Why Investors Shouldn't Be Surprised By ISE Chemicals Corporation's (TSE:4107) P/E

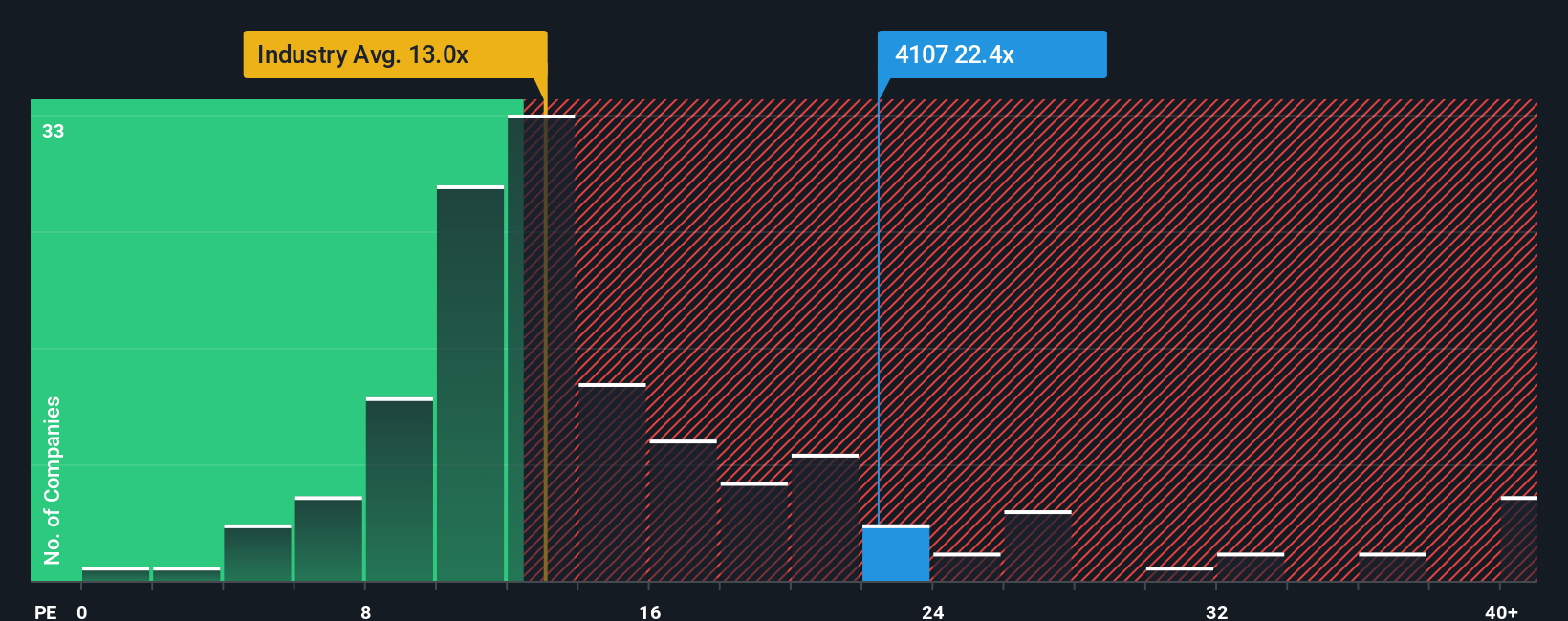

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider ISE Chemicals Corporation (TSE:4107) as a stock to avoid entirely with its 22.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been quite advantageous for ISE Chemicals as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for ISE Chemicals

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as ISE Chemicals' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. The latest three year period has also seen an excellent 209% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that ISE Chemicals' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On ISE Chemicals' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ISE Chemicals revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ISE Chemicals you should know about.

If you're unsure about the strength of ISE Chemicals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4107

ISE Chemicals

Engages in the iodine and natural gas, and metallic compound businesses in Japan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives