- China

- /

- Auto Components

- /

- SZSE:000030

Exploring 3 Promising Undiscovered Gems In Asia

Reviewed by Simply Wall St

Amidst a backdrop of global trade uncertainties and mixed performances in major indices, smaller-cap stocks have shown resilience, with indexes like the S&P MidCap 400 and Russell 2000 posting gains. This environment highlights the potential for discovering promising opportunities within Asia's dynamic markets, where companies that demonstrate strong fundamentals and adaptability to economic shifts can stand out as compelling investment prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.75% | 29.33% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Holly Futures | 2.30% | 18.13% | -25.64% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

FAWER Automotive Parts Limited (SZSE:000030)

Simply Wall St Value Rating: ★★★★★☆

Overview: FAWER Automotive Parts Limited Company focuses on the research, development, manufacture, and sale of auto parts both in China and internationally, with a market cap of CN¥9.77 billion.

Operations: FAWER Automotive Parts Limited generates revenue primarily from the sale of auto parts in both domestic and international markets. The company's cost structure includes expenses related to research, development, and manufacturing processes.

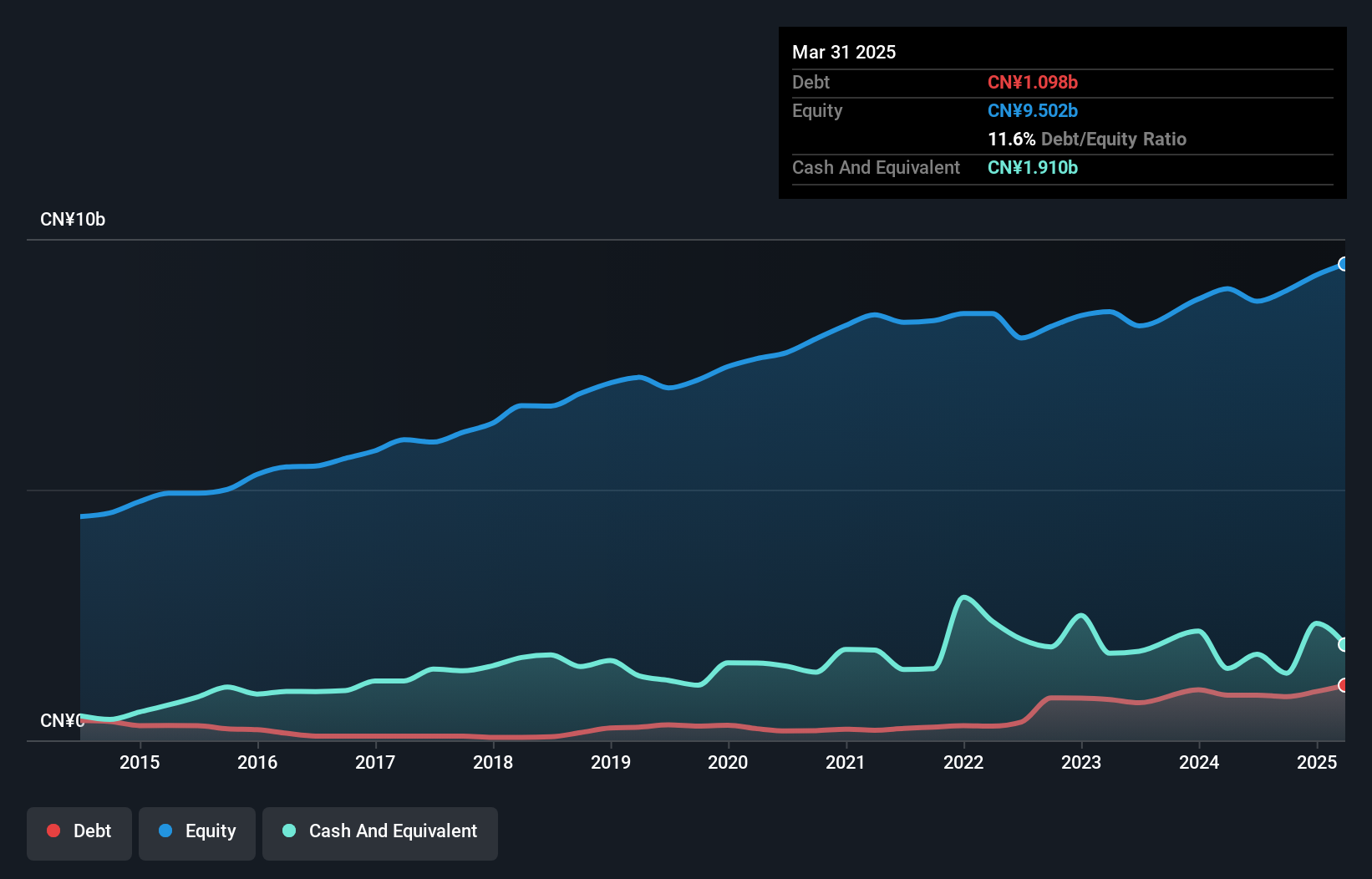

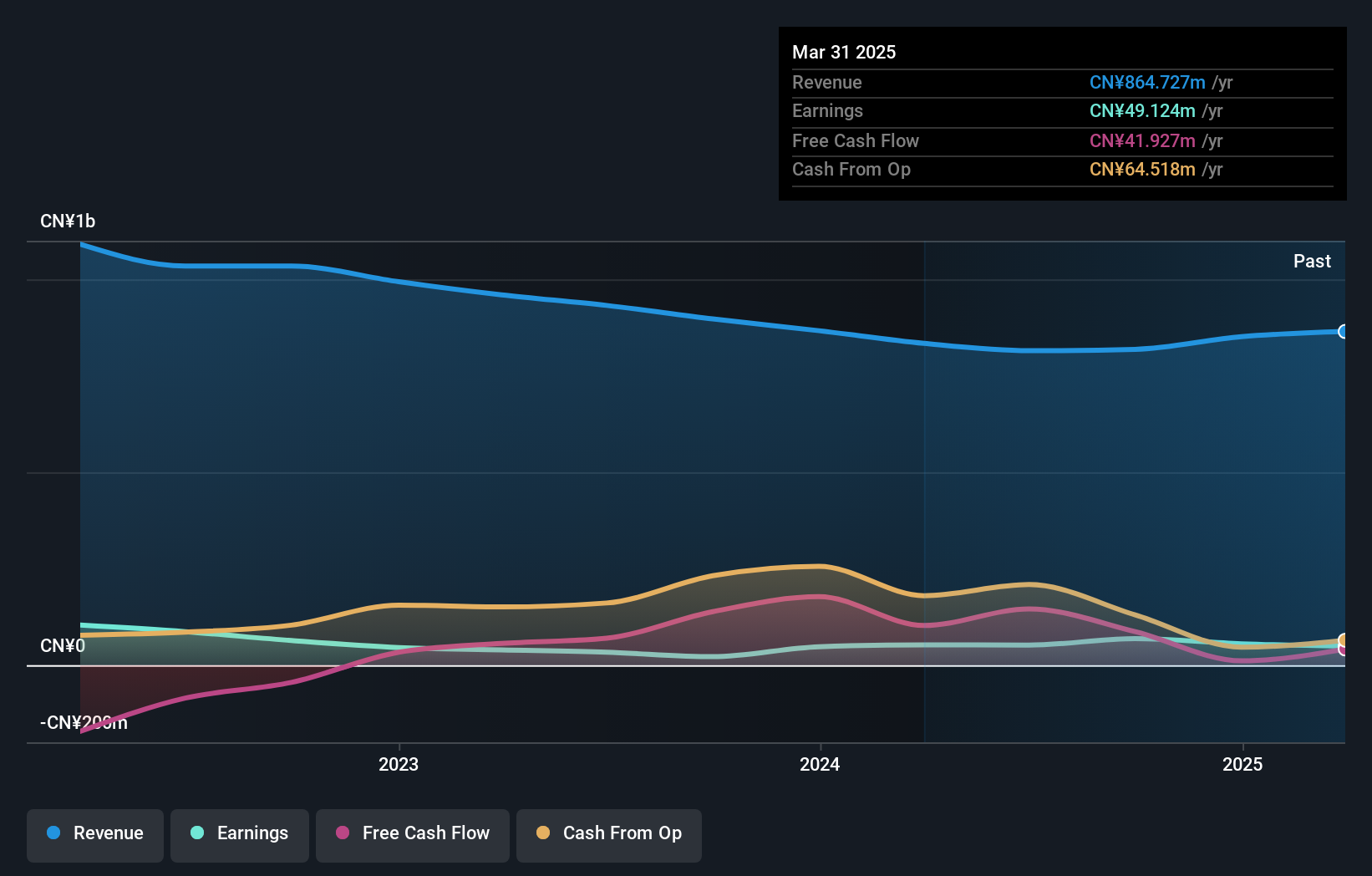

FAWER Automotive Parts Limited, a small player in the auto components sector, has shown resilience with earnings growth of 11.9% over the past year, outpacing the industry's 7.6%. The company's debt-to-equity ratio increased to 11.7% from 4% over five years, yet it holds more cash than its total debt, indicating financial stability. With a price-to-earnings ratio of 14.6x below China's market average of 35.8x, FAWER offers value potential despite historical earnings decline at an annual rate of 10%. Recent revenue and net income improvements suggest positive momentum for this under-the-radar stock.

Shenzhen Bestek Technology (SZSE:300822)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Bestek Technology Co., Ltd. focuses on the research, development, manufacture, and sale of smart controllers and products both in China and internationally, with a market cap of CN¥6.72 billion.

Operations: Shenzhen Bestek Technology generates revenue primarily through the sale of smart controllers and related products. The company's net profit margin shows a notable trend, reflecting its efficiency in converting revenue into actual profit.

Shenzhen Bestek Technology, a small player in the tech world, showcases an intriguing financial profile. With earnings growth of 213% over the past year, it has outpaced its industry peers significantly. The company is debt-free now, a notable shift from five years ago when its debt-to-equity ratio was 0.6%. Despite this progress, earnings have seen a yearly decline of 31% over five years. Its free cash flow position remains positive at US$145 million as of June 2024, suggesting strong operational efficiency. However, investors should be cautious due to recent share price volatility and fluctuating financial performance.

- Unlock comprehensive insights into our analysis of Shenzhen Bestek Technology stock in this health report.

Understand Shenzhen Bestek Technology's track record by examining our Past report.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifenet Insurance Company offers life insurance products and services across Japan, North America, and internationally, with a market capitalization of ¥148.59 billion.

Operations: Lifenet Insurance generates revenue primarily from its life insurance products and services. The company recorded a market capitalization of ¥148.59 billion, reflecting its financial scale in the industry.

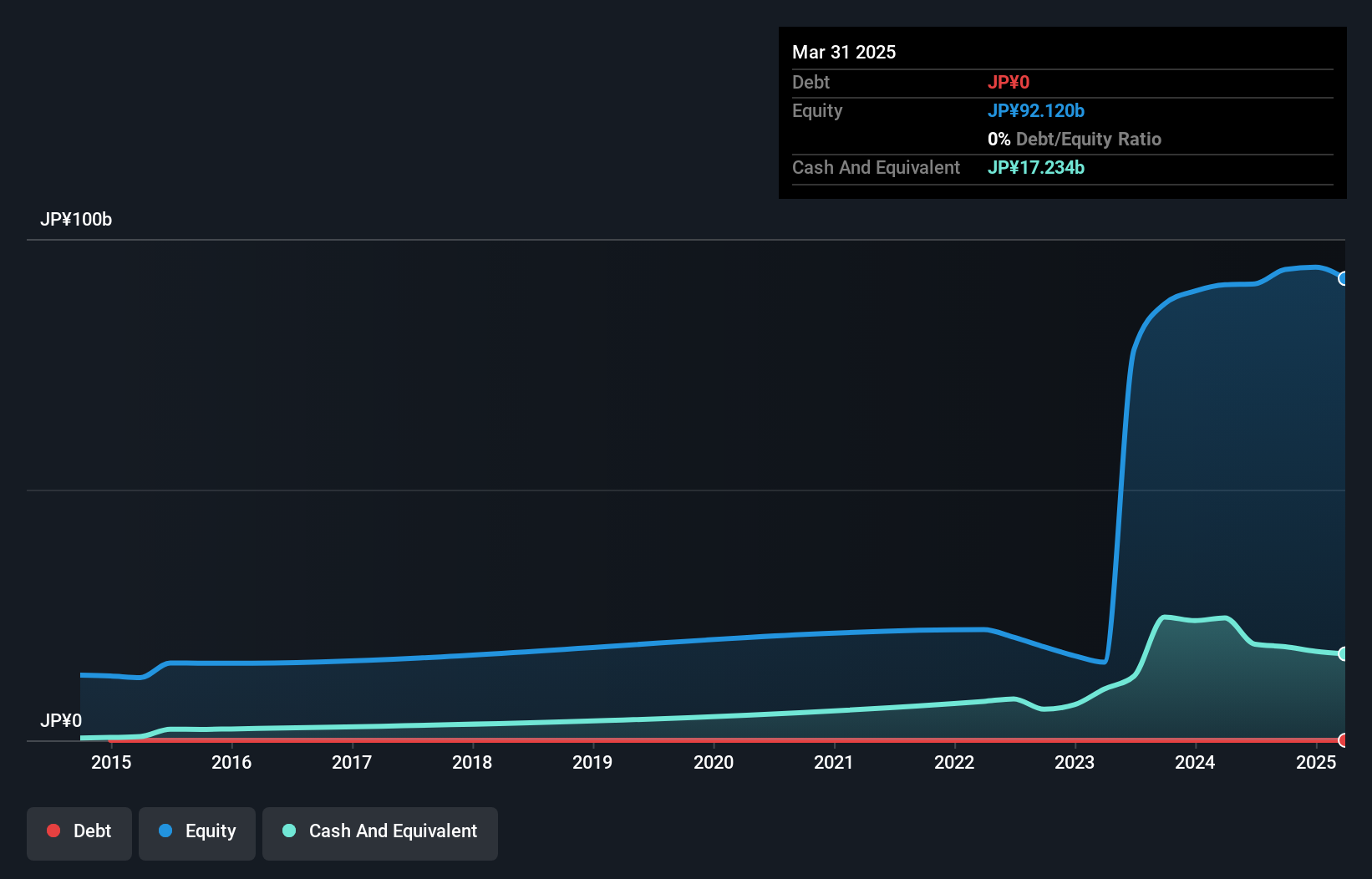

Lifenet Insurance, a nimble player in the insurance sector, showcases impressive financial health with high-quality earnings and no debt over the past five years. Its earnings surged by 114% last year, outpacing the industry average of 40.3%. The company reported an annualized premium of JPY 34.52 billion for March 2025, reflecting a solid increase from JPY 28.75 billion a year earlier. With free cash flow consistently positive and projected earnings growth at 7.54% annually, Lifenet's strategic executive changes and robust premium growth indicate promising potential for continued success in its market niche.

- Navigate through the intricacies of Lifenet Insurance with our comprehensive health report here.

Gain insights into Lifenet Insurance's past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 2652 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000030

FAWER Automotive Parts Limited

Engages in the research and development, manufacture, and sale of auto parts in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives