- Japan

- /

- Aerospace & Defense

- /

- TSE:186A

3 Global Stocks Estimated To Be Trading At Up To 39.8% Discount

Reviewed by Simply Wall St

As global markets navigate a landscape marked by government shutdowns and mixed economic signals, investors are keeping a close eye on equities that may be undervalued amidst the volatility. With U.S. stocks showing resilience despite political gridlock and European indices buoyed by technology gains, identifying stocks trading at significant discounts can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.72 | 49.7% |

| Teikoku Sen-i (TSE:3302) | ¥3395.00 | ¥6752.86 | 49.7% |

| SRE Holdings (TSE:2980) | ¥3210.00 | ¥6382.78 | 49.7% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Midsummer (OM:MIDS) | SEK2.70 | SEK5.36 | 49.6% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.36 | €12.58 | 49.4% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.80 | CN¥79.42 | 49.9% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95922.12 | 49.8% |

| Circle (BIT:CIRC) | €8.20 | €16.22 | 49.5% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.87 | ₱7.66 | 49.5% |

Underneath we present a selection of stocks filtered out by our screen.

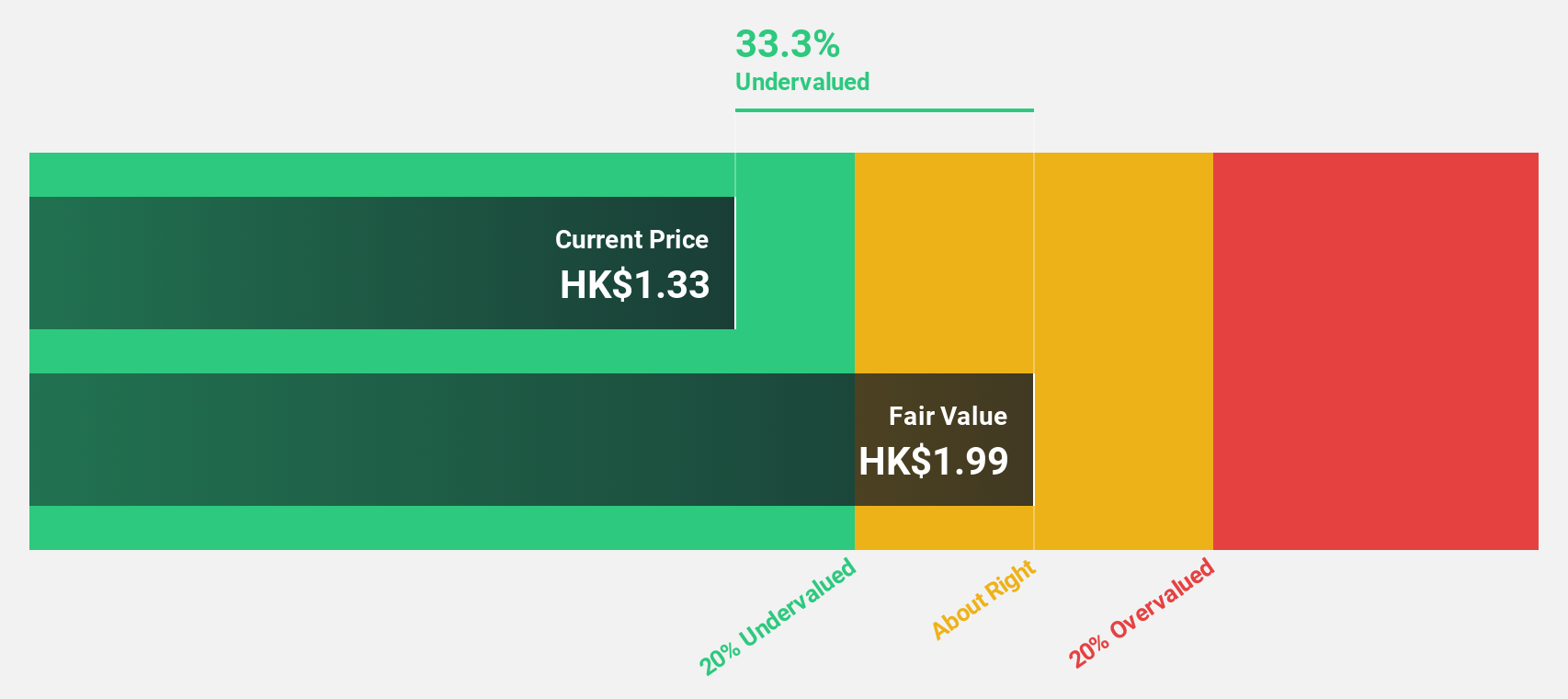

MicroPort CardioFlow Medtech (SEHK:2160)

Overview: MicroPort CardioFlow Medtech Corporation is a medical device company focused on developing and commercializing transcatheter and surgical solutions for structural heart diseases in China and globally, with a market cap of approximately HK$3.79 billion.

Operations: The company generates revenue of CN¥367.53 million from its Surgical & Medical Devices segment, focusing on solutions for structural heart diseases in China and internationally.

Estimated Discount To Fair Value: 21.8%

MicroPort CardioFlow Medtech's current trading price of HK$1.57 is significantly below the estimated fair value of HK$2.01, suggesting it may be undervalued based on cash flows. The company has recently become profitable, with earnings forecasted to grow substantially at 107.9% annually, outpacing both revenue growth and market expectations. Recent results showed a reduced net loss due to increased overseas sales and improved operational efficiency, enhancing its appeal as an undervalued investment opportunity.

- Our growth report here indicates MicroPort CardioFlow Medtech may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of MicroPort CardioFlow Medtech.

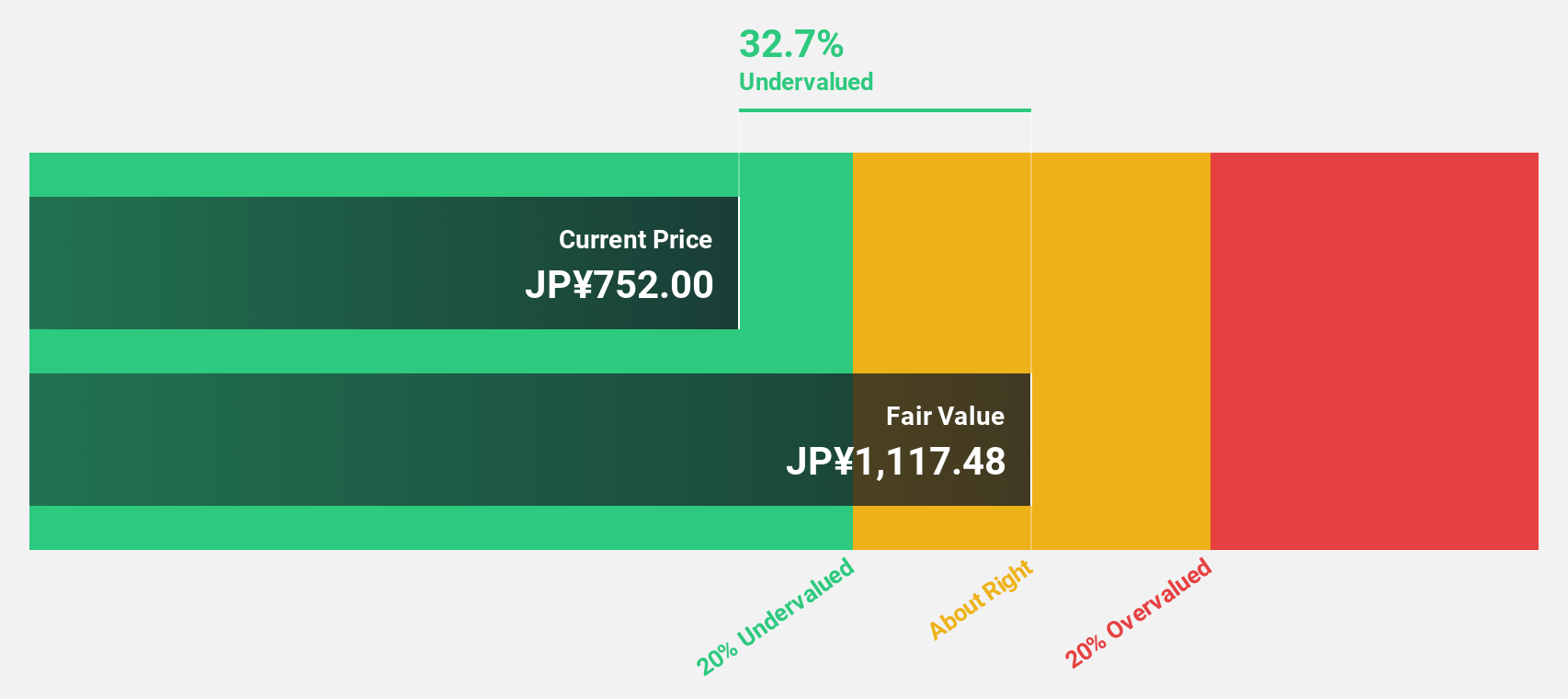

Astroscale Holdings (TSE:186A)

Overview: Astroscale Holdings Inc. offers on-orbit service solutions and has a market cap of ¥103.54 billion.

Operations: The company generates revenue of ¥3.47 billion from its In-Orbit Servicing Business segment.

Estimated Discount To Fair Value: 27.1%

Astroscale Holdings is trading at ¥821, significantly below its estimated fair value of ¥1126.9, indicating potential undervaluation based on cash flows. The company is poised for substantial revenue growth at 45.3% annually, exceeding market averages and expected to become profitable in three years. Recent developments include a strategic contract with the Japan Science and Technology Agency worth ¥0.59 billion, enhancing its prospects in satellite life extension services despite past shareholder dilution and share price volatility.

- The growth report we've compiled suggests that Astroscale Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Astroscale Holdings.

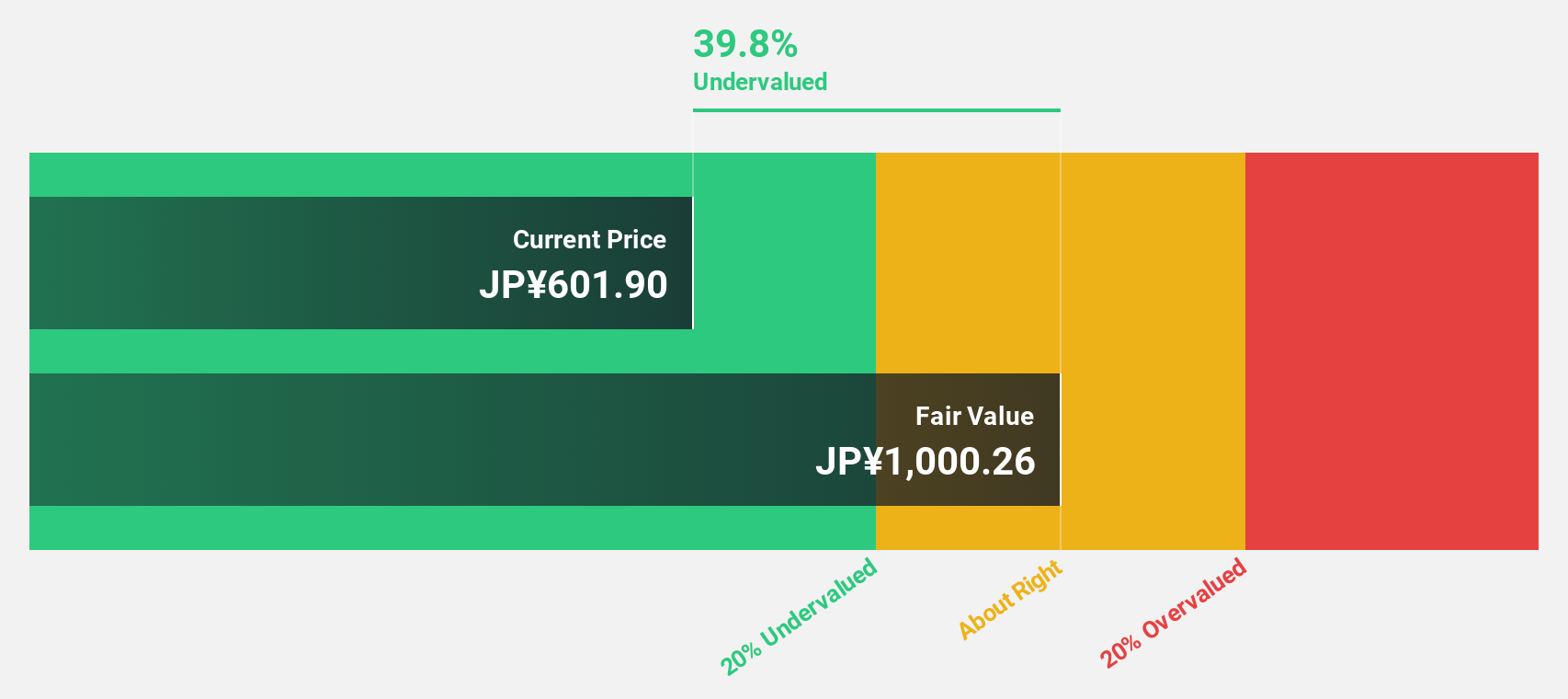

Nippon Steel (TSE:5401)

Overview: Nippon Steel Corporation operates in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions both domestically in Japan and internationally, with a market capitalization of approximately ¥3.18 trillion.

Operations: The company's revenue is primarily derived from steelmaking and steel fabrication (¥7.69 billion), followed by engineering and construction (¥405.56 million), chemicals and materials (¥263.54 million), and system solutions (¥345.21 million).

Estimated Discount To Fair Value: 39.8%

Nippon Steel is trading at ¥624.4, well below its estimated fair value of ¥1036.45, reflecting potential undervaluation based on cash flows. Despite a forecasted revenue growth of 6% annually, slower than desired, the company is expected to become profitable within three years. Recent legal resolutions with U.S. Steel and involvement in a consortium for Whyalla Steelworks highlight strategic positioning but financial challenges persist with recent losses and reduced dividend guidance amid a stock split plan.

- In light of our recent growth report, it seems possible that Nippon Steel's financial performance will exceed current levels.

- Take a closer look at Nippon Steel's balance sheet health here in our report.

Summing It All Up

- Investigate our full lineup of 512 Undervalued Global Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:186A

Astroscale Holdings

Engages in research and development of technology related to on-orbit services in Japan, the United Kingdom, the United States, and France.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026