The board of Takemoto Yohki Co., Ltd. (TSE:4248) has announced that it will pay a dividend of ¥18.00 per share on the 27th of March. This makes the dividend yield 4.3%, which will augment investor returns quite nicely.

Check out our latest analysis for Takemoto Yohki

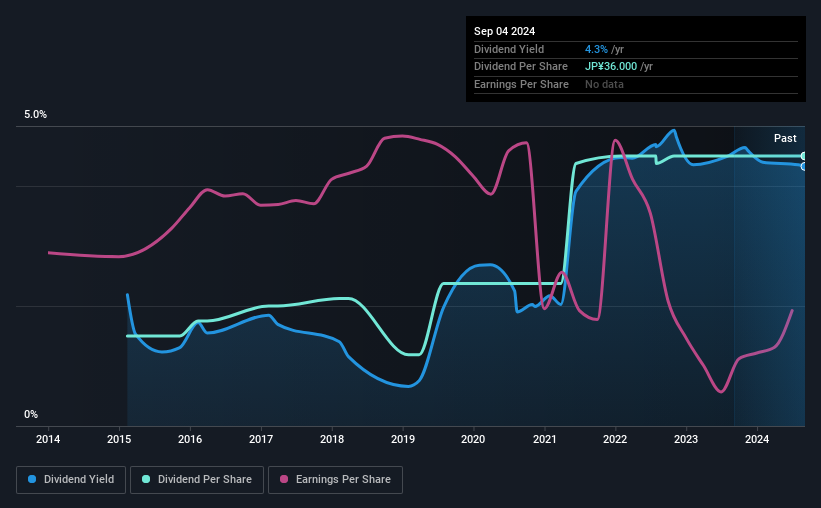

Takemoto Yohki Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Takemoto Yohki's profits didn't cover the dividend, but the company was generating enough cash instead. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

If the company can't turn things around, EPS could fall by 16.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 128%, which could put the dividend in jeopardy if the company's earnings don't improve.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from ¥12.00 total annually to ¥36.00. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Takemoto Yohki's EPS has declined at around 16% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Takemoto Yohki's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, Takemoto Yohki has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Takemoto Yohki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4248

Takemoto Yohki

Plans, develops, manufactures, and sells plastic packaging containers in Japan, China, India, the United States, Thailand, the Netherlands, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)