Dai-ichi Life (TSE:8750): Assessing Valuation After Major Capital Boost to Strengthen Regulatory Position

Reviewed by Kshitija Bhandaru

Dai-ichi Life Holdings (TSE:8750) has secured a substantial subordinated loan from a syndicate of 32 Japanese financial institutions. This move aims to strengthen its capital base in preparation for regulatory changes under Japan's Economic Value-based Solvency Framework.

See our latest analysis for Dai-ichi Life Holdings.

Following this latest capital move, Dai-ichi Life Holdings has seen its momentum cool off a bit in recent weeks. However, long-term investors remain well rewarded: the stock boasts an impressive 18% total shareholder return over one year and a remarkable 231% over five years. This suggests continued confidence in its underlying outlook despite recent volatility.

If you’re in the mood to discover more compelling opportunities, now is a great moment to broaden your watchlist with fast growing stocks with high insider ownership

Yet with shares still trading at a 22% discount to analyst price targets and over 50% below some intrinsic value estimates, the real question is whether Dai-ichi Life remains undervalued or if the market is already anticipating future gains.

Most Popular Narrative: 17% Undervalued

With the fair value from the most widely followed narrative sitting well above Dai-ichi Life Holdings’ last close, this outlook puts the company on investors' radars. The market has not fully reflected the company’s diversified platform, according to the narrative’s underlying thesis.

Expansion in international business, particularly in Asia and Australia, is delivering strong profit growth and improving diversification. This reduces reliance on Japan's mature insurance market, which supports higher consolidated revenue and earnings stability.

Curious what earnings and margin shifts this valuation is built on? The core driver here is future profit growth based on international moves and recurring revenue. There is a lynchpin forecast locked within this narrative that could surprise even experienced market watchers. See for yourself what assumptions power this fair value calculation.

Result: Fair Value of ¥1,346 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low interest rates or rising operating costs could quickly undermine investor expectations and challenge Dai-ichi Life as it seeks higher margins.

Find out about the key risks to this Dai-ichi Life Holdings narrative.

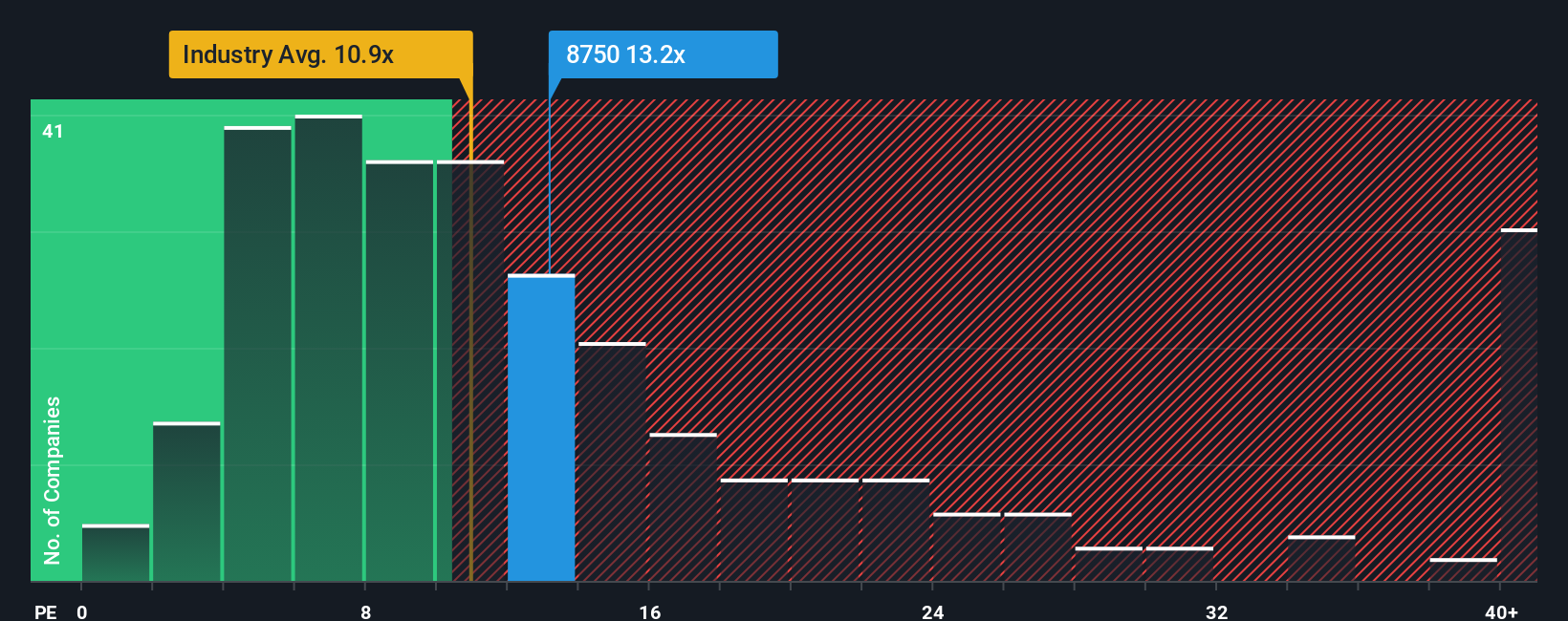

Another View: Checking Value with Earnings Multiples

Looking at price-to-earnings ratios, Dai-ichi Life trades at 12x earnings, which is slightly higher than the Asian Insurance industry average of 11.7x. However, when compared to its peer group average of 15x, it looks cheaper. The market's "fair ratio" for Dai-ichi Life is estimated around 15.2x. This suggests there may be room for upside if sentiment shifts. Does this gap signal a value opportunity or could there be a reason the market remains cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dai-ichi Life Holdings Narrative

If you want to dive deeper or have your own view to test, you can explore the numbers firsthand and shape a unique perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dai-ichi Life Holdings.

Looking for More Investment Ideas?

Expand your strategy by checking out new sectors and powerful trends. If you miss out, you might leave some of the market’s best potential on the table. Use these handpicked tools to uncover what others often overlook:

- Spot the strongest potential with these 874 undervalued stocks based on cash flows, where companies trade below intrinsic value but show signs of robust fundamentals.

- Benefit from steady income streams by evaluating these 18 dividend stocks with yields > 3%, which offers yields above 3% and the security of proven payouts.

- Explore opportunities in artificial intelligence by investigating these 24 AI penny stocks, featuring businesses at the forefront of AI innovation and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives