Investors Give Mitsubishi Gas Chemical Company, Inc. (TSE:4182) Shares A 28% Hiding

Mitsubishi Gas Chemical Company, Inc. (TSE:4182) shares have had a horrible month, losing 28% after a relatively good period beforehand. The last month has meant the stock is now only up 7.1% during the last year.

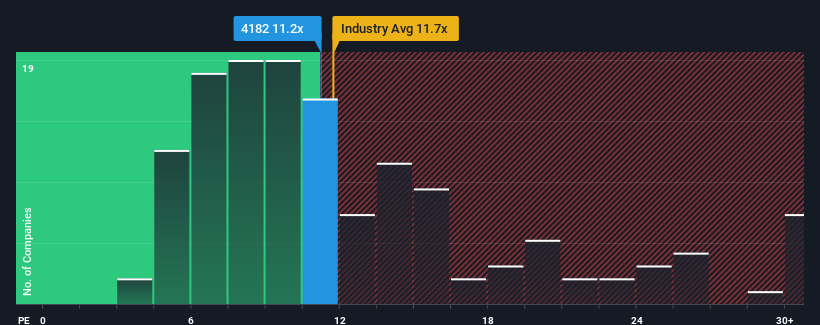

In spite of the heavy fall in price, there still wouldn't be many who think Mitsubishi Gas Chemical Company's price-to-earnings (or "P/E") ratio of 11.2x is worth a mention when the median P/E in Japan is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Mitsubishi Gas Chemical Company hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Mitsubishi Gas Chemical Company

Is There Some Growth For Mitsubishi Gas Chemical Company?

The only time you'd be comfortable seeing a P/E like Mitsubishi Gas Chemical Company's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 16% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 9.6% per annum, which is noticeably less attractive.

With this information, we find it interesting that Mitsubishi Gas Chemical Company is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Mitsubishi Gas Chemical Company's plummeting stock price has brought its P/E right back to the rest of the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Mitsubishi Gas Chemical Company's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Mitsubishi Gas Chemical Company that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives