C. Uyemura (TSE:4966): Revisiting Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Price-to-Earnings of 13.1x: Is it justified?

C.UyemuraLtd is currently trading at a price-to-earnings (P/E) ratio of 13.1x, which puts it slightly above the average for the Japanese Chemicals industry, currently at 13x. This suggests that investors are paying a small premium compared to the broader sector.

The price-to-earnings ratio is a popular benchmark that compares a company's current share price to its per-share earnings. It provides a snapshot of how highly the market is valuing a company's profitability relative to its sector peers. In chemical manufacturing, where revenue and profit growth can be steady but unspectacular, even a modest premium warrants attention.

This small premium may indicate the market's willingness to pay up for anticipated stability or potentially improving future results. It also suggests that upside may already be partly priced in, and that buyers are expecting the company's earnings growth to continue outpacing at least some of its competitors.

Result: Fair Value of ¥11,250 (ABOUT RIGHT)

See our latest analysis for C.UyemuraLtd.However, near-term economic headwinds or weaker-than-expected earnings could quickly temper investor enthusiasm and challenge the current optimism around C.UyemuraLtd.

Find out about the key risks to this C.UyemuraLtd narrative.Another View: What Does Our DCF Model Say?

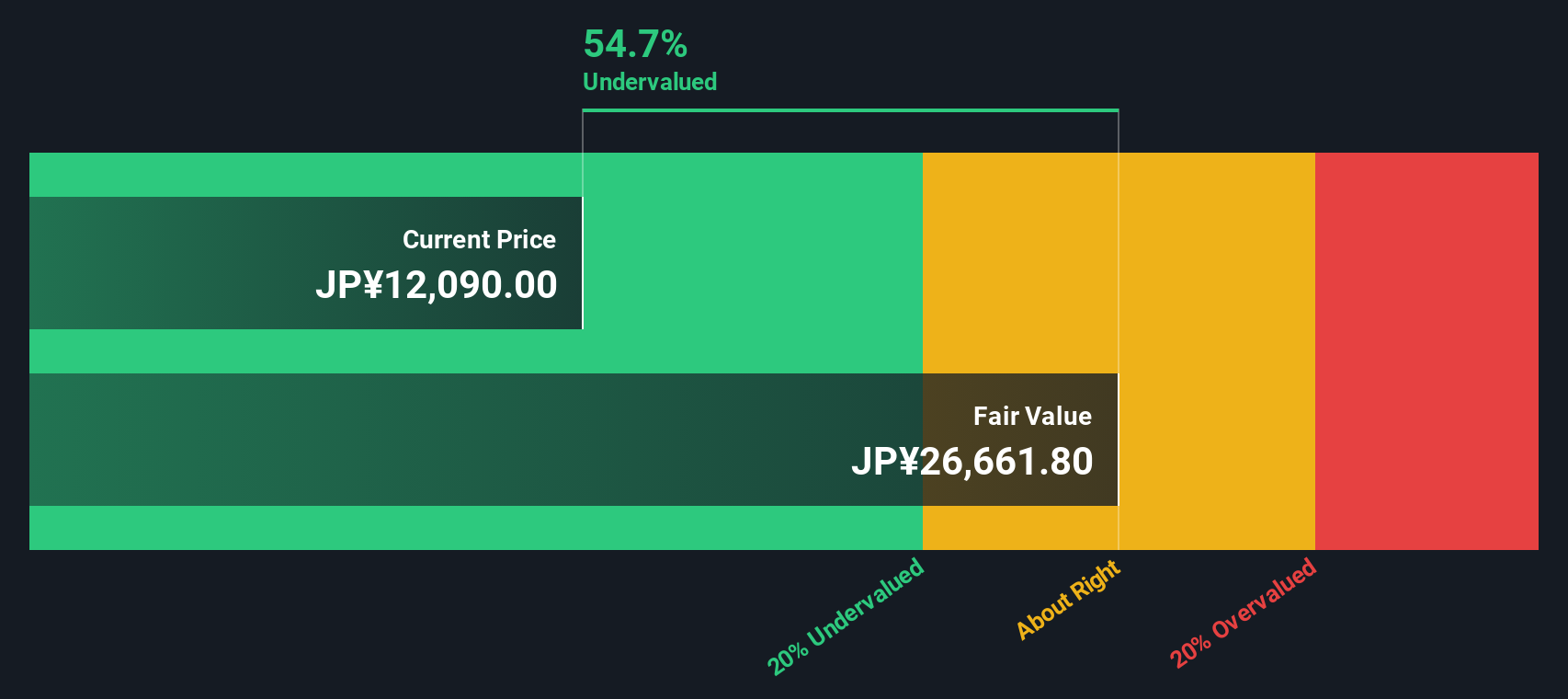

Looking from a different angle, our DCF model paints a much more optimistic picture. It suggests that the current share price is well below what the business could be worth. Could the market be overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own C.UyemuraLtd Narrative

If you'd rather reach your own conclusion or want to dig deeper into the numbers, you can easily piece together your own perspective in just a few minutes. Do it your way

A great starting point for your C.UyemuraLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your next market win pass you by. Turn curiosity into action by checking out unique stock picks tailored to different strategies and growth stories using the Simply Wall Street Screener:

- Uncover hidden bargains by targeting undervalued stocks based on future cash flows with our intuitive tool for bargain hunters: undervalued stocks based on cash flows

- Supercharge your search for next-generation breakthroughs in healthcare with a selection of cutting-edge medical AI companies. healthcare AI stocks

- Boost your passive income by finding companies offering robust dividend yields above 3%, perfect for strengthening your portfolio. dividend stocks with yields > 3%

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4966

C.UyemuraLtd

Researches, develops, manufactures, and sells plating chemicals, industrial chemicals, non-ferrous metals, and other products in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives