- Japan

- /

- Entertainment

- /

- TSE:2432

DeNA Co., Ltd.'s (TSE:2432) 26% Share Price Plunge Could Signal Some Risk

The DeNA Co., Ltd. (TSE:2432) share price has fared very poorly over the last month, falling by a substantial 26%. Looking at the bigger picture, even after this poor month the stock is up 98% in the last year.

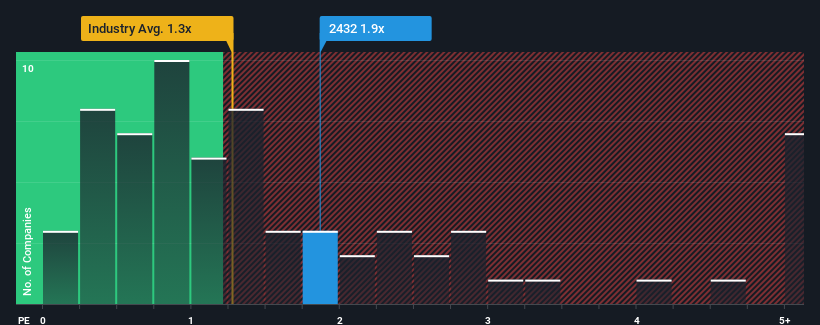

Even after such a large drop in price, given close to half the companies operating in Japan's Entertainment industry have price-to-sales ratios (or "P/S") below 1.3x, you may still consider DeNA as a stock to potentially avoid with its 1.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for DeNA

What Does DeNA's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, DeNA has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DeNA.Is There Enough Revenue Growth Forecasted For DeNA?

In order to justify its P/S ratio, DeNA would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. Revenue has also lifted 25% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 0.2% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that DeNA's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

There's still some elevation in DeNA's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see DeNA trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware DeNA is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on DeNA, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2432

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026