Is Sompo Holdings' (TSE:8630) Share Buyback a Sign of Confidence or Limited Growth Ambitions?

Reviewed by Sasha Jovanovic

- Sompo Holdings has completed its share buyback program, repurchasing 16,637,800 shares, representing 1.8% of its outstanding shares, for ¥74,702.79 million, as announced earlier this year.

- This move often indicates management's confidence in the company and is seen as a way to enhance value for existing shareholders.

- We’ll explore how the completion of this sizable share repurchase shapes Sompo Holdings’ investment narrative and management’s confidence signal.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sompo Holdings' Investment Narrative?

To be a shareholder in Sompo Holdings, it’s important to believe in the company’s ability to create value through efficient capital management, international expansion, and stable earnings growth, even in a market with moderate profit expectations. The just-completed buyback, totaling more than ¥74 billion for 1.8% of shares, is a sign of management’s conviction in the current valuation, but its impact on the near-term catalysts, such as the upcoming Q2, 2026 earnings release and possible M&A activity with Aspen Insurance, may be incremental rather than transformative, given recent price gains and strong total returns. Risks still center on ongoing margin pressure and the shift to IFRS, which could affect financial transparency and reporting volatility. Ultimately, the buyback fits into a broader value narrative, but does not fundamentally alter the biggest short-term risks or opportunities for the business.

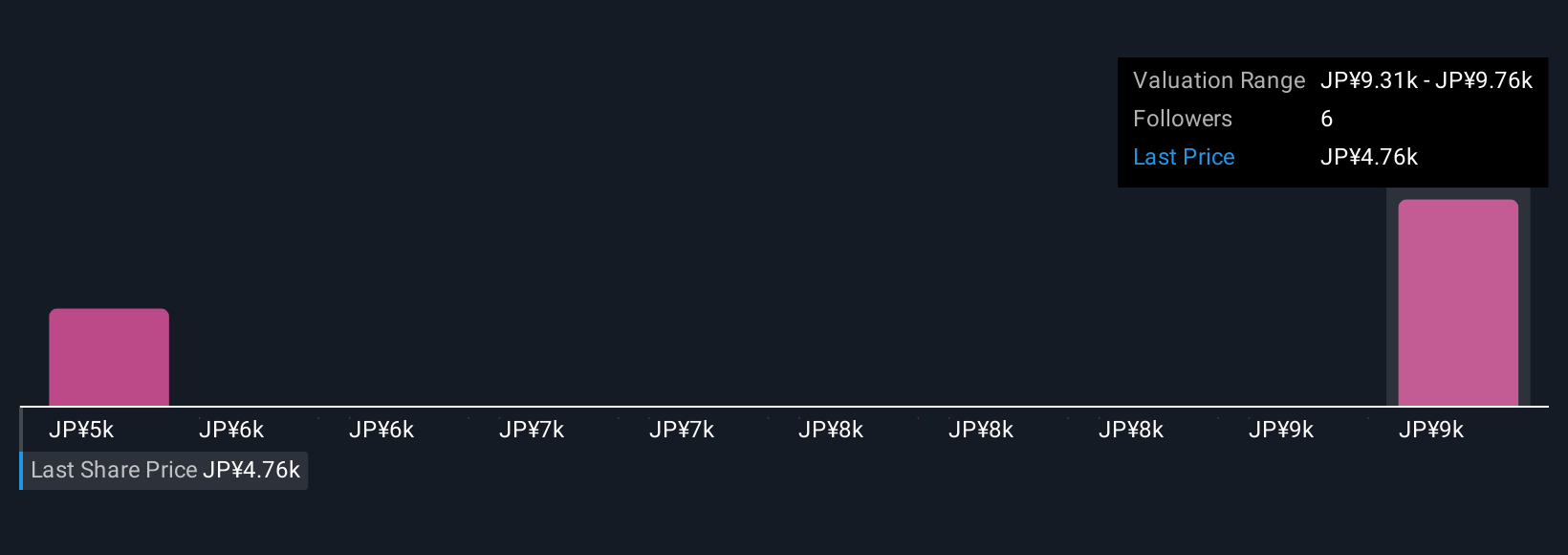

Yet, the change to IFRS reporting might affect future earnings visibility in ways some investors may overlook. Sompo Holdings' shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Sompo Holdings - why the stock might be worth just ¥5318!

Build Your Own Sompo Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sompo Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sompo Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sompo Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8630

Sompo Holdings

Provides property and casualty insurance services in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives