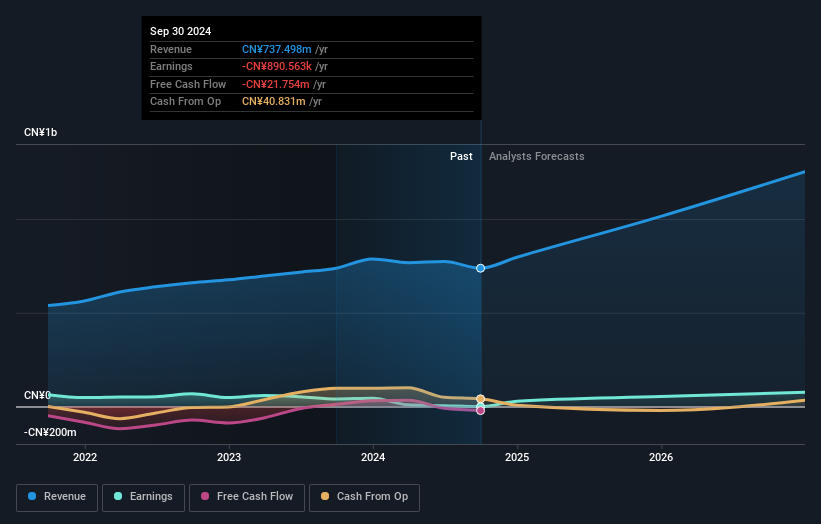

Anhui Wanyi Science and TechnologyLtd (SHSE:688600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Wanyi Science and Technology Co., Ltd. operates within the technology sector and has a market capitalization of CN¥1.90 billion.

Operations: Anhui Wanyi Science and Technology Co., Ltd. focuses on the technology sector, generating revenue through its specialized products and services. The company's financial performance is reflected in its market capitalization of CN¥1.90 billion, indicating its presence in the industry.

Anhui Wanyi Science and Technology Co., Ltd. is navigating a transformative phase, with revenue projected to surge by 23.9% annually, outpacing the broader Chinese market's growth of 13.4%. This uptick is underpinned by robust earnings forecasts, expecting a dramatic increase of 78.2% per year as the company moves towards profitability within three years. Notably, its commitment to innovation is evident from its R&D investments which have consistently aligned with strategic growth areas in technology. Recent share repurchase activities further reflect confidence in their trajectory, having bought back shares worth CNY 103.92 million since last November, enhancing shareholder value amidst expansive operational scaling.

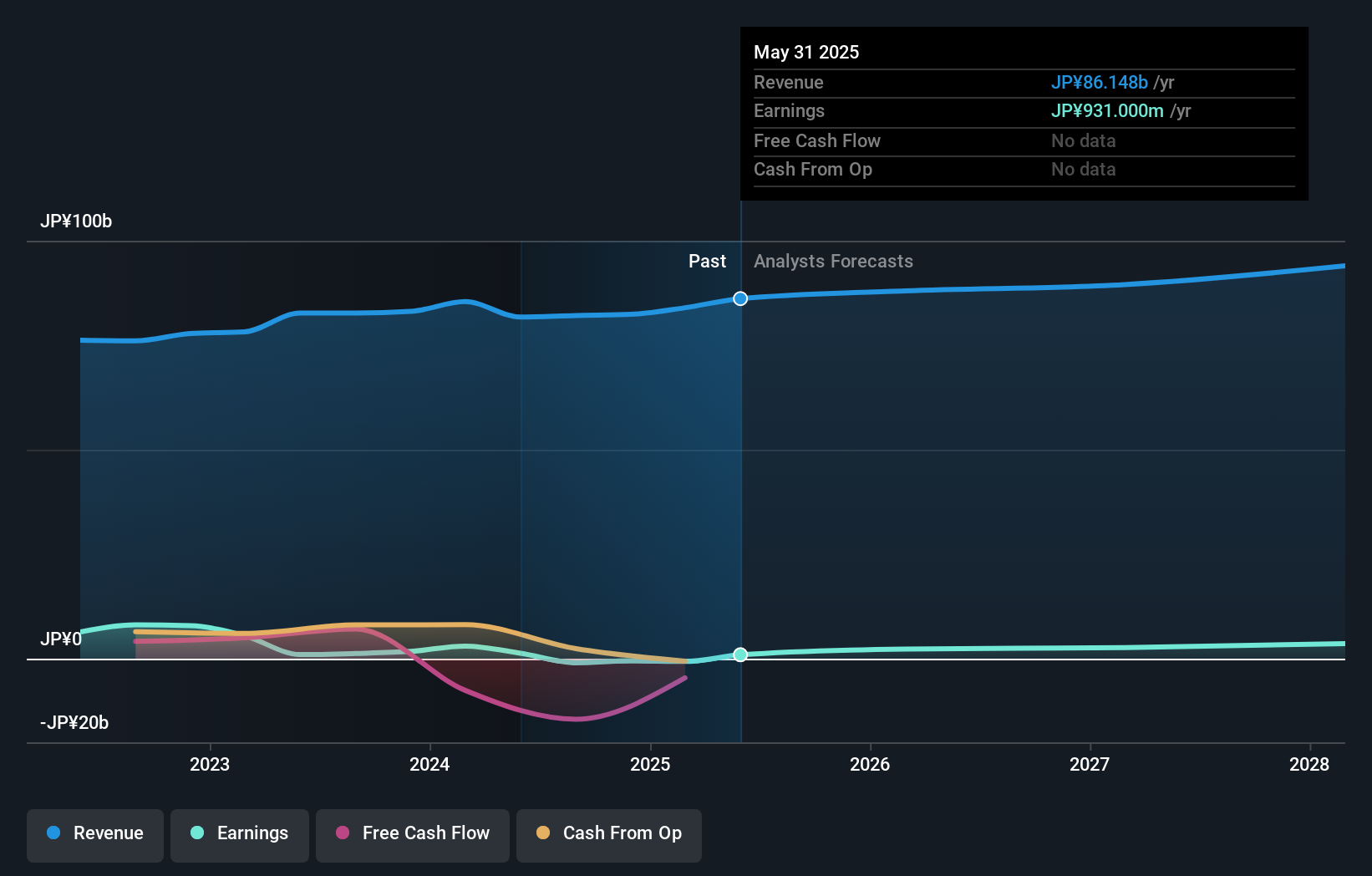

Shochiku (TSE:9601)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shochiku Co., Ltd. operates in audio and video, theatre, real estate, and other businesses both in Japan and internationally with a market cap of ¥168.89 billion.

Operations: Shochiku Co., Ltd. derives its revenue from diverse segments, including audio and video production, theatre operations, and real estate activities across Japan and international markets. The company focuses on leveraging its expertise in entertainment content creation while managing costs associated with these operations.

Shochiku, a player in the entertainment sector, is on a promising trajectory with its revenue expected to climb by 4.4% annually, slightly outpacing Japan's market average of 4.3%. This growth is coupled with an impressive forecast of earnings increasing by approximately 121% per year as the company approaches profitability within the next three years. The firm's commitment to innovation and future readiness is underscored by significant R&D investments, positioning it uniquely within its industry despite current unprofitability. With these strategic moves, Shochiku appears poised for transformative growth, leveraging both technological advancements and market dynamics to enhance its competitive stance.

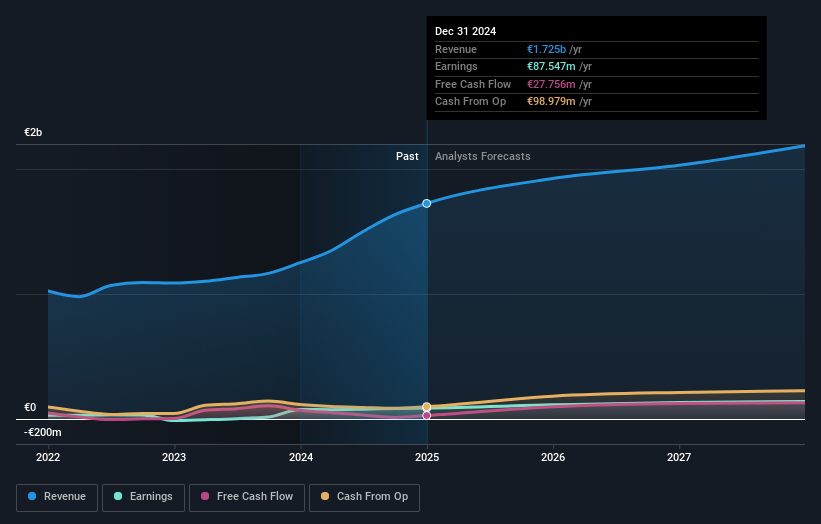

Kontron (XTRA:SANT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kontron AG provides internet of things (IoT) solutions both in Austria and internationally, with a market capitalization of approximately €1.21 billion.

Operations: The company generates revenue primarily from its Europe segment, contributing approximately €1.16 billion, and from Software + Solutions at €429.91 million. The global segment adds another €294.77 million to the revenue stream.

With a robust pipeline of high-profile contracts and strategic positioning in defense technologies, Kontron AG is setting the stage for substantial growth. The company's recent announcement of expected revenue to hit between EUR 1.9 billion and EUR 2.0 billion in 2025, coupled with an operating earnings forecast of at least EUR 220 million, reflects a significant upward trajectory from the previous year's EUR 1.7 billion revenue—a more than 40% increase. This financial uplift is bolstered by a major EUR 165 million order from a leading European defense technology firm, emphasizing Kontron's expertise in high-performance computing for critical applications. Additionally, securing a new USD 20 million contract in the U.S., focusing on unmanned aerial vehicle systems, underlines its competitive edge and innovation strength in emerging tech sectors crucial for future security frameworks.

- Unlock comprehensive insights into our analysis of Kontron stock in this health report.

Evaluate Kontron's historical performance by accessing our past performance report.

Where To Now?

- Delve into our full catalog of 1209 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688600

Anhui Wanyi Science and TechnologyLtd

AnHui Wanyi Science and Technology Co.,Ltd.

Excellent balance sheet low.

Market Insights

Community Narratives