Evaluating Nippon Shokubai (TSE:4114) After Its Substantial Share Buyback: What Does the Valuation Say?

Reviewed by Kshitija Bhandaru

Nippon Shokubai (TSE:4114) just wrapped up its latest share buyback initiative, acquiring more than 2.8 million shares from late July through September. This move often draws attention from investors who are considering longer-term value.

See our latest analysis for Nippon Shokubai.

This buyback concludes at a time when Nippon Shokubai’s share price has swung lower in recent weeks. However, the three-year total shareholder return stands at more than 53%, suggesting that the company’s steady long-term gains remain in place despite recent volatility and a soft start to the year.

If management’s buyback move has you thinking about what other opportunities are out there, now is a great moment to discover fast growing stocks with high insider ownership

The real question now is whether Nippon Shokubai’s fundamentals and recent buyback indicate the stock is trading below its true value, or if the market has already accounted for all the future growth ahead.

Price-to-Earnings of 15.6x: Is it justified?

Nippon Shokubai’s shares are trading at a price-to-earnings (P/E) ratio of 15.6x, which puts it on the expensive end compared to both its sector and key valuation benchmarks.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of the company’s earnings. For Nippon Shokubai, this means the market currently prices in strong recent growth and may be assuming those conditions can persist. However, the P/E ratio alone does not tell the whole story. It must be weighed against profit trends and future expectations.

Compared to the Japanese Chemicals industry average P/E of 13.0x and a fair P/E ratio estimate of 13.1x, Nippon Shokubai’s 15.6x is well above both. This signals that the current share price bakes in optimism beyond typical industry levels and the historical norms suggested by fair value calculations, indicating a notable premium.

Explore the SWS fair ratio for Nippon Shokubai

Result: Price-to-Earnings of 15.6x (OVERVALUED)

However, slower revenue growth or renewed share price volatility could challenge optimism and put pressure on Nippon Shokubai’s elevated valuation in the coming quarters.

Find out about the key risks to this Nippon Shokubai narrative.

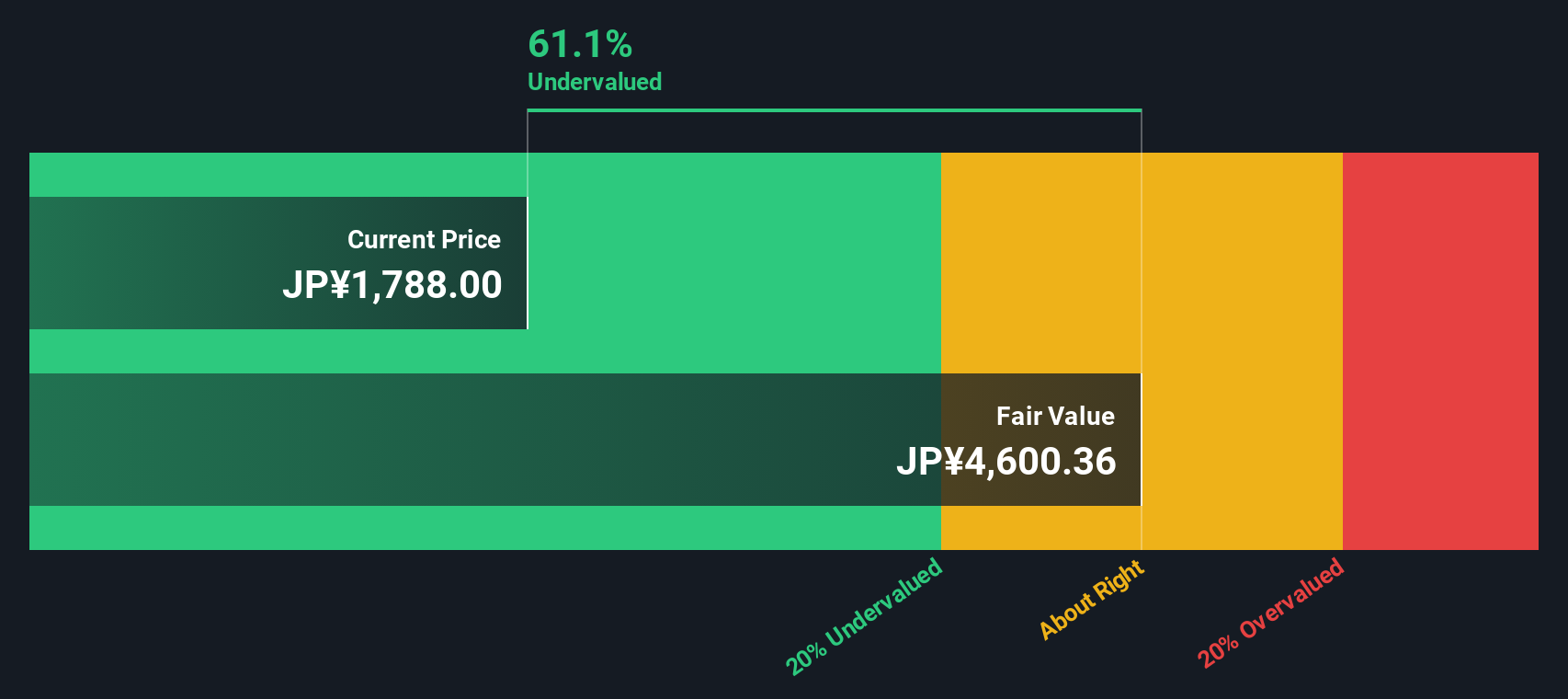

Another View: DCF Points to Significant Undervaluation

The SWS DCF model presents a completely different perspective. According to this approach, Nippon Shokubai’s share price is trading a striking 61% below its estimated fair value. Instead of appearing expensive, this method suggests the market might be too pessimistic about future cash flows and company potential. Which view should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Shokubai for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Shokubai Narrative

If you want to see things from your own angle or put more weight on your own analysis, it only takes a few minutes to build a personal view. Do it your way

A great starting point for your Nippon Shokubai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great investors always keep options open, so don’t miss out while fresh opportunities are within reach. Use these powerful screeners to zero in on your next standout winner today.

- Uncover stable income potential by checking out these 19 dividend stocks with yields > 3% with consistently high yields over 3%.

- Accelerate your portfolio with AI-powered companies by jumping into these 24 AI penny stocks shaping everything from automation to smart healthcare.

- Step ahead of the crowd and track undervalued gems early via these 898 undervalued stocks based on cash flows based on strong cash flows and healthy fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shokubai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4114

Nippon Shokubai

Engages in the manufacture and sale of various chemical products in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives