- Sweden

- /

- Hospitality

- /

- OM:BETS B

Betsson And 2 Other Great Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, investors are keeping a close eye on dividend stocks for their potential to provide steady income amidst uncertainty. In this environment, selecting strong dividend-paying companies can be an effective strategy for those seeking to balance risk and reward while capitalizing on market opportunities.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

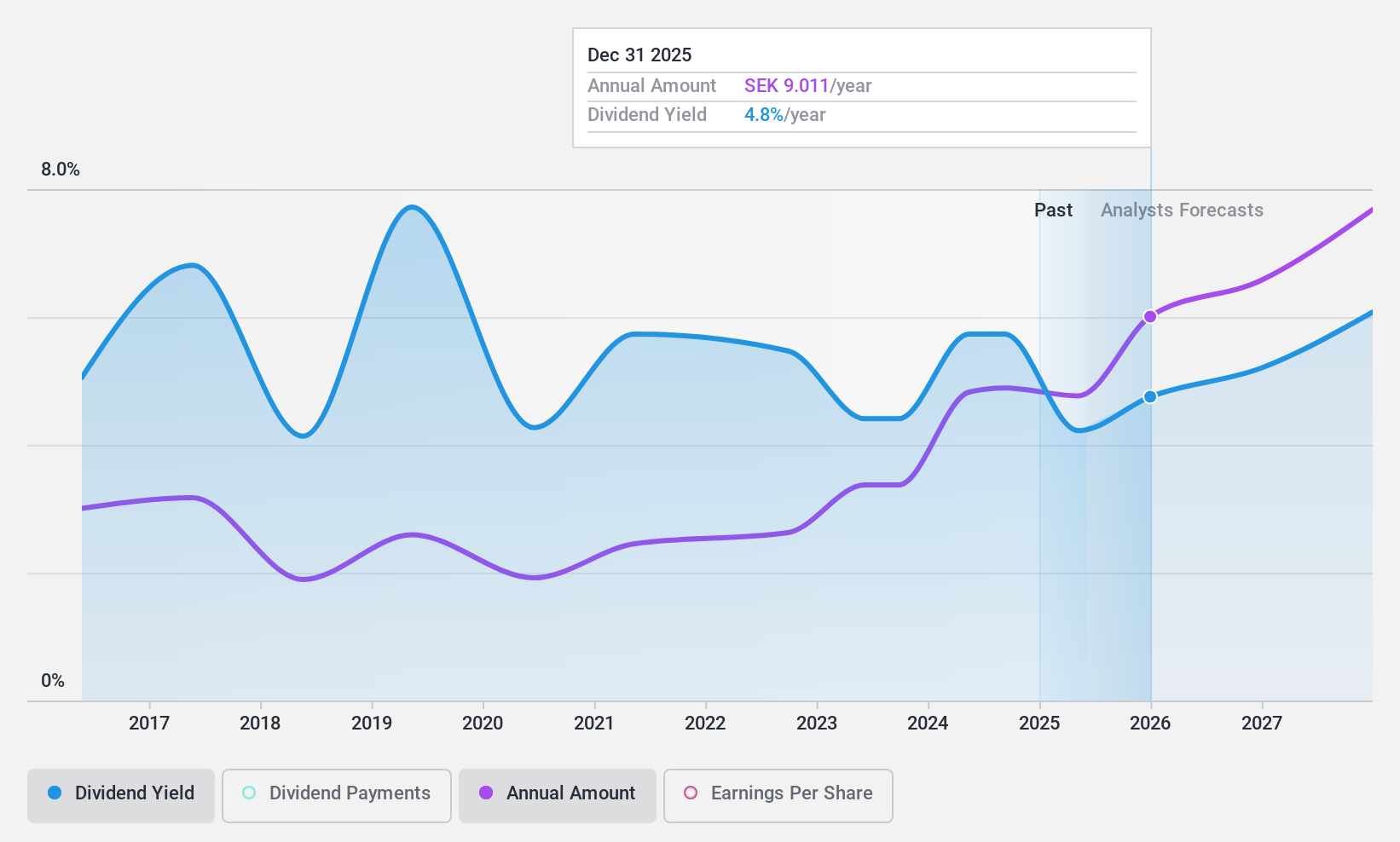

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates and manages an online gaming business across various regions including the Nordic countries, Latin America, and Europe, with a market cap of SEK19.69 billion.

Operations: Betsson AB generates revenue primarily from its Casinos & Resorts segment, amounting to €1.05 billion.

Dividend Yield: 5.2%

Betsson's dividend yield is in the top 25% of Swedish payers, but its payments have been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 51.9% and 46.3%, respectively. The stock trades significantly below estimated fair value, suggesting potential for capital appreciation alongside dividends. Recent earnings show stable sales growth but a slight decrease in net income compared to the previous year, highlighting profitability challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Betsson.

- Our expertly prepared valuation report Betsson implies its share price may be lower than expected.

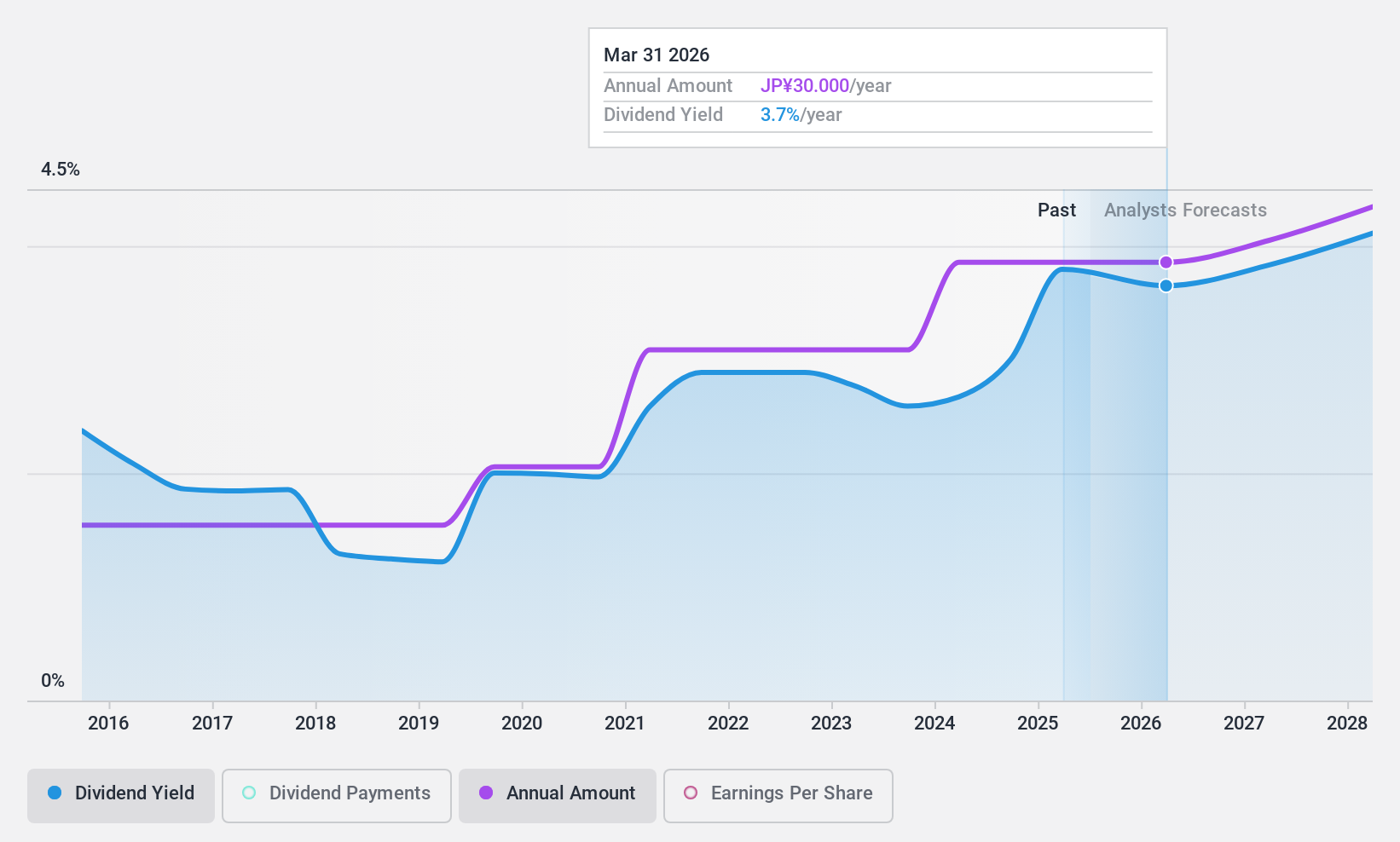

Rengo (TSE:3941)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rengo Co., Ltd. and its subsidiaries manufacture and sell paperboard and packaging-related products both in Japan and internationally, with a market cap of ¥215.38 billion.

Operations: Rengo Co., Ltd.'s revenue is primarily derived from its Paperboard and Paper Processing-Related Business at ¥515.01 billion, followed by the Overseas Related Business at ¥207.45 billion, Flexible Packaging-Related Business at ¥150.86 billion, and Heavy Duty Packaging Business at ¥48.30 billion.

Dividend Yield: 3.4%

Rengo offers a reliable dividend yield of 3.43%, supported by a low payout ratio of 22.2% and a cash payout ratio of 38.5%, indicating strong coverage by both earnings and cash flows. The company has consistently increased its dividends over the past decade with minimal volatility, although its yield is slightly below the top tier in Japan. Rengo's stock trades at an attractive valuation with a P/E ratio of 6.5x, well below the market average, despite having high debt levels.

- Click here to discover the nuances of Rengo with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Rengo is priced lower than what may be justified by its financials.

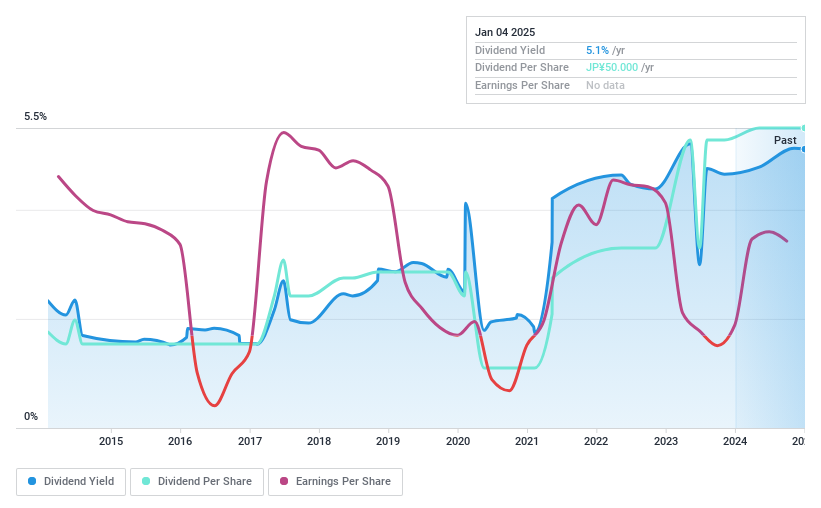

Neturen (TSE:5976)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neturen Co., Ltd. and its subsidiaries manufacture and sell specialty steel and wire products both in Japan and internationally, with a market cap of ¥34.28 billion.

Operations: Neturen Co., Ltd.'s revenue is generated from its operations in manufacturing and selling specialty steel and wire products across domestic and international markets.

Dividend Yield: 5.1%

Neturen's dividend yield of 5.1% ranks within the top 25% of Japanese dividend payers, but its sustainability is questionable due to a high cash payout ratio of 2080.2%, indicating dividends are not well covered by cash flows. Despite becoming profitable this year and having a reasonable payout ratio of 61%, dividends have been volatile over the past decade. Recent buybacks totaling ¥1.11 billion may impact future dividend strategies or financial stability.

- Get an in-depth perspective on Neturen's performance by reading our dividend report here.

- The analysis detailed in our Neturen valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 1949 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives