- Japan

- /

- Auto Components

- /

- TSE:5185

3 Dividend Stocks To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with the Nasdaq Composite reaching new heights while other major indexes face declines, investors are keenly observing economic indicators such as inflation and labor market data that suggest potential shifts in monetary policy. Amid these fluctuating conditions, dividend stocks can offer stability and income potential, making them an appealing choice for enhancing investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1868 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

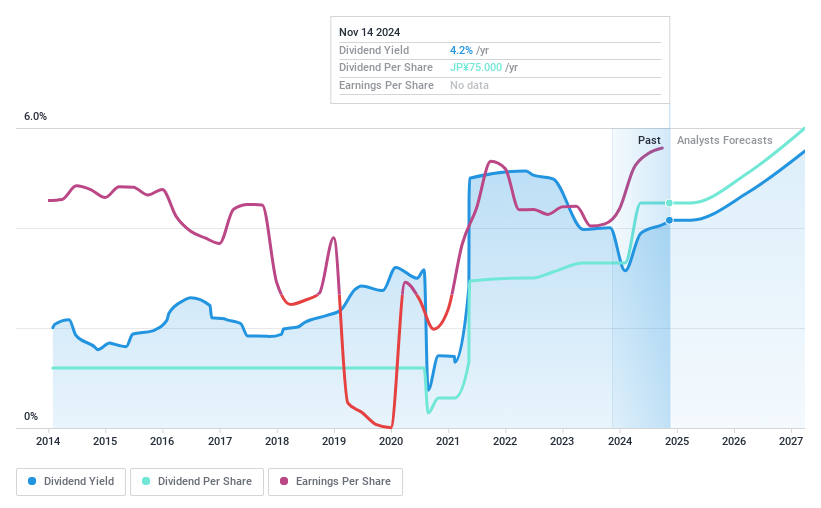

FukokuLtd (TSE:5185)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fukoku Co., Ltd. is engaged in the production and sale of rubber products both in Japan and internationally, with a market capitalization of ¥27.64 billion.

Operations: Fukoku Co., Ltd.'s revenue segments include the production and sale of rubber products domestically and globally.

Dividend Yield: 4.4%

Fukoku Ltd. recently announced a dividend increase to JPY 37.50 per share, reflecting its stable and reliable dividend history over the past decade. Although its 4.37% yield ranks in the top tier of JP market payers, concerns arise as dividends are not fully covered by cash flows despite a low payout ratio of 14.8%. Trading significantly below estimated fair value, Fukoku presents good relative value compared to peers and industry standards.

- Get an in-depth perspective on FukokuLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that FukokuLtd's share price might be on the cheaper side.

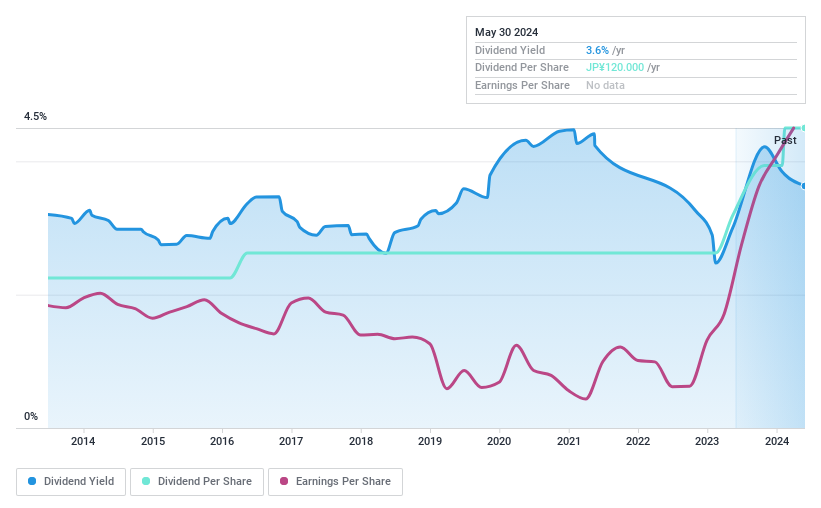

Mars Group Holdings (TSE:6419)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mars Group Holdings Corporation, with a market cap of ¥58.29 billion, operates in Japan through its subsidiaries in the amusement, automatic recognition system, and hotel and restaurant sectors.

Operations: Mars Group Holdings Corporation generates revenue from its amusement segment (¥37.59 billion), smart solution related business (¥5.34 billion), and hotel/restaurant related business (¥2.48 billion).

Dividend Yield: 6.2%

Mars Group Holdings has consistently delivered stable and reliable dividends over the past decade, with recent increases reflecting a robust dividend history. The current yield of 6.17% places it among the top 25% in the JP market, supported by a sustainable payout ratio of 40.2%. Earnings growth of 40.1% over the past year further strengthens its dividend coverage. Trading at a significant discount to its estimated fair value, Mars offers attractive potential for income-focused investors.

- Click here to discover the nuances of Mars Group Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Mars Group Holdings' shares may be trading at a discount.

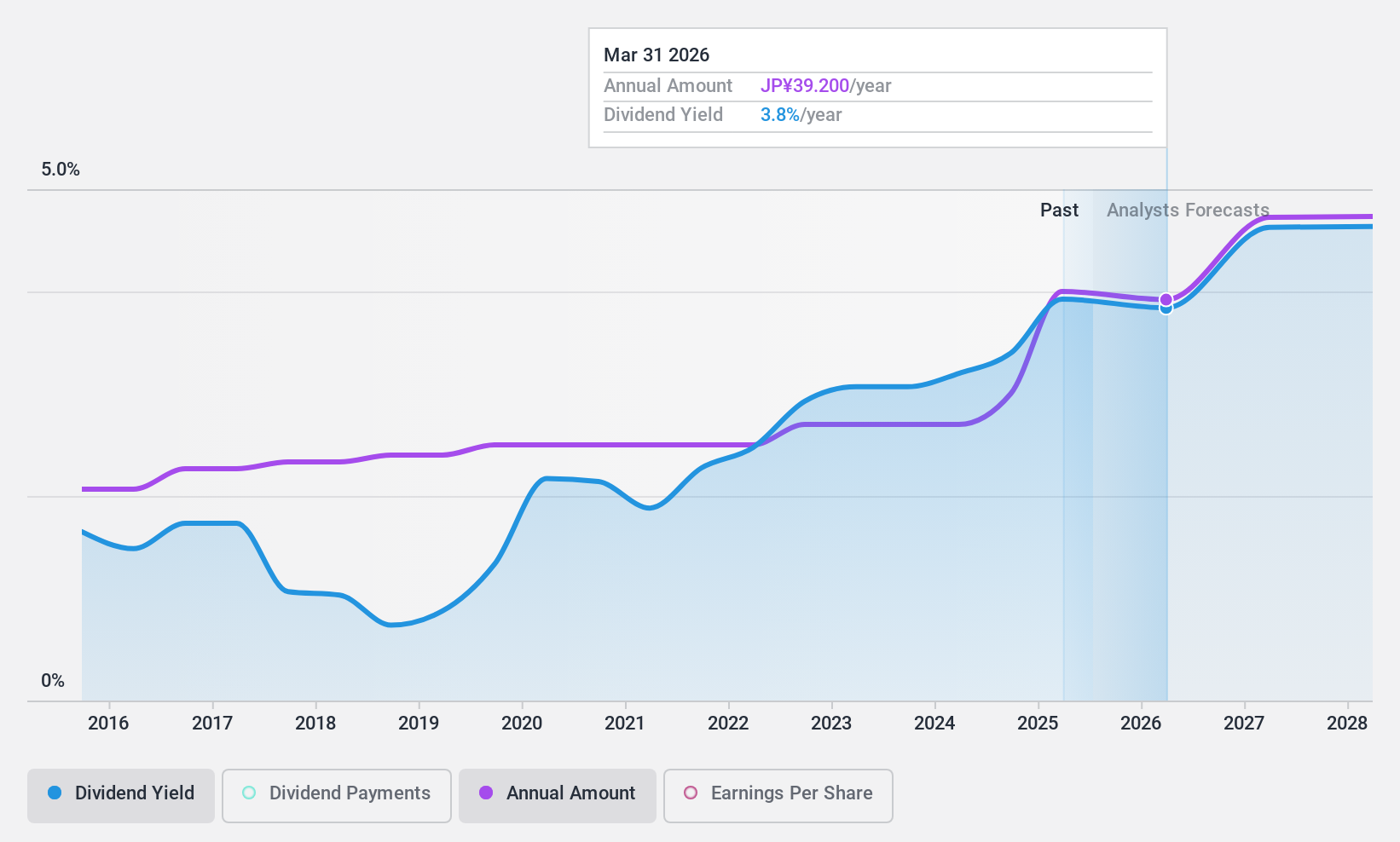

Zenrin (TSE:9474)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zenrin Co., Ltd. is involved in the collection and management of geospatial information globally, with a market cap of ¥43.61 billion.

Operations: Zenrin Co., Ltd.'s revenue segments include the collection and management of diverse geospatial data on a global scale.

Dividend Yield: 3.7%

Zenrin's dividends have been stable and growing over the past decade, supported by a payout ratio of 72.9% and cash flow coverage at 62.5%. Although its dividend yield of 3.67% is slightly below the top quartile in Japan, it remains reliable. Zenrin trades at a significant discount to its estimated fair value, enhancing its appeal for value-conscious investors despite recent earnings growth being impacted by large one-off items.

- Click here and access our complete dividend analysis report to understand the dynamics of Zenrin.

- Upon reviewing our latest valuation report, Zenrin's share price might be too pessimistic.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1868 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5185

FukokuLtd

Produces and sells rubber products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives