Will Tokai Carbon's (TSE:5301) New Bond Issue Redefine Its Long-Term Funding Strategy?

Reviewed by Sasha Jovanovic

- Tokai Carbon Co., Ltd. announced it has finalized the terms for its 4th Series of Unsecured Straight Bonds, with a total issue amount of ¥10 billion, a coupon rate of 1.663% per annum, and a maturity set for October 9, 2030.

- The strong credit ratings assigned to this bond issuance may enhance the company's financial flexibility and support long-term initiatives.

- We'll explore how securing additional long-term funding through this bond issuance could shape Tokai Carbon's ongoing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Tokai Carbon's Investment Narrative?

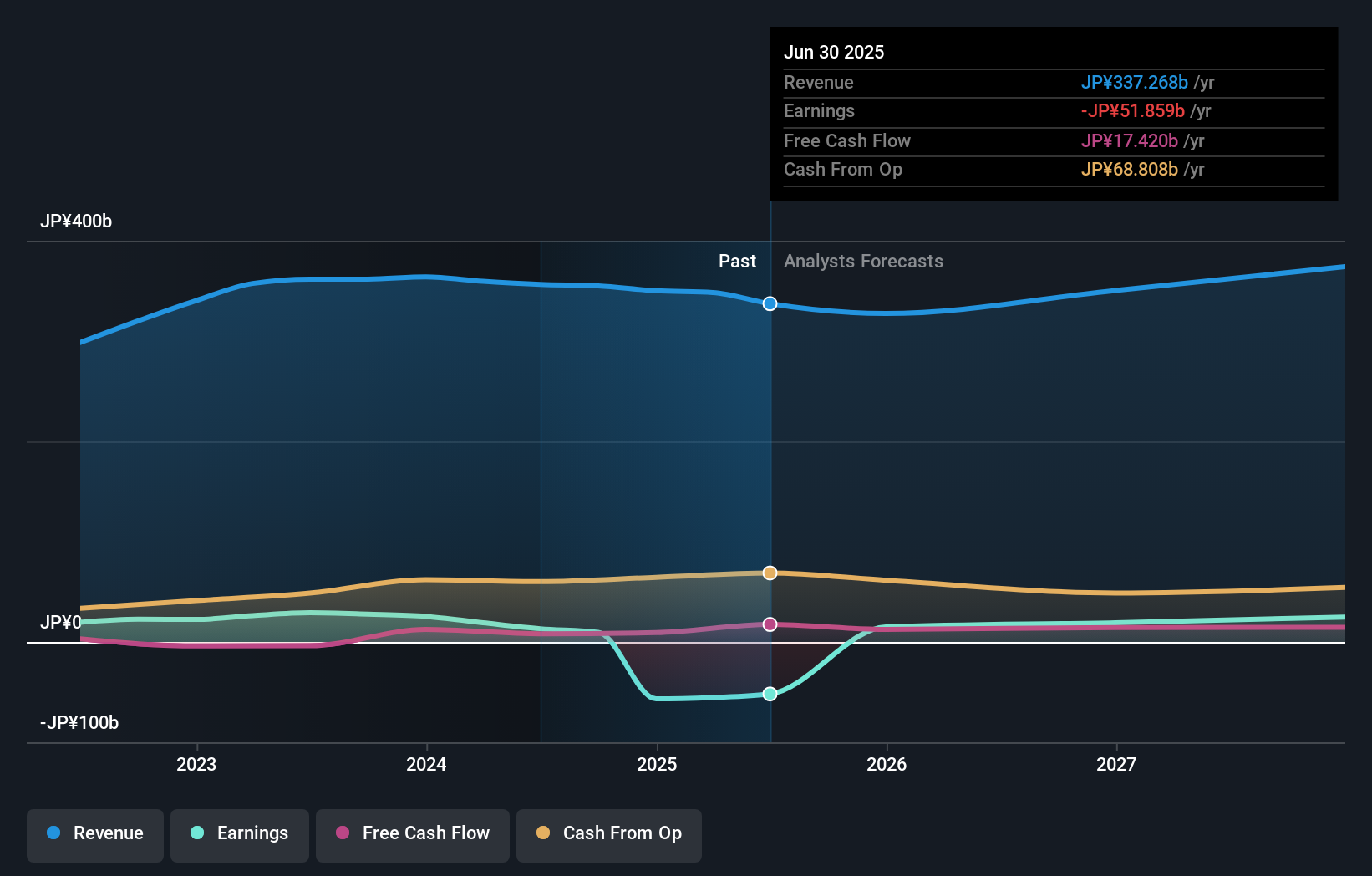

If I were weighing Tokai Carbon as a shareholder, I'd have to buy into its turnaround potential, especially with new long-term capital now on hand. The recent ¥10 billion bond issue, backed by strong credit ratings, could relieve some pressure from its underwhelming profitability and dividend coverage, possibly smoothing over the risk of capital constraints in the near future. Yet, it's crucial to remember that Tokai Carbon remains unprofitable, with losses compounding over several years, and recent executive changes suggest ongoing restructuring. The new funding could support acquisitions or operational investments, especially after the announcement to acquire Bridgestone Carbon Thailand, but its impact on short-term catalysts appears muted as the market had already factored in steady growth and gradual returns to profitability. Ultimately, access to fresh capital is supportive, yet mounting losses and board turnover continue to weigh on sentiment for many investors.

But keep in mind, ongoing losses might still outweigh the benefits of added financial flexibility. Tokai Carbon's shares have been on the rise but are still potentially undervalued by 36%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Tokai Carbon - why the stock might be worth just ¥1160!

Build Your Own Tokai Carbon Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokai Carbon research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tokai Carbon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokai Carbon's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tokai Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5301

Tokai Carbon

Manufactures and sells carbon-related products and services in Japan.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)