- Hong Kong

- /

- Specialty Stores

- /

- SEHK:887

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainties, global markets experienced notable declines, with U.S. stocks facing broad-based losses despite a late-week rally. As investors navigate these turbulent times, dividend stocks can offer a measure of stability and income potential, making them an appealing option for those looking to balance risk amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Emperor Watch & Jewellery (SEHK:887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emperor Watch & Jewellery Limited is an investment holding company involved in the sale of watches and jewelry products, with a market capitalization of approximately HK$1.11 billion.

Operations: The company's revenue segment consists of HK$5.09 billion from the sale of watches and jewelry products.

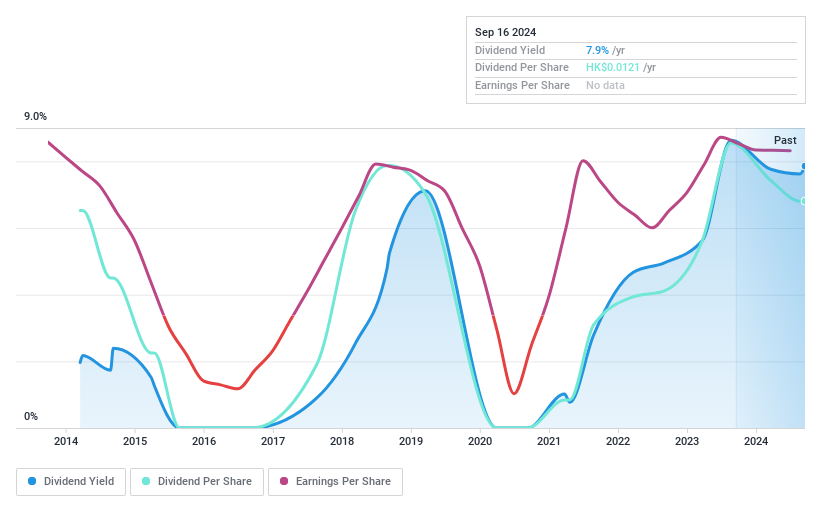

Dividend Yield: 7.2%

Emperor Watch & Jewellery's dividend yield of 7.25% is below the top quartile in Hong Kong, but it maintains a sustainable payout with earnings and cash flow coverage at 27.5% and 32.2%, respectively. Despite past volatility, dividends have grown over the last decade. However, reliability remains an issue due to historical fluctuations exceeding 20%. Trading at a significant discount to its estimated fair value suggests potential for capital appreciation alongside dividend income.

- Click to explore a detailed breakdown of our findings in Emperor Watch & Jewellery's dividend report.

- The analysis detailed in our Emperor Watch & Jewellery valuation report hints at an deflated share price compared to its estimated value.

Wah Hong Industrial (TPEX:8240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Hong Industrial Corp. is involved in the development, production, and sale of composite materials and advanced plastic compounds both in Taiwan and internationally, with a market capitalization of NT$4.44 billion.

Operations: Wah Hong Industrial Corp.'s revenue segments are distributed as follows: Taiwan accounts for NT$3.78 billion, East China contributes NT$4.06 billion, and South China adds NT$1.40 billion.

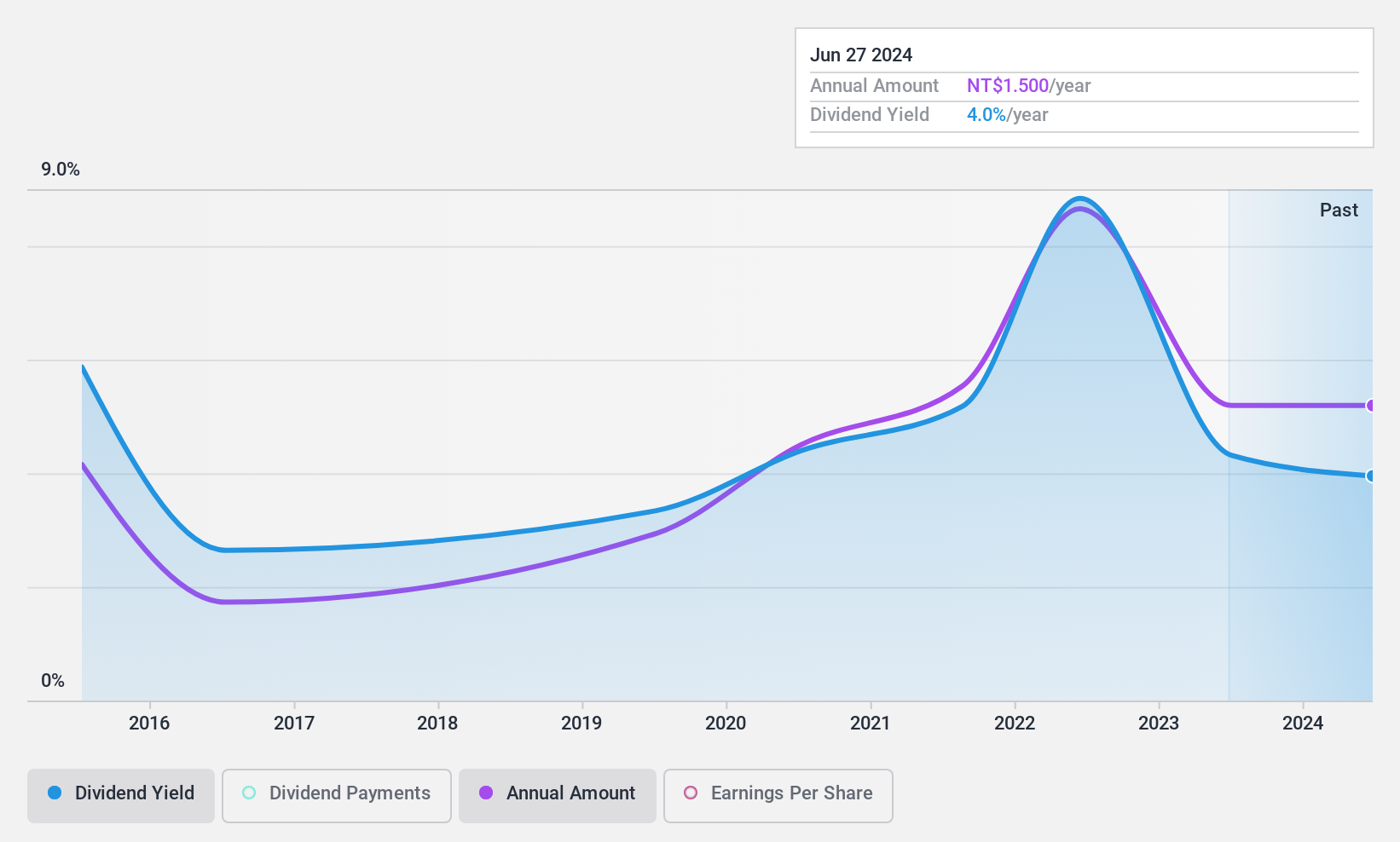

Dividend Yield: 3.4%

Wah Hong Industrial's dividend yield of 3.38% is lower than Taiwan's top quartile, but dividends are covered by earnings and cash flow with payout ratios of 46.2% and 66.5%, respectively. Despite past volatility, dividends have increased over the last decade, though stability remains a concern due to historical drops exceeding 20%. The company's price-to-earnings ratio of 13.8x suggests it is undervalued compared to the market average, providing potential value for investors.

- Delve into the full analysis dividend report here for a deeper understanding of Wah Hong Industrial.

- According our valuation report, there's an indication that Wah Hong Industrial's share price might be on the expensive side.

Kyoei Steel (TSE:5440)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyoei Steel Ltd. manufactures, processes, and sells billets and steel products in Japan, Vietnam, North America, and internationally with a market cap of ¥77.97 billion.

Operations: Kyoei Steel Ltd.'s revenue segments include the Domestic Steel Business at ¥152.49 billion, the Overseas Steel Business at ¥162.63 billion, and the Environmental Recycling Business at ¥7.04 billion.

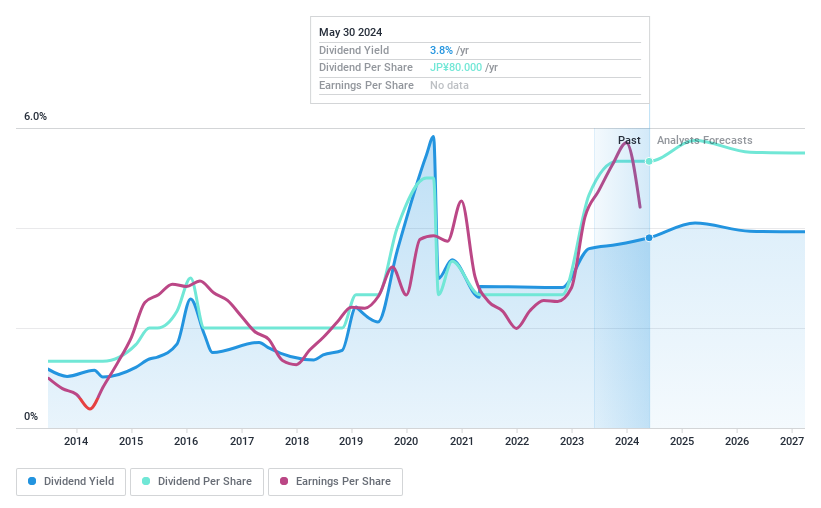

Dividend Yield: 5%

Kyoei Steel's dividend yield of 5.02% ranks in the top 25% in Japan, though its history shows volatility over the past decade. Despite this, dividends have grown and are well-covered by earnings and cash flows with payout ratios of 41.4% and 21.4%, respectively. The stock trades at a significant discount to its estimated fair value, suggesting it offers good relative value compared to peers despite recent profit margin declines from last year.

- Dive into the specifics of Kyoei Steel here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kyoei Steel shares in the market.

Where To Now?

- Access the full spectrum of 1958 Top Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emperor Watch & Jewellery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:887

Emperor Watch & Jewellery

An investment holding company, engages in the sale of watches and jewelry products.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives