As global markets continue to navigate the evolving economic landscape, U.S. stocks have been buoyed by optimism surrounding potential trade deals and significant investments in artificial intelligence infrastructure, driving major indexes like the S&P 500 to new highs. In this dynamic environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration amid fluctuating market sentiments and policy shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

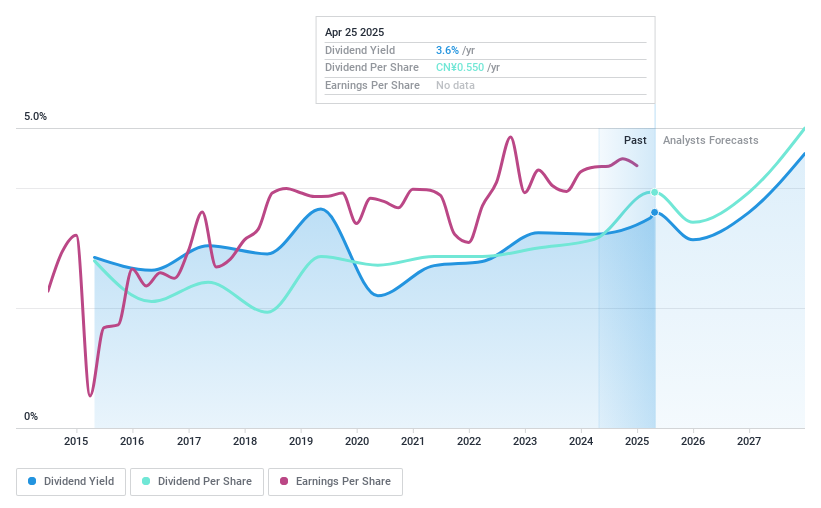

Heilongjiang Agriculture (SHSE:600598)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Heilongjiang Agriculture Company Limited focuses on the contracting and management of cultivated land in China, with a market cap of CN¥25.30 billion.

Operations: Heilongjiang Agriculture Company Limited generates revenue primarily from its Agriculture Industry segment, amounting to CN¥5.42 billion.

Dividend Yield: 3.1%

Heilongjiang Agriculture has shown growth in earnings, with a net income of CNY 1.35 billion for the first nine months of 2024, up from CNY 1.29 billion the previous year. The company's dividend yield is competitive at 3.09%, ranking in the top quartile within China. However, its dividends have been volatile over the past decade despite being covered by earnings and cash flows, with payout ratios of 70.1% and 66.6%, respectively.

- Dive into the specifics of Heilongjiang Agriculture here with our thorough dividend report.

- Our valuation report unveils the possibility Heilongjiang Agriculture's shares may be trading at a discount.

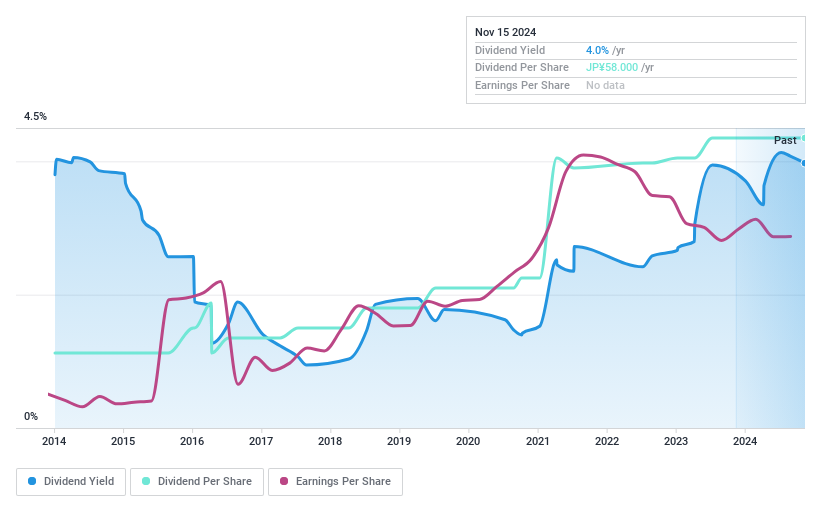

LIKE (TSE:2462)

Simply Wall St Dividend Rating: ★★★★★★

Overview: LIKE Co., Ltd. provides a variety of human resource services in Japan with a market cap of ¥28.02 billion.

Operations: LIKE Co., Ltd.'s revenue segments include Nursing-Related Service Business at ¥8.29 billion, Child Care Support Service Business at ¥31.44 billion, and Comprehensive Human Resources Services Business at ¥21.28 billion.

Dividend Yield: 4%

LIKE Co., Ltd. offers a high and stable dividend yield of 3.97%, ranking in the top 25% of Japanese dividend payers. Its dividends have been consistently growing and reliable over the past decade, supported by a payout ratio of 50.6% from earnings and 74.7% from cash flows, indicating sustainability. The company's Price-To-Earnings ratio is attractively below the market average at 12.7x, suggesting good value for investors seeking dependable income streams in Japan's market.

- Take a closer look at LIKE's potential here in our dividend report.

- Upon reviewing our latest valuation report, LIKE's share price might be too optimistic.

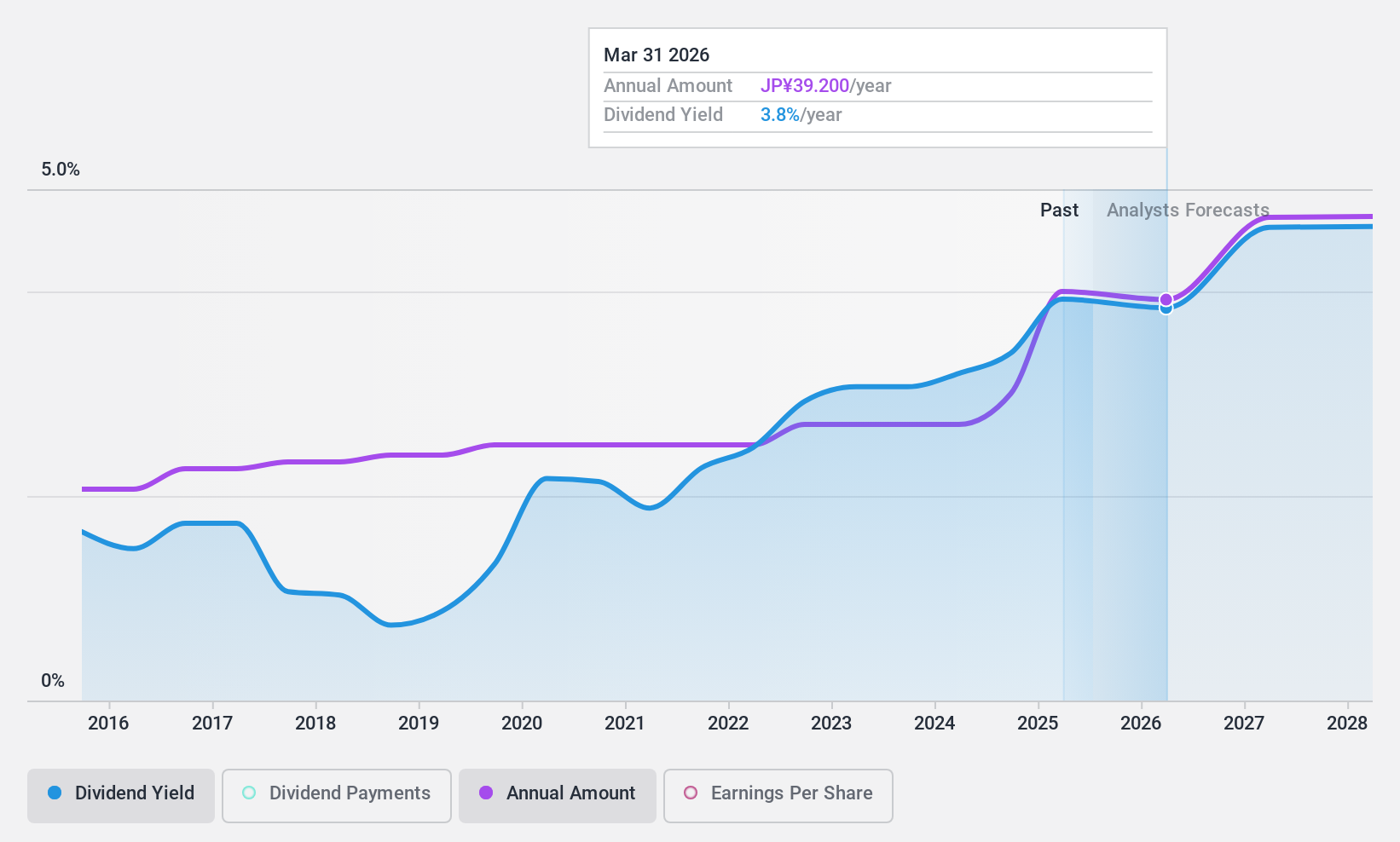

Zenrin (TSE:9474)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zenrin Co., Ltd. specializes in the collection and management of geospatial information on a global scale, with a market cap of ¥45.32 billion.

Operations: Zenrin Co., Ltd.'s revenue segments focus on geospatial information services across various global markets.

Dividend Yield: 3.5%

Zenrin's dividend yield of 3.53% is reliable and stable, having grown over the past decade, though it falls slightly below the top tier in Japan. The payout ratios of 72.9% from earnings and 62.5% from cash flows indicate sustainability, ensuring dividends are well-covered by profits and cash flows. Trading at a significant discount to its fair value and peers, Zenrin presents an attractive opportunity for income-focused investors despite some large one-off items affecting recent financial results.

- Click to explore a detailed breakdown of our findings in Zenrin's dividend report.

- According our valuation report, there's an indication that Zenrin's share price might be on the cheaper side.

Where To Now?

- Reveal the 1971 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang Agriculture might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600598

Heilongjiang Agriculture

Engages in the contracting and management of cultivated land in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives