A Fresh Look at Kaneka (TSE:4118) Valuation as Medical Device Expansion Advances

Reviewed by Kshitija Bhandaru

Kaneka (TSE:4118) just announced a new exclusive partnership, teaming up with Toro Neurovascular to bring Toro’s neurovascular catheter portfolio to the United States, pending regulatory clearance. This agreement signals Kaneka’s continuing push into advanced medical technologies.

See our latest analysis for Kaneka.

Kaneka’s recent partnership with Toro Neurovascular follows a completed share buyback, reflecting management’s confidence in the company’s future. Momentum has been building, with the stock’s 1-year total shareholder return up 13.75% and a strong 5-year total return of 60.01%. This comes even as the share price dipped slightly over the last month. The combination of expansion moves and capital returns suggests a company positioning for long-term growth rather than short-term gains.

If Kaneka’s mix of innovation and shareholder action has you thinking bigger, now could be the right time to discover See the full list for free.

With Kaneka’s share price trading at an 11% discount to analyst targets and strong growth numbers on display, is the market offering investors a hidden value, or is future growth already reflected in the stock?

Price-to-Earnings of 11.5x: Is it justified?

Compared to both its industry and peer averages, Kaneka's current price-to-earnings ratio of 11.5x signals the shares are trading at an attractive valuation relative to the Japanese market.

The price-to-earnings (P/E) multiple reflects how much investors are willing to pay for a company’s earnings. In the chemicals sector, this metric is widely used to assess whether growth and profitability prospects are already captured in the share price. For Kaneka, a P/E of 11.5x is below the Japanese market average (14.7x), the industry average (13x), and the peer group average (15x).

This suggests the market may be undervaluing Kaneka’s earnings power, despite recent headwinds in earnings growth. Notably, regression analysis estimates a fair price-to-earnings ratio of 15.3x for the company, indicating further upside if investor sentiment shifts closer to sector norms.

Explore the SWS fair ratio for Kaneka

Result: Price-to-Earnings of 11.5x (UNDERVALUED)

However, slower revenue growth or unexpected industry challenges could weigh on Kaneka’s outlook. This reminds investors that value opportunities carry uncertainty.

Find out about the key risks to this Kaneka narrative.

Another View: DCF Model Offers a Contrasting Perspective

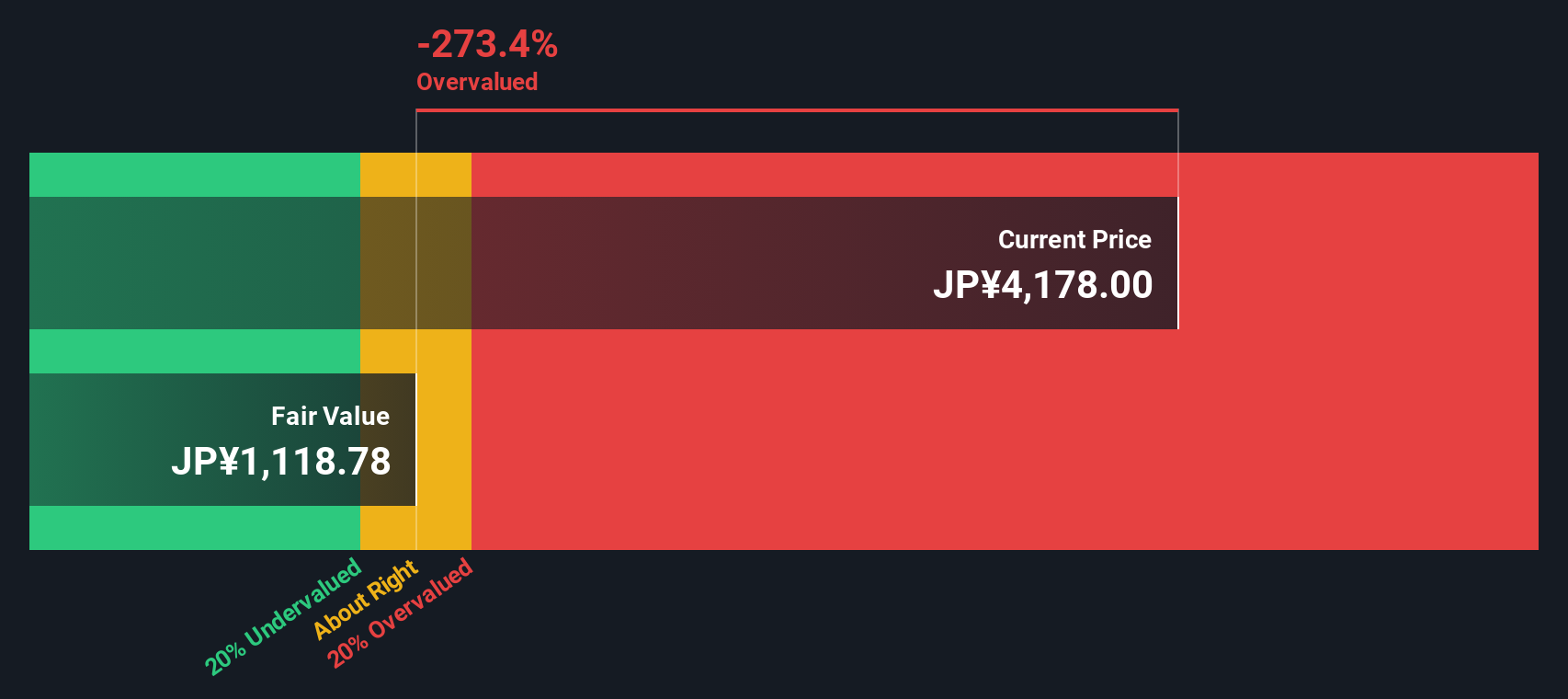

While the price-to-earnings ratio paints Kaneka as undervalued compared to industry benchmarks, the SWS DCF model tells a different story. According to this approach, Kaneka’s current share price (¥4193) sits well above our estimate of fair value (¥1124.76), which suggests possible over-optimism in the market. Does this highlight hidden risks, or is the market simply looking further ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaneka for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaneka Narrative

If you see the story differently or want to examine the numbers yourself, you can build a personal narrative and reach your own conclusions in minutes. Do it your way

A great starting point for your Kaneka research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Shake up your portfolio and catch the trends others might miss by tracking breakthrough themes with Simply Wall Street’s powerful screener tools:

- Tap into growth with these 898 undervalued stocks based on cash flows, which may be poised for a rebound in value before the rest of the market catches on.

- Unlock consistent income streams by targeting these 19 dividend stocks with yields > 3%, featuring companies offering reliable yields above 3%.

- Ride the cutting edge by scanning these 24 AI penny stocks, highlighting companies shaping tomorrow through artificial intelligence and advanced automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaneka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4118

Kaneka

Engages in the manufacture and sale of polyvinyl chloride (PVC), crosslinked PVC, PVC-PVAc polymers, paste PVC, acryl grafted-vinyl chloride copolymer, and chlorinated PVC in Japan and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives