SKY Perfect JSAT Holdings Inc. (TSE:9412) Just Released Its Half-Yearly Earnings: Here's What Analysts Think

SKY Perfect JSAT Holdings Inc. (TSE:9412) shareholders are probably feeling a little disappointed, since its shares fell 3.7% to JP¥834 in the week after its latest half-year results. It was a credible result overall, with revenues of JP¥31b and statutory earnings per share of JP¥61.69 both in line with analyst estimates, showing that SKY Perfect JSAT Holdings is executing in line with expectations. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for SKY Perfect JSAT Holdings

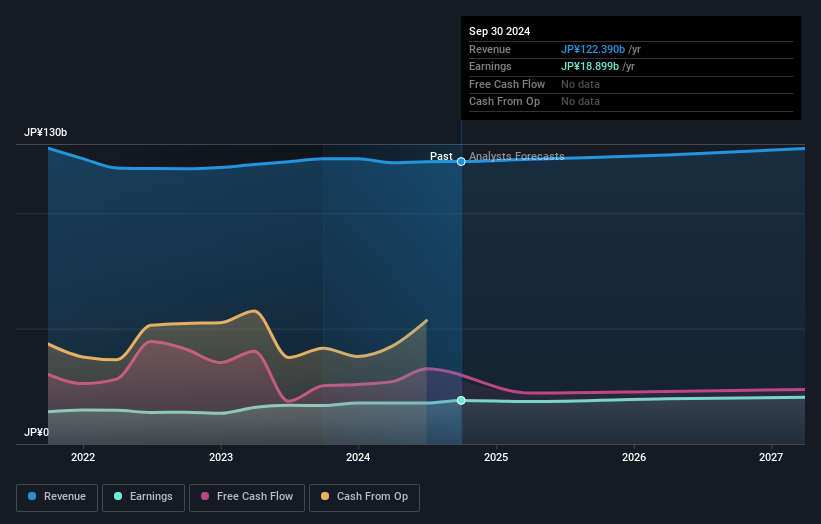

Taking into account the latest results, SKY Perfect JSAT Holdings' twin analysts currently expect revenues in 2025 to be JP¥123.4b, approximately in line with the last 12 months. Statutory earnings per share are forecast to shrink 2.3% to JP¥65.15 in the same period. In the lead-up to this report, the analysts had been modelling revenues of JP¥124.0b and earnings per share (EPS) of JP¥65.05 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

There were no changes to revenue or earnings estimates or the price target of JP¥1,105, suggesting that the company has met expectations in its recent result.

Of course, another way to look at these forecasts is to place them into context against the industry itself. From these estimates it looks as though the analysts expect the years of declining revenue to come to an end, given the flat forecast out to 2025. That would be a definite improvement, given that the past five years have seen revenue shrink 3.6% annually. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 3.8% annually. So it's pretty clear that, although revenues are improving, SKY Perfect JSAT Holdings is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that SKY Perfect JSAT Holdings' revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on SKY Perfect JSAT Holdings. Long-term earnings power is much more important than next year's profits. We have analyst estimates for SKY Perfect JSAT Holdings going out as far as 2027, and you can see them free on our platform here.

You can also see our analysis of SKY Perfect JSAT Holdings' Board and CEO remuneration and experience, and whether company insiders have been buying stock.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026