As global markets navigate a period of mixed performance, with the Nasdaq hitting record highs while other indexes face declines and economic indicators suggest a cooling labor market, investors are increasingly focused on stability and income generation. In such an environment, dividend stocks can offer a compelling opportunity by providing regular income streams alongside potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Mitsubishi Gas Chemical Company (TSE:4182)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Gas Chemical Company, Inc. is involved in the manufacturing and sale of basic and fine chemicals, as well as functional materials in Japan, with a market cap of ¥5.36 billion.

Operations: Mitsubishi Gas Chemical Company, Inc.'s revenue segments include Specialty Chemicals at ¥437.94 million and Green Energy & Chemicals at ¥367.42 million.

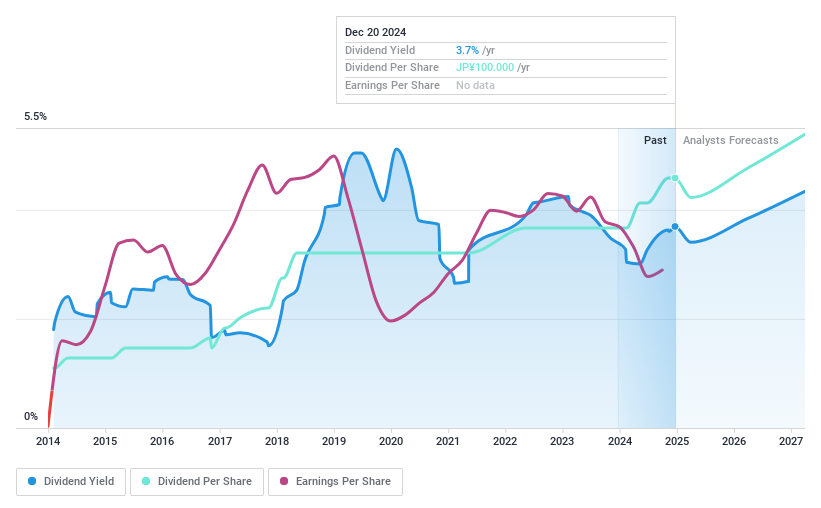

Dividend Yield: 3.7%

Mitsubishi Gas Chemical Company offers a stable dividend yield of 3.72%, though it is slightly below the top tier in Japan. While dividends have been stable and growing over the past decade, they are not fully covered by free cash flows. Recent actions include a ¥15 billion fixed-income offering and a share buyback program to enhance shareholder value. The company revised earnings guidance, reflecting challenges but also potential improvements in profitability from specific business segments.

- Navigate through the intricacies of Mitsubishi Gas Chemical Company with our comprehensive dividend report here.

- Our valuation report unveils the possibility Mitsubishi Gas Chemical Company's shares may be trading at a discount.

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides IT services and digital solutions in Japan and has a market cap of ¥48.97 billion.

Operations: Cresco Ltd.'s revenue is primarily derived from its IT Service Business, with ¥16.15 billion from Finance, ¥21.15 billion from Enterprise, and ¥14.50 billion from Manufacturing, complemented by ¥3.83 billion from its Digital Solution Business in Japan.

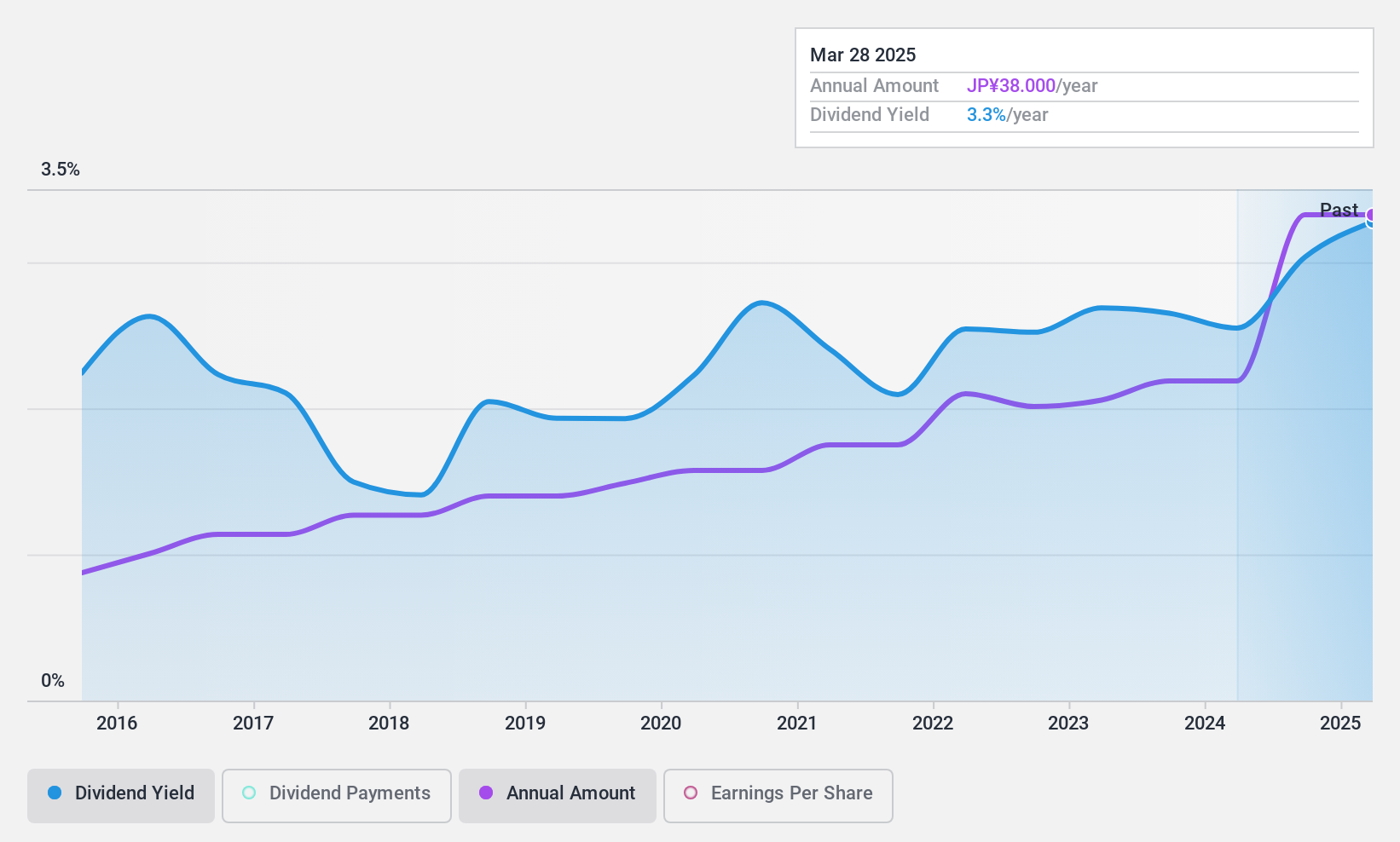

Dividend Yield: 3.2%

Cresco's dividend yield of 3.2% is below Japan's top-tier payers, and its dividends have been volatile and unreliable over the past decade. However, with a low payout ratio of 34.3% and cash payout ratio of 36%, dividends are well covered by earnings and cash flows. Despite an unstable dividend history, Cresco's earnings have grown at 9.9% annually over five years, suggesting potential for future stability in payouts.

- Click to explore a detailed breakdown of our findings in Cresco's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Cresco shares in the market.

YagiLtd (TSE:7460)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yagi & Co., Ltd. is a fiber trading company based in Japan with a market capitalization of ¥16.56 billion.

Operations: Yagi & Co., Ltd.'s revenue segments include the Apparel Business at ¥41.51 billion, Material Business at ¥23.65 billion, Lifestyle Business at ¥7.53 billion, Real Estate Business at ¥821.48 million, and Brand/Retail Business (Excluding Lifestyle Business) at ¥9.46 billion.

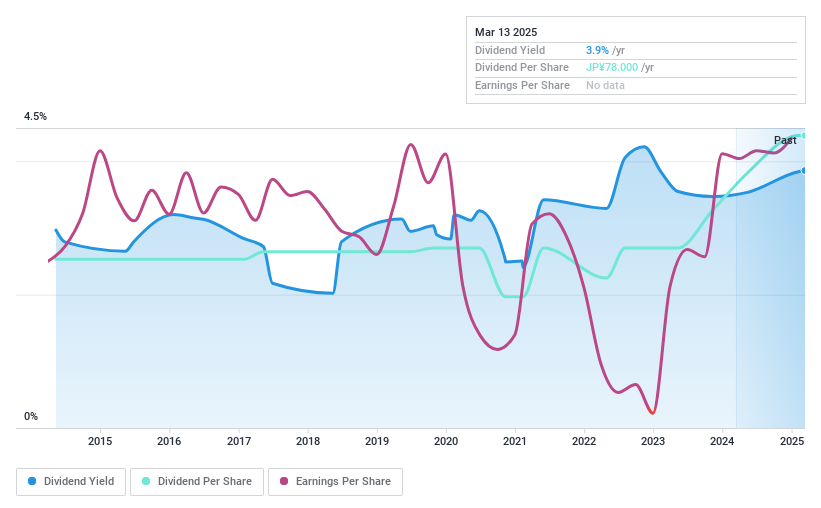

Dividend Yield: 3.4%

Yagi Ltd.'s dividend yield of 3.44% lags behind Japan's top dividend payers, and its dividends have been volatile over the past decade. However, a low payout ratio of 22.7% and cash payout ratio of 12% ensure dividends are well covered by earnings and cash flows. Earnings surged by 69.3% last year, indicating robust financial health despite an unstable dividend track record, with payments increasing over the past ten years.

- Get an in-depth perspective on YagiLtd's performance by reading our dividend report here.

- The analysis detailed in our YagiLtd valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 1973 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4674

Cresco

Engages in the provision of information technology (IT) services and digital solutions in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives