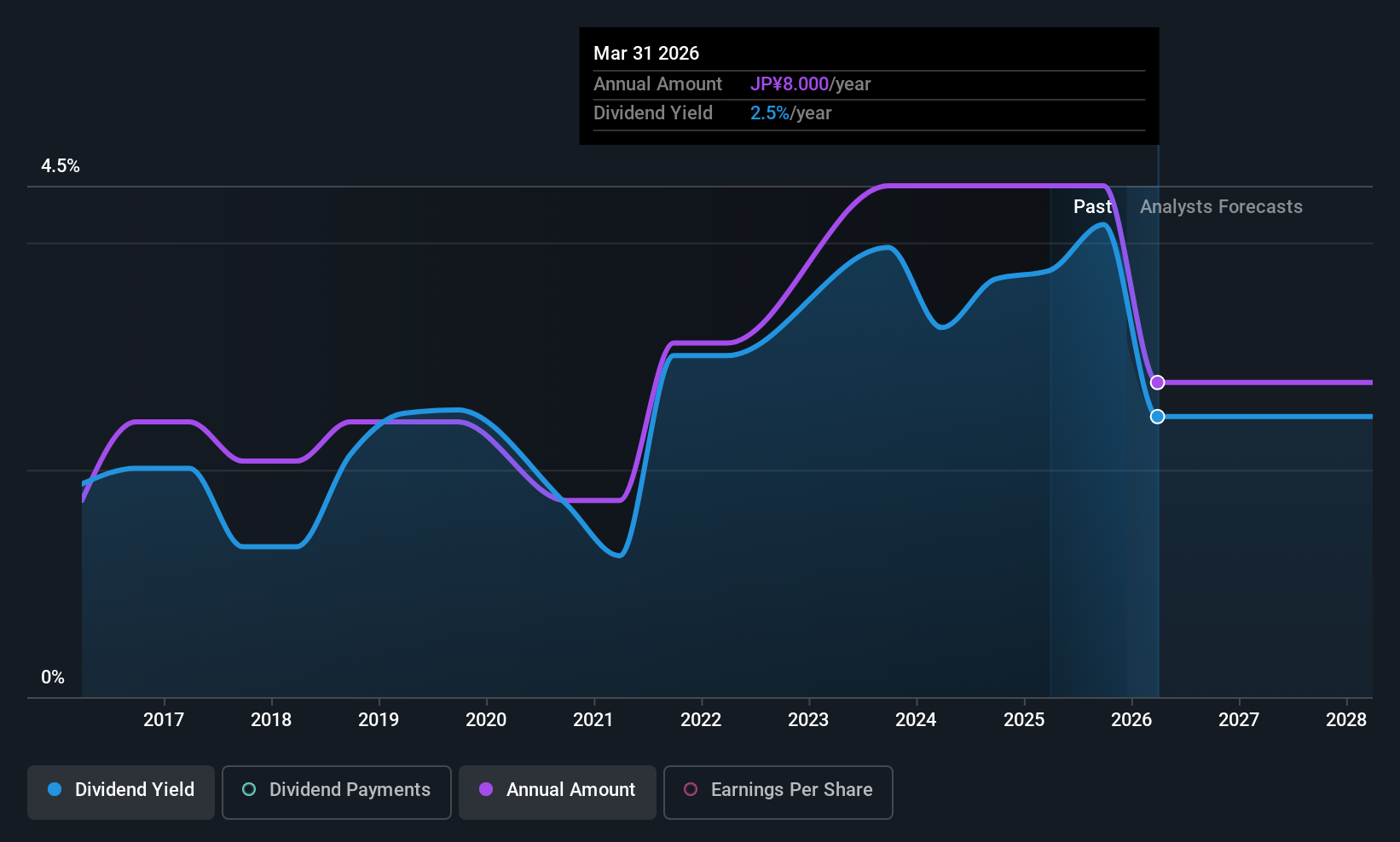

The board of Nippon Concrete Industries Co., Ltd. (TSE:5269) has announced that it will pay a dividend on the 12th of June, with investors receiving ¥4.00 per share. However, the dividend yield of 2.5% still remains in a typical range for the industry.

Nippon Concrete Industries Might Find It Hard To Continue The Dividend

Solid dividend yields are great, but they only really help us if the payment is sustainable. Even though Nippon Concrete Industries is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS is forecast to expand by 45.5%. This is the right direction to be moving, but it is not enough to achieve profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

See our latest analysis for Nippon Concrete Industries

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the dividend has gone from ¥5.00 total annually to ¥8.00. This works out to be a compound annual growth rate (CAGR) of approximately 4.8% a year over that time. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Nippon Concrete Industries' earnings per share has shrunk at 48% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Nippon Concrete Industries' Dividend Doesn't Look Great

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, this doesn't get us very excited from an income standpoint.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Nippon Concrete Industries that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nippon Concrete Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5269

Nippon Concrete Industries

Produces, constructs, and distributes precast concrete products.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)