- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

3 Stocks Estimated To Be Up To 49.5% Undervalued

Reviewed by Simply Wall St

Amid recent political developments and economic shifts, global markets have shown resilience, with major U.S. indices reaching record highs fueled by optimism surrounding trade policies and advancements in artificial intelligence. As investors navigate these evolving conditions, identifying undervalued stocks can present opportunities for potential growth within a buoyant market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Subros (BSE:517168) | ₹600.55 | ₹1196.98 | 49.8% |

| Round One (TSE:4680) | ¥1302.00 | ¥2590.44 | 49.7% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.14 | 50% |

| GlobalData (AIM:DATA) | £1.785 | £3.57 | 49.9% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.93 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37697.69 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €6.76 | €13.46 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.01 | 49.8% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.86 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Bufab (OM:BUFAB)

Overview: Bufab AB (publ) is a trading company specializing in sourcing, quality control, and logistics solutions for C-parts both in Sweden and internationally, with a market cap of SEK17.43 billion.

Operations: Bufab's revenue segments include SEK2.45 billion from Sweden, SEK3.12 billion from Other Europe, SEK1.78 billion from North America, and SEK0.95 billion from Asia and the Pacific region.

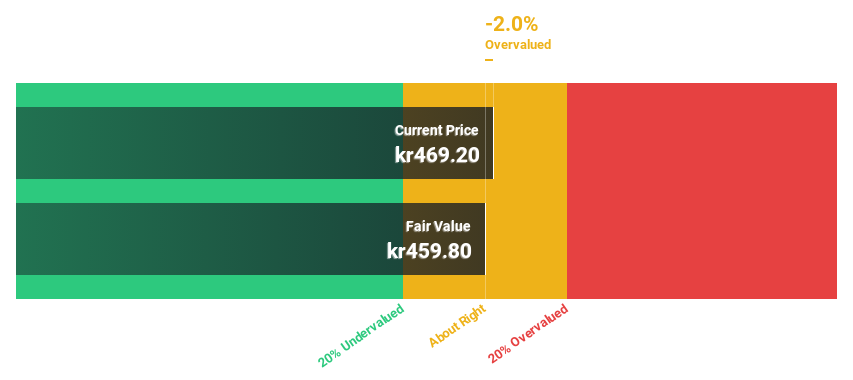

Estimated Discount To Fair Value: 49.5%

Bufab, trading at SEK467.4, is significantly undervalued based on discounted cash flow analysis with an estimated fair value of SEK925.04. Despite a high debt level, its earnings are projected to grow 20.83% annually, outpacing both its revenue growth of 5.8% and the Swedish market's earnings growth rate of 13.9%. This positions Bufab as a potentially attractive investment opportunity for those focusing on cash flow valuation metrics amidst slower revenue expansion forecasts.

- Our earnings growth report unveils the potential for significant increases in Bufab's future results.

- Dive into the specifics of Bufab here with our thorough financial health report.

Kadokawa (TSE:9468)

Overview: Kadokawa Corporation is a Japanese entertainment company with a market cap of ¥476.18 billion.

Operations: Kadokawa's revenue is primarily driven by its Publishing and IP Creation segment at ¥146 billion, followed by Animation and Live-Action Footage at ¥49.40 billion, Game at ¥29.66 billion, Web Service at ¥18.47 billion, and Education/Edtech at ¥14.34 billion.

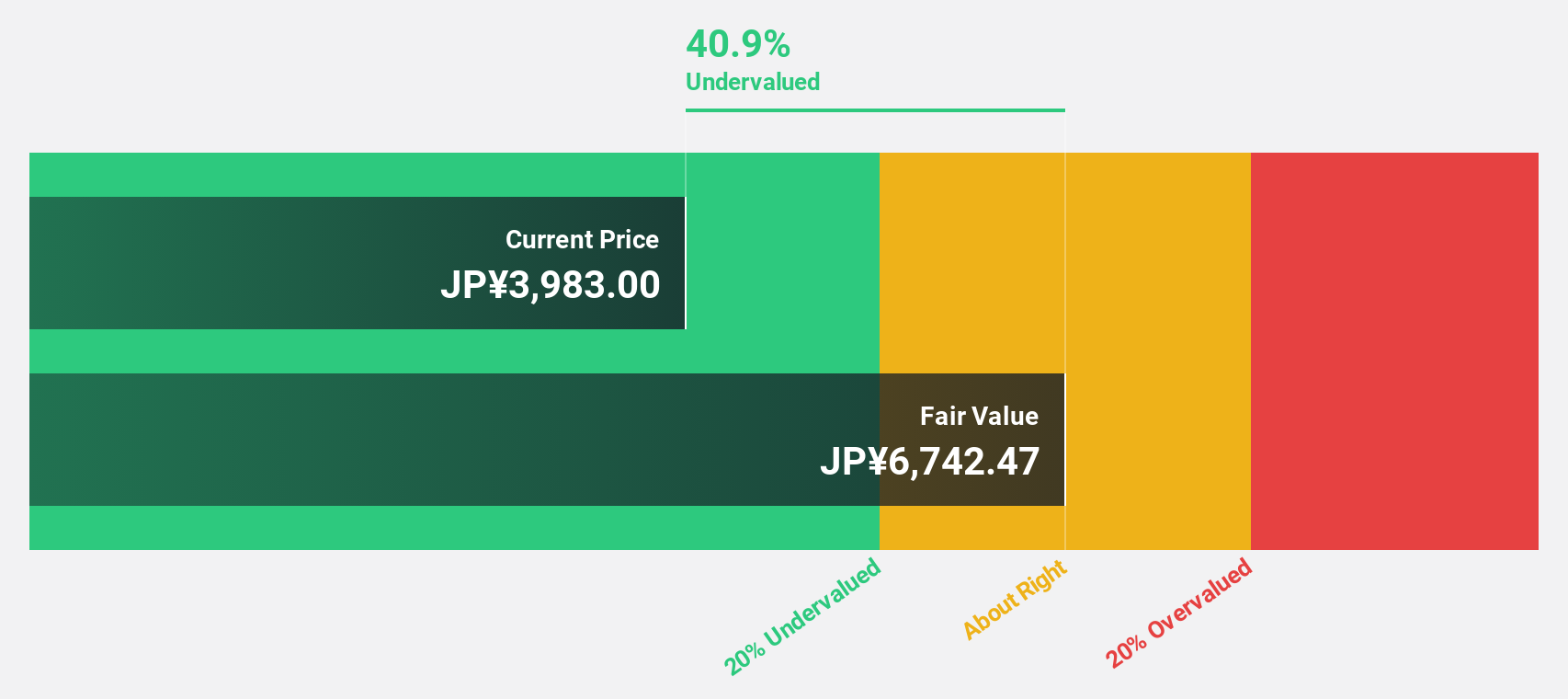

Estimated Discount To Fair Value: 36.2%

Kadokawa, trading at ¥3,250, appears significantly undervalued with a fair value estimate of ¥5,090.23 based on discounted cash flow analysis. Despite recent share price volatility and low forecasted return on equity of 9.5% in three years, earnings are projected to grow substantially at 26.68% annually—outpacing both its revenue growth of 7.4% and the Japanese market's earnings growth rate of 8.1%. Recent strategic alliances and private placements could further enhance value potential.

- The growth report we've compiled suggests that Kadokawa's future prospects could be on the up.

- Click here to discover the nuances of Kadokawa with our detailed financial health report.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical equipment industry, focusing on manufacturing and servicing electric machinery, with a market cap of NT$76.58 billion.

Operations: The company's revenue is primarily derived from its Motor Energy Business, which generated NT$18.87 billion, followed by the Service Business at NT$5.06 billion and Engineering and Other at NT$2.52 billion.

Estimated Discount To Fair Value: 45.4%

Chung-Hsin Electric and Machinery Manufacturing is trading at NT$155, significantly below its estimated fair value of NT$283.91. Despite a high debt level, the company shows strong financial performance with third-quarter sales reaching NT$6.39 billion and net income at NT$920.15 million, an increase from the previous year. Earnings are forecast to grow 19.7% annually, surpassing Taiwan's market growth rate of 17.4%, indicating robust future potential despite slower revenue growth projections.

- The analysis detailed in our Chung-Hsin Electric and Machinery Manufacturing growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Chung-Hsin Electric and Machinery Manufacturing.

Taking Advantage

- Unlock our comprehensive list of 896 Undervalued Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUFAB

Bufab

Operates as a trading company that provides solutions for sourcing, quality control, and logistics for C-parts in Sweden and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives