- Japan

- /

- Interactive Media and Services

- /

- TSE:4689

LY (TSE:4689) Eyes Growth with MINI Apps and PayPay Synergies Despite LYP Premium Challenges

Reviewed by Simply Wall St

LY (TSE:4689) has demonstrated strong financial performance, with a notable 4.7% increase in revenue and a 9.1% rise in adjusted EBITDA, driven by strategic initiatives and digital transformation efforts. However, challenges such as the underperformance of LYP Premium and declining display ad revenue persist, highlighting areas needing strategic attention. The company report will explore LY's competitive advantages, critical issues, growth opportunities, and regulatory challenges.

Dive into the specifics of LY here with our thorough analysis report.

Competitive Advantages That Elevate LY

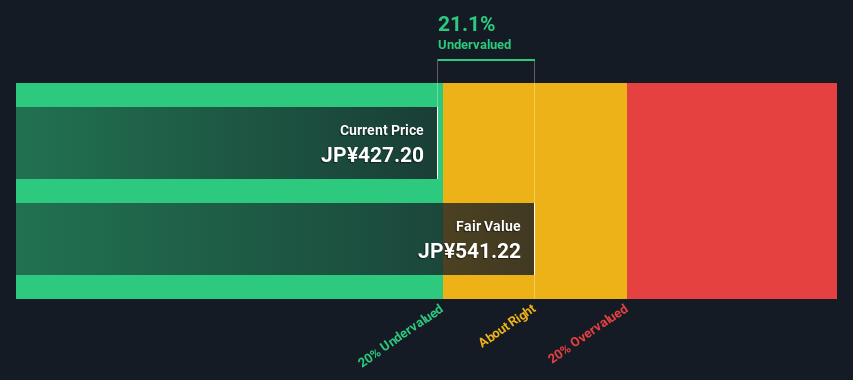

LY's financial performance is underscored by its record-breaking second-quarter results, with revenue rising 4.7% year-over-year to ¥462.2 billion and adjusted EBITDA increasing by 9.1% to ¥112.6 billion. This achievement highlights effective management and strategic initiatives, as noted by CEO Takeshi Idezawa. The company's focus on digital transformation through enhancements to the Official Account and MINI App has bolstered customer experience and monetization efforts. Additionally, the strategic consolidation of PayPay has been pivotal, driving a 16.8% increase in strategic business revenue to ¥81.2 billion. Furthermore, LY's profitability this year, with earnings growth forecasted at 11.9% annually, and a satisfactory net debt to equity ratio of 19.4%, indicate a stable financial foundation. The company is currently trading below its estimated fair value, suggesting potential undervaluation despite its higher industry average Price-To-Earnings Ratio.

Critical Issues Affecting the Performance of LY and Areas for Growth

Challenges persist with LY's LYP Premium, which has underperformed against expectations, reflecting difficulties in aligning with market demands. This sentiment was echoed by Idezawa, who acknowledged the unmet expectations. The decline in display ad revenue, despite efforts such as the Yahoo! JAPAN app renewal, points to possible strategic missteps or intensified competition. Additionally, the Yahoo! Auction service's underperformance, exacerbated by currency fluctuations and competition from flea markets, signals a need for strategic recalibration. LY's return on equity remains low at 4.4% for 4689 and 3.2% for 1H8, with profit margins decreasing from 13.2% to 5.7% over the past year, highlighting areas for improvement.

Areas for Expansion and Innovation for LY

LY is poised to capitalize on significant growth opportunities, particularly in the expansion of MINI Apps, which are set to become comprehensive digital transformation tools due to regulatory changes. Idezawa has expressed optimism about entering a phase of full-fledged expansion. The domestic gift market presents another avenue for growth, with LINE GIFT projected to expand by over 30% year-on-year for the next five years. Furthermore, the planned expansion of PayPay-centered synergies aims to enhance user convenience and accelerate growth in financial services, potentially boosting revenue and market share.

Regulatory Challenges Facing LY

LY faces several external threats, including volatility in the search ads segment, which CFO Ryosuke Sakaue identified as a concern due to the competitive dynamics. The absence of a strong video platform is another challenge, as user preferences shift towards shorter social media content, impacting advertising revenue capture. Economic uncertainties, such as currency fluctuations and regulatory changes, pose additional risks to LY's operations and financial stability, necessitating vigilant risk management strategies. CEO Makoto Hide has highlighted the potential impacts of a stronger yen on business operations.

See what the latest analyst reports say about LY's future prospects and potential market movements.

Conclusion

LY's strong financial performance, highlighted by significant revenue and EBITDA growth, underscores the effectiveness of its strategic initiatives, particularly in digital transformation and the consolidation of PayPay. However, challenges such as underperformance in LYP Premium and declining display ad revenue indicate areas requiring strategic adjustments. Despite these hurdles, LY is well-positioned for future growth through the expansion of MINI Apps and LINE GIFT, with potential synergies from PayPay enhancing its market share in financial services. The company's current trading price below its estimated fair value suggests potential for investment growth, provided it addresses its competitive and operational challenges, including the impact of economic uncertainties and the absence of a strong video platform.

Next Steps

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4689

Flawless balance sheet and good value.