In the wake of cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. As global markets navigate these shifts, investors may find stability in dividend stocks that offer consistent yields amidst economic fluctuations. A good dividend stock in this context is one that not only provides attractive yields but also demonstrates resilience and reliability in diverse market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Mitsui Chemicals (TSE:4183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Chemicals, Inc. operates globally in sectors including mobility, life and health care, basic and green materials, and ICT, with a market cap of ¥613.98 billion.

Operations: Mitsui Chemicals generates revenue from various segments, including ¥570.13 billion from Mobility Solutions (including Functional Polymeric Materials), ¥294.21 billion from Life & Healthcare Solutions, ¥810.42 billion from Basic & Green Materials (including Urethane), and ¥241.26 billion from ICT Solutions.

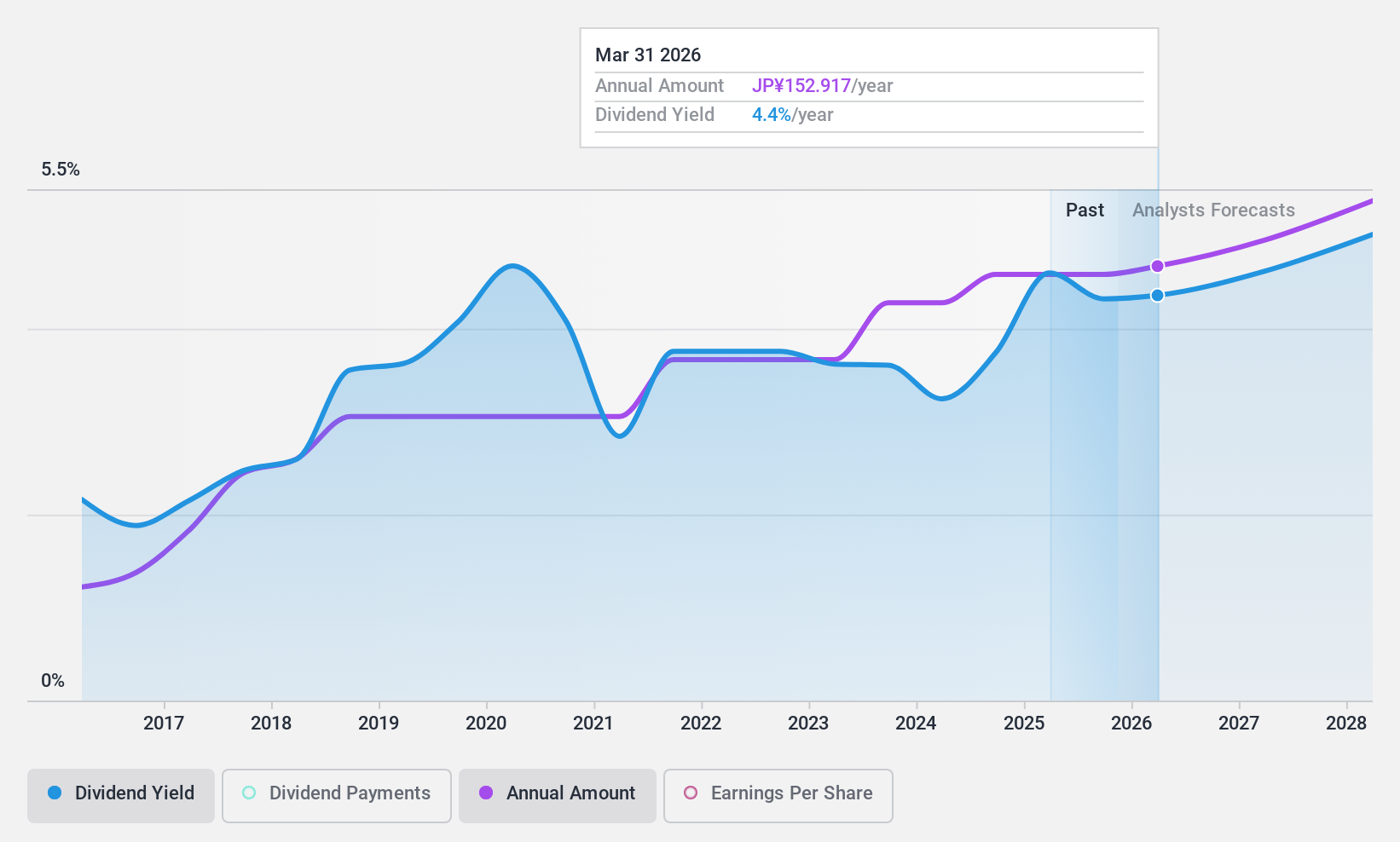

Dividend Yield: 4.4%

Mitsui Chemicals offers a dividend yield of 4.43%, placing it in the top 25% of JP market payers, with dividends covered by earnings (53.5% payout ratio) and cash flows (62% cash payout ratio). However, its dividend history is volatile and unreliable over the past decade. The company completed a share buyback program worth ¥9.99 billion to enhance shareholder returns, signaling a commitment to capital efficiency despite high debt levels.

- Click here to discover the nuances of Mitsui Chemicals with our detailed analytical dividend report.

- Our valuation report unveils the possibility Mitsui Chemicals' shares may be trading at a discount.

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a manufacturer and seller of notebook computers operating in Asia, the Americas, Europe, and internationally, with a market cap of NT$1.04 trillion.

Operations: Quanta Computer Inc.'s revenue from The Electronics Sector amounts to NT$2.78 billion.

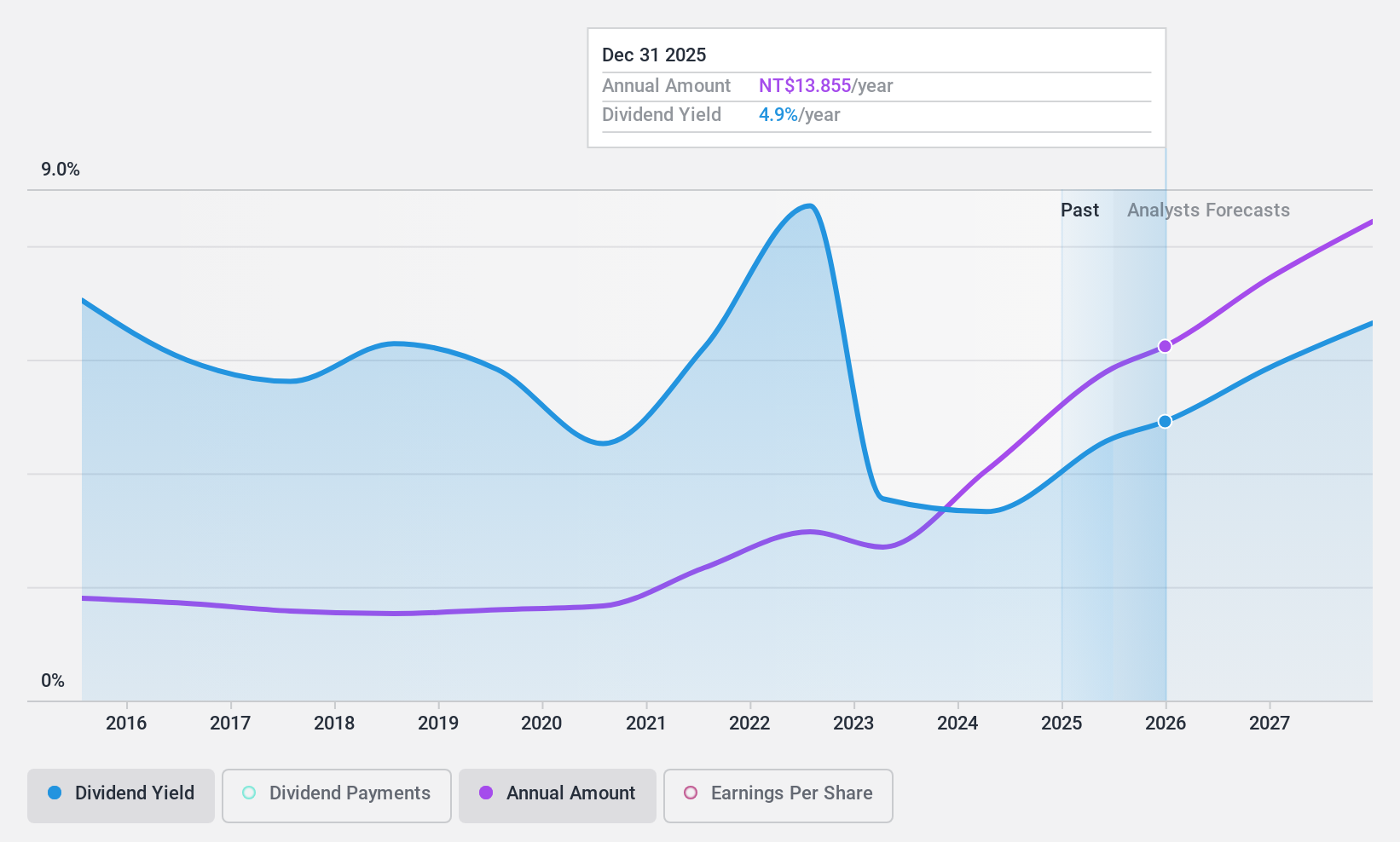

Dividend Yield: 3.3%

Quanta Computer's dividend yield of 3.33% is below the top quartile in Taiwan, with a payout ratio of 64.1%, indicating earnings coverage but not by free cash flows. Despite trading significantly below its estimated fair value and good relative value to peers, the lack of free cash flow coverage raises sustainability concerns. However, dividends have reliably grown over the past decade without volatility, supported by recent robust earnings growth and consistent profitability increases.

- Dive into the specifics of Quanta Computer here with our thorough dividend report.

- The valuation report we've compiled suggests that Quanta Computer's current price could be quite moderate.

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chang Wah Electromaterials Inc. operates in the trading of electrical, telecommunication, and semiconductor materials and parts across Taiwan, Asia, and internationally with a market cap of approximately NT$30.46 billion.

Operations: Chang Wah Electromaterials Inc.'s revenue primarily comes from its main operations, generating NT$7.12 billion, and its subsidiary, Chang Wah Technology Co., Ltd., contributing NT$11.74 billion.

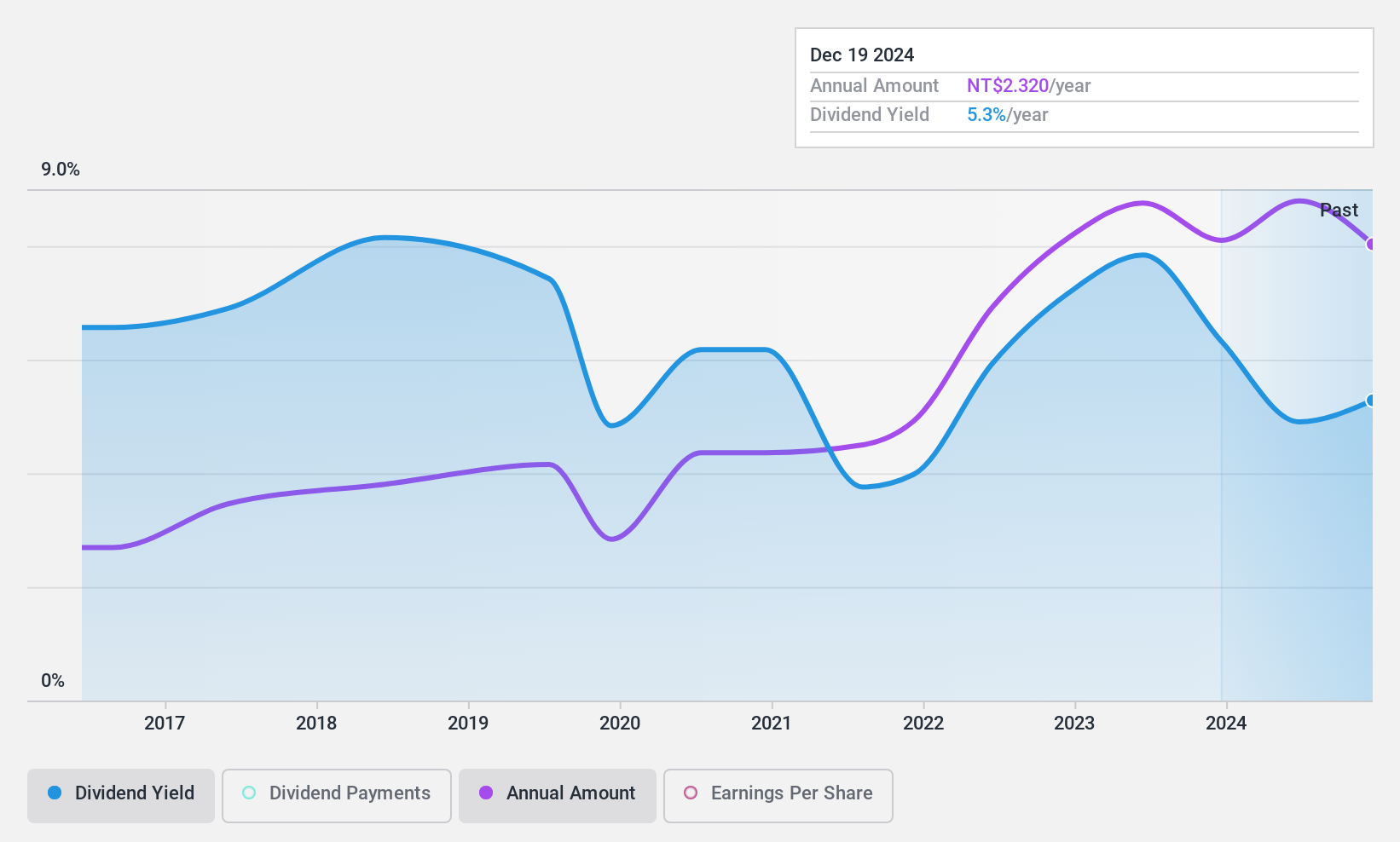

Dividend Yield: 5.3%

Chang Wah Electromaterials offers a dividend yield of 5.33%, placing it in the top 25% of Taiwan's market, yet its high payout ratio of 133.5% suggests dividends are not well covered by earnings. Despite recent increases, dividends have been volatile over the past decade. The cash payout ratio at 82.5% indicates coverage by cash flows, but sustainability concerns persist due to declining net income and earnings per share compared to last year’s figures.

- Get an in-depth perspective on Chang Wah Electromaterials' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Chang Wah Electromaterials is trading beyond its estimated value.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1968 more companies for you to explore.Click here to unveil our expertly curated list of 1971 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4183

Mitsui Chemicals

Engages in the mobility, life and health care, basic and green materials, ICT, and other businesses worldwide.

Excellent balance sheet established dividend payer.