- Japan

- /

- Metals and Mining

- /

- TSE:7305

3 Dividend Stocks To Consider Offering Up To 5.8% Yield

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by AI competition concerns and shifting central bank policies, investors are seeking stability amid fluctuating indices. With the Federal Reserve maintaining steady interest rates and the European Central Bank cutting them, dividend stocks can offer a reliable income stream in uncertain times. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for those looking to enhance their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

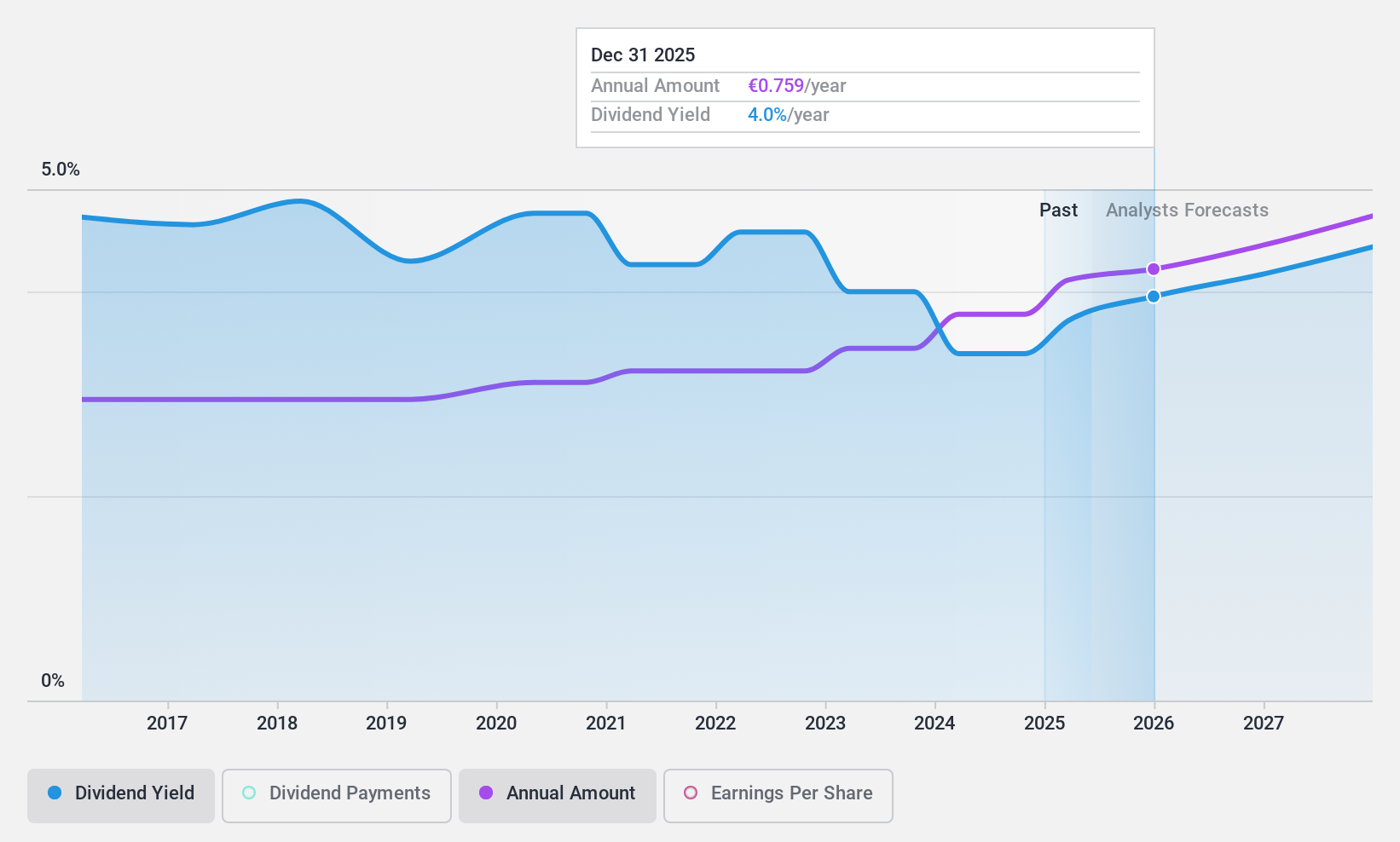

Kemira Oyj (HLSE:KEMIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kemira Oyj is a chemicals company operating in Finland and globally across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of €3.28 billion.

Operations: Kemira Oyj's revenue is primarily derived from its Pulp & Paper segment, which generates €1.65 billion, and its Industry & Water segment, contributing €1.38 billion.

Dividend Yield: 3.2%

Kemira Oyj offers a reliable dividend history with stable payments over the past decade, supported by a reasonable payout ratio of 61.1% and strong cash flow coverage at 36.9%. Although its dividend yield of 3.2% is below the Finnish market's top quartile, it remains well-covered by earnings and cash flows. Recent organizational changes aim to enhance operational efficiency, potentially impacting future profitability positively as earnings are forecasted to grow annually by 10.87%.

- Delve into the full analysis dividend report here for a deeper understanding of Kemira Oyj.

- Our valuation report here indicates Kemira Oyj may be undervalued.

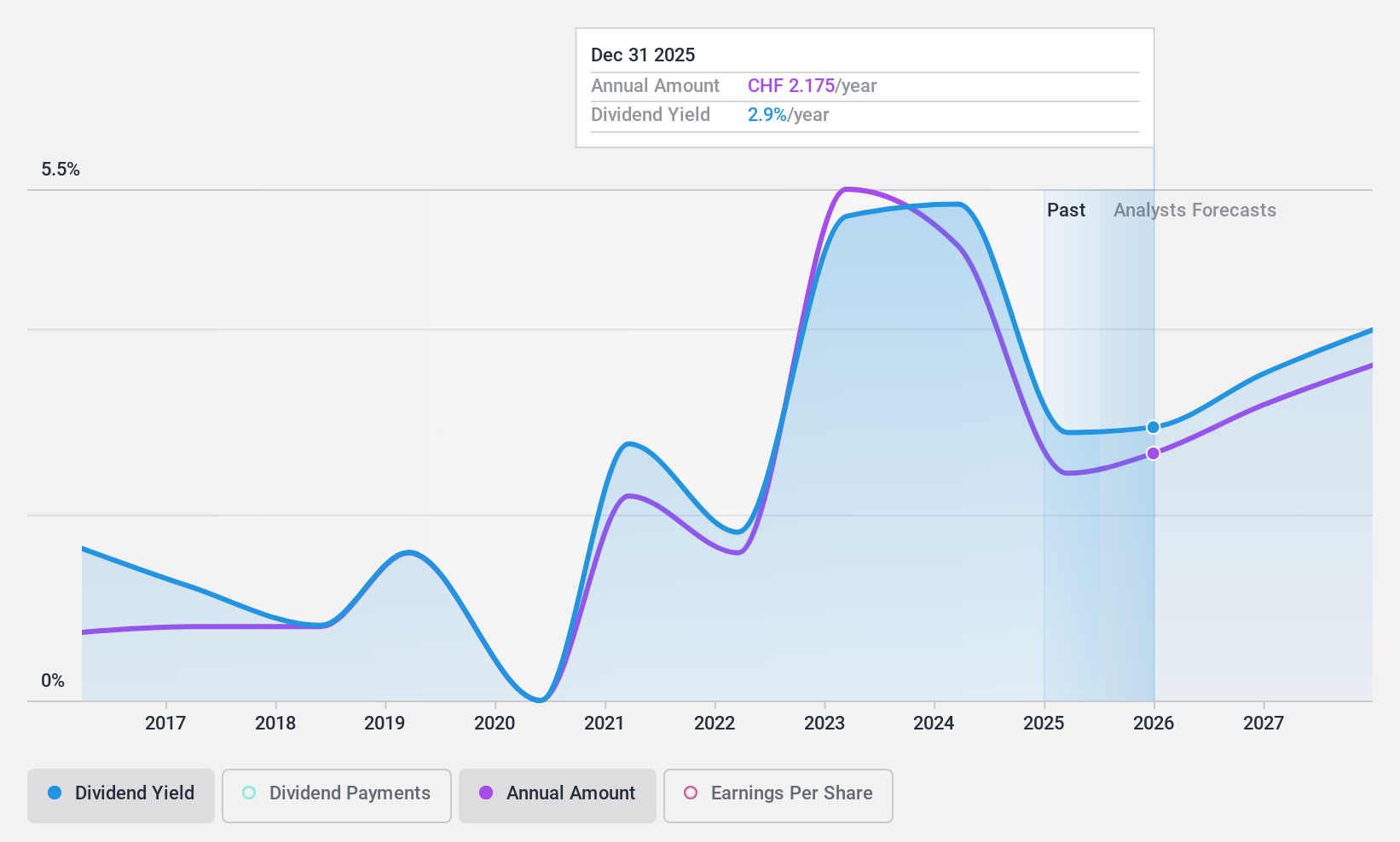

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG, with a market cap of CHF478.41 million, operates in the manufacture and sale of chemicals and packaging films across Switzerland, Europe, the Americas, Asia, and other international markets.

Operations: CPH Group AG's revenue is primarily derived from its Chemistry segment at CHF128.62 million, Packaging at CHF219.70 million, and Spun-off divisions (Paper) contributing CHF245.37 million.

Dividend Yield: 5%

CPH Group's dividend yield of 5.01% ranks in the top quartile of the Swiss market, yet its sustainability is questionable due to a high payout ratio of 249.1%, indicating dividends are not covered by earnings. Despite a decade-long increase in dividend payments, they remain volatile and unreliable. The company's cash flow coverage is reasonable with a cash payout ratio at 47%, but profit margins have significantly declined from last year, impacting overall financial health.

- Click here and access our complete dividend analysis report to understand the dynamics of CPH Group.

- Our comprehensive valuation report raises the possibility that CPH Group is priced lower than what may be justified by its financials.

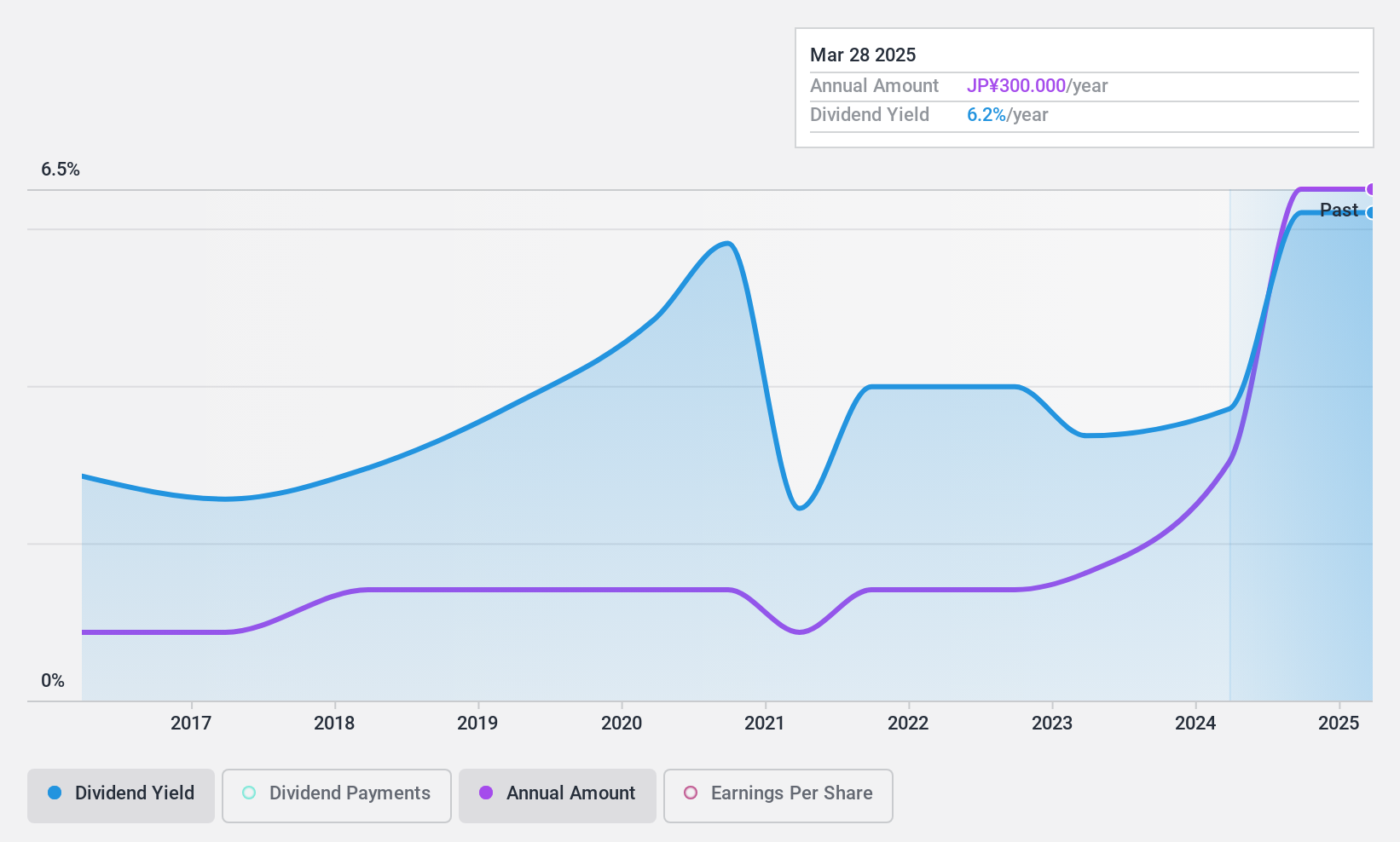

Araya Industrial (TSE:7305)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Araya Industrial Co., Ltd. manufactures and sells steel products both in Japan and internationally, with a market cap of approximately ¥28.56 billion.

Operations: Araya Industrial Co., Ltd. generates revenue through its primary segments, with ¥30.61 million from bicycle-related products, ¥42.77 billion from steel pipe-related operations, and ¥611 million from real estate rentals and other activities.

Dividend Yield: 5.9%

Araya Industrial offers a dividend yield of 5.88%, placing it in the top quartile of the Japanese market. Despite this, its dividend history is marked by volatility, with payments experiencing significant fluctuations over the past decade. However, dividends are covered by earnings and cash flows, with payout ratios at 61.7% and 53%, respectively. Profit margins have decreased from last year (4.8% to 3.2%), potentially affecting future stability in payouts despite current coverage levels.

- Unlock comprehensive insights into our analysis of Araya Industrial stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Araya Industrial shares in the market.

Summing It All Up

- Gain an insight into the universe of 1974 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7305

Araya Industrial

Manufactures and sells steel products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives