After Leaping 25% Carlit Co., Ltd. (TSE:4275) Shares Are Not Flying Under The Radar

Despite an already strong run, Carlit Co., Ltd. (TSE:4275) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 85%.

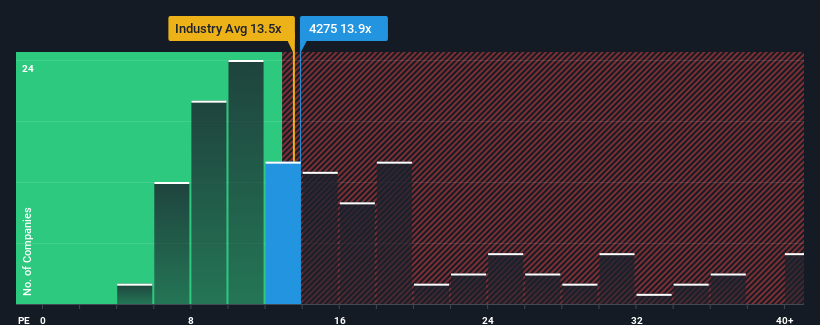

Although its price has surged higher, it's still not a stretch to say that Carlit's price-to-earnings (or "P/E") ratio of 13.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Carlit as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Carlit

Is There Some Growth For Carlit?

The only time you'd be comfortable seeing a P/E like Carlit's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. The latest three year period has also seen an excellent 113% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 9.7% each year during the coming three years according to the two analysts following the company. That's shaping up to be similar to the 9.6% each year growth forecast for the broader market.

In light of this, it's understandable that Carlit's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Carlit's P/E?

Carlit's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Carlit's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Carlit, and understanding should be part of your investment process.

You might be able to find a better investment than Carlit. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4275

Carlit

Through its subsidiaries, engages in the manufacture and sale of industrial explosives.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives