Japan Post Holdings (TSE:6178): Evaluating Valuation After Regulatory Setbacks and New Operational Restrictions

Reviewed by Kshitija Bhandaru

Japan Post Holdings (TSE:6178) recently faced regulatory actions tied to deficiencies in roll call procedures at its key postal subsidiary, resulting in a license revocation for general motor truck transportation as well as additional restrictions for over 100 offices. With ongoing scrutiny and new operational requirements, investors are watching how these developments may influence both customer trust and operational efficiency.

See our latest analysis for Japan Post Holdings.

Japan Post Holdings’ share price has slipped about 5% year-to-date, with a recent 2.7% dip possibly reflecting market unease following regulatory action, even as the company completed a major share buyback. Still, longer-term momentum appears intact, with a solid 5.8% total shareholder return over the past year and a striking 65.6% total return in three years.

If recent headlines have you curious about what else is gaining traction, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and regulatory hurdles still fresh, is Japan Post Holdings now undervalued and presenting a buying opportunity, or has the market already accounted for both its risks and long-term growth?

Price-to-Earnings of 11.3x: Is it justified?

Against its last close of ¥1,428, Japan Post Holdings trades at a price-to-earnings (P/E) ratio of 11.3x, which signals relative affordability among its insurance peers and compared to broader market benchmarks.

The P/E ratio reflects how much investors are willing to pay for each yen of earnings and is particularly relevant for mature sectors like insurance, where profit stability often outweighs rapid growth. In this case, it suggests the market is placing a reasonable value on Japan Post Holdings’ current earnings power.

Looking deeper, Japan Post Holdings’ P/E of 11.3x sits below the Asian Insurance industry average of 11.8x and well beneath the peer average of 15.8x. Additionally, it trades at a discount to its estimated fair P/E ratio of 13.8x, indicating potential for price adjustment if earnings meet or exceed expectations.

Explore the SWS fair ratio for Japan Post Holdings

Result: Price-to-Earnings of 11.3x (UNDERVALUED)

However, ongoing regulatory scrutiny and modest revenue growth could limit Japan Post Holdings' upside and could weigh on market sentiment in the near term.

Find out about the key risks to this Japan Post Holdings narrative.

Another View: What Does the SWS DCF Model Say?

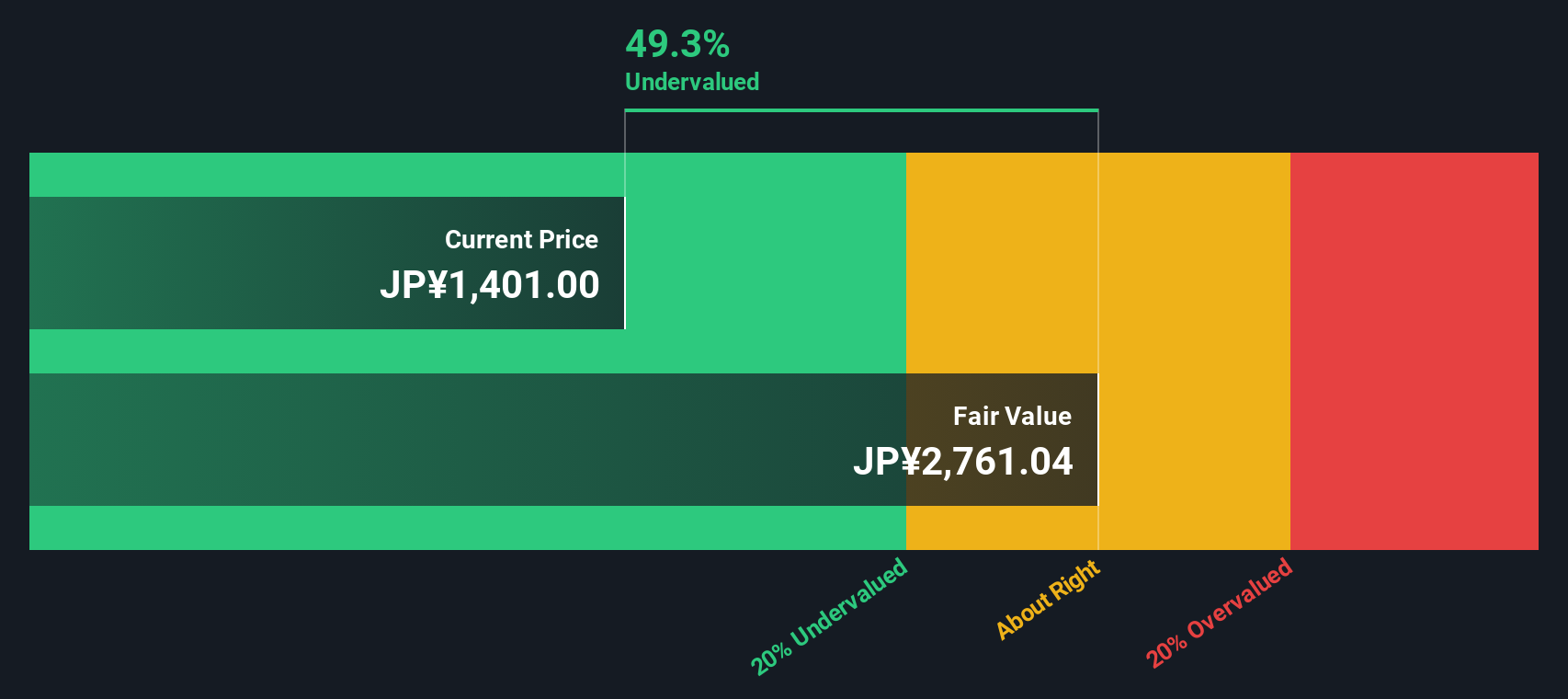

While Japan Post Holdings appears to be a bargain based on earnings multiples, the SWS DCF model offers an even more pronounced perspective. According to our DCF analysis, shares are trading about 48% below estimated fair value, which suggests deeper undervaluation than what multiples alone indicate. Could this gap signal an overlooked opportunity or reflect lingering risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Post Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Post Holdings Narrative

If you want to take a closer look and craft your own perspective based on the available data, you can easily build your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Japan Post Holdings.

Looking for more investment ideas?

Now is the time to reset your watchlist and get ahead. Grab your next investing edge with specialized opportunities powered by Simply Wall Street's intelligent screeners.

- Unlock high-powered yield by checking out these 19 dividend stocks with yields > 3% offering robust returns above 3% from reliable payers.

- Spot future leaders in artificial intelligence by starting with these 24 AI penny stocks driving innovation in this transformative sector.

- Uncover exceptional bargains waiting in plain sight with these 892 undervalued stocks based on cash flows that stand out for their strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6178

Japan Post Holdings

Provides postal, banking, and insurance services in Japan.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives