- Japan

- /

- Metals and Mining

- /

- TSE:5463

Some Shareholders Feeling Restless Over Maruichi Steel Tube Ltd.'s (TSE:5463) P/E Ratio

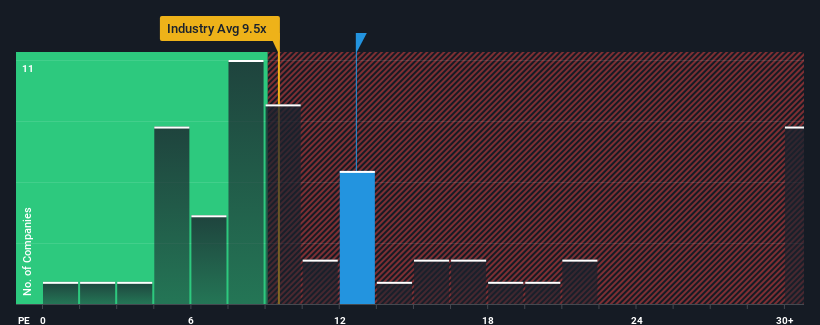

There wouldn't be many who think Maruichi Steel Tube Ltd.'s (TSE:5463) price-to-earnings (or "P/E") ratio of 12.6x is worth a mention when the median P/E in Japan is similar at about 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Maruichi Steel Tube's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Maruichi Steel Tube

Is There Some Growth For Maruichi Steel Tube?

There's an inherent assumption that a company should be matching the market for P/E ratios like Maruichi Steel Tube's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 216% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 0.3% per year over the next three years. That's shaping up to be materially lower than the 10% each year growth forecast for the broader market.

In light of this, it's curious that Maruichi Steel Tube's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Maruichi Steel Tube's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Maruichi Steel Tube currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Maruichi Steel Tube that you should be aware of.

Of course, you might also be able to find a better stock than Maruichi Steel Tube. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5463

Maruichi Steel Tube

Manufactures and sells steel tubes, surface treated steel sheets, and poles in Japan, North America, and Asia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives