- Japan

- /

- Healthtech

- /

- TSE:4480

Medley And 2 Other High Growth Stocks With Strong Insider Ownership On The Japanese Exchange

Reviewed by Simply Wall St

Japan's stock markets have recently gained momentum, buoyed by the Bank of Japan's dovish stance and China's announcement of robust stimulus measures. This favorable backdrop has created a fertile environment for growth companies with high insider ownership, which often signals strong confidence in the company's future prospects. In this article, we will explore three such stocks on the Japanese exchange: Medley and two others that exemplify high growth potential coupled with significant insider investment.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Let's explore several standout options from the results in the screener.

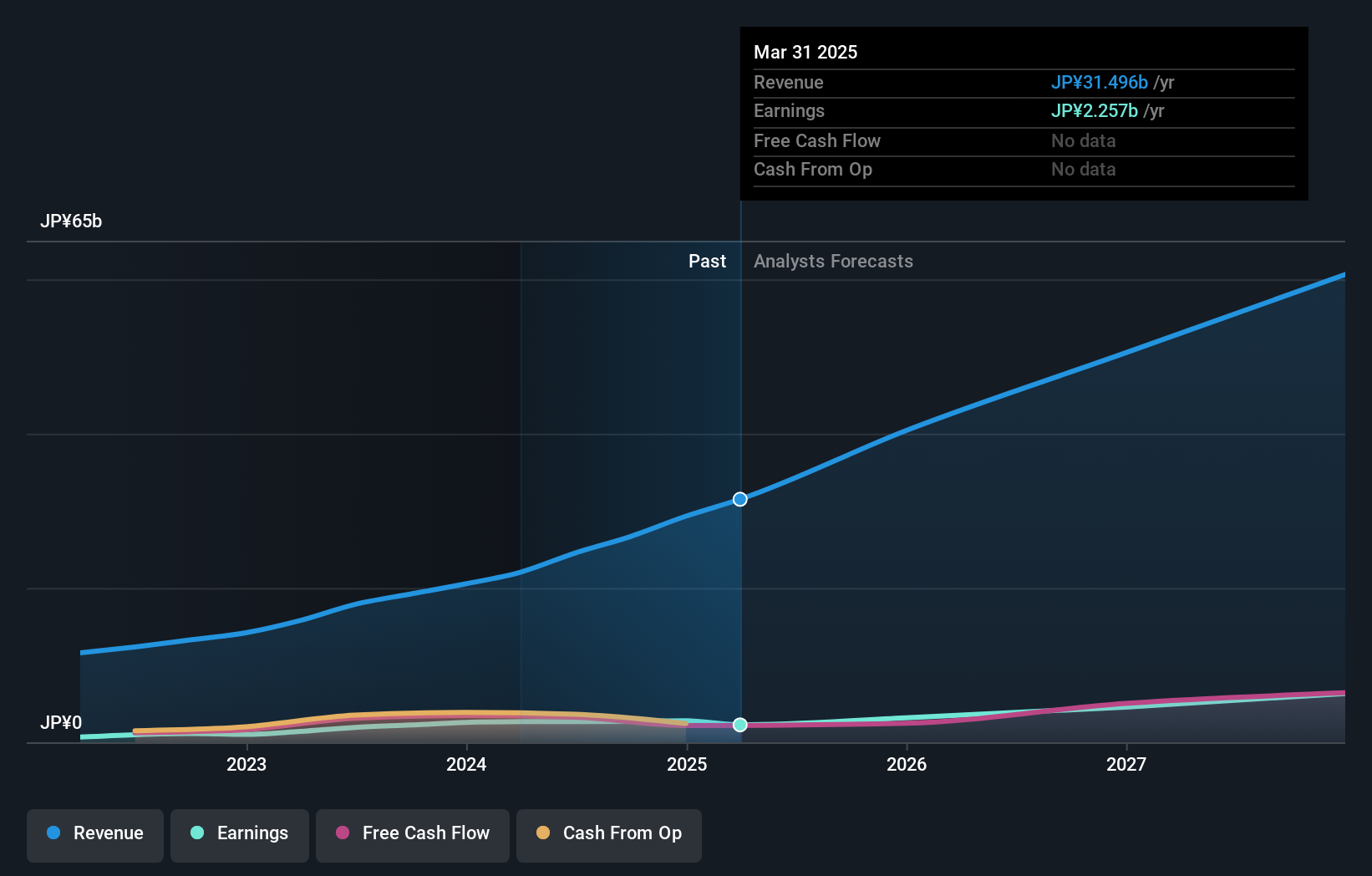

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥128.32 billion.

Operations: Revenue segments include ¥0.57 billion from New Services, ¥6.09 billion from the Medical Platform Business, and ¥17.87 billion from the Human Resource Platform Business.

Insider Ownership: 34%

Earnings Growth Forecast: 30.4% p.a.

Medley, Inc. is trading at 49.9% below its estimated fair value and has no significant insider trading activity over the past three months. Its earnings are forecast to grow significantly at 30.36% annually, with revenue expected to increase by 25% per year, outpacing the Japanese market average. Despite a highly volatile share price recently, Medley reported a 39.2% earnings growth last year and expects a high return on equity of 24.4%. Recent developments include board discussions to acquire Offshore Inc., potentially expanding its business scope further.

- Delve into the full analysis future growth report here for a deeper understanding of Medley.

- The analysis detailed in our Medley valuation report hints at an inflated share price compared to its estimated value.

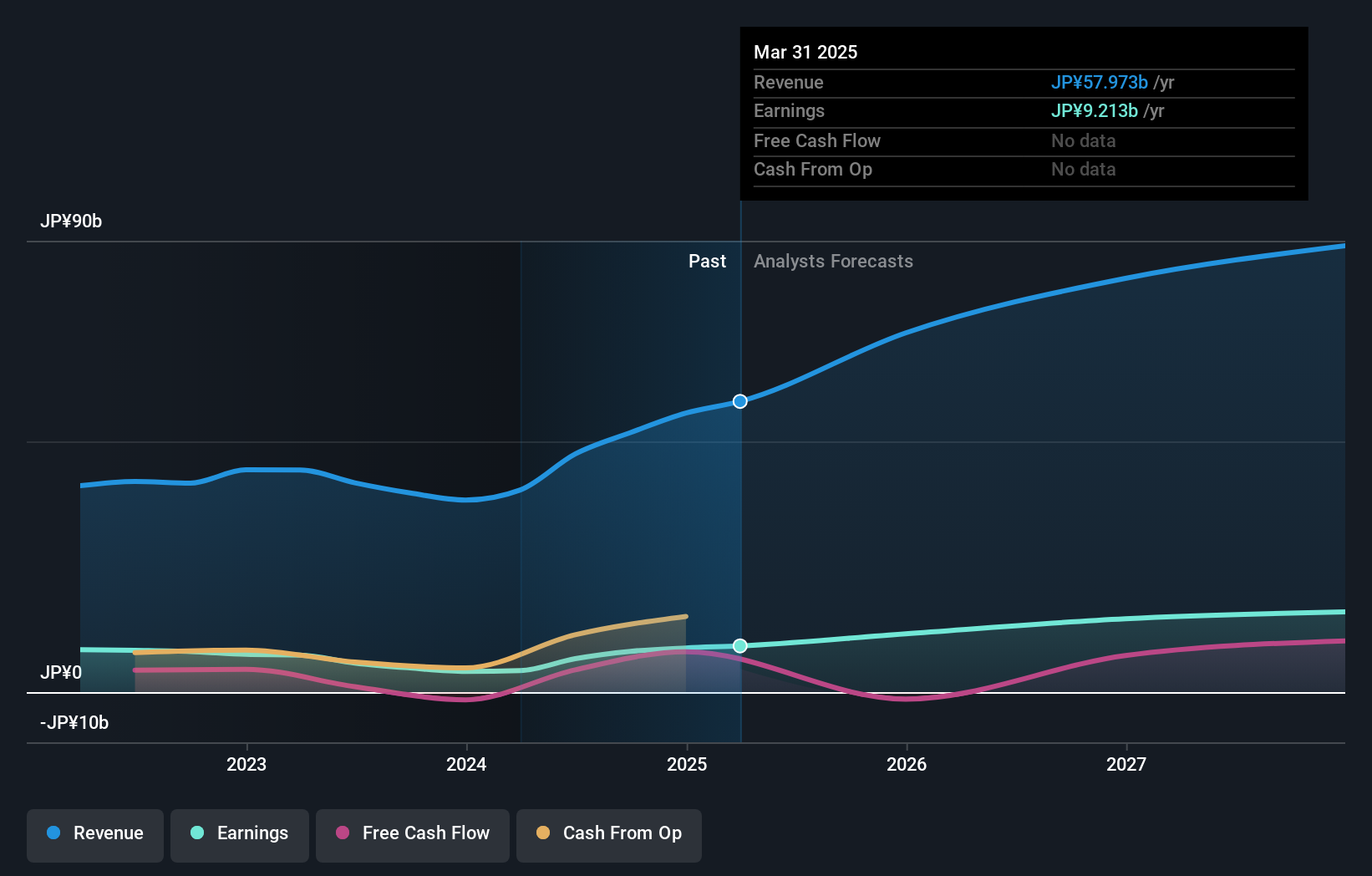

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥158.41 billion.

Operations: The company generates revenue from two primary segments: ¥2.19 billion from the TE Business and ¥45.29 billion from the Probe Card Business.

Insider Ownership: 15.3%

Earnings Growth Forecast: 31.5% p.a.

Micronics Japan is trading at 58.1% below its estimated fair value and has no significant insider trading activity over the past three months. Earnings are forecast to grow significantly at 31.53% annually, with revenue expected to increase by 20.8% per year, both outpacing the Japanese market average. Despite a highly volatile share price recently, Micronics Japan expects a high return on equity of 25.4%. Upcoming Q2 results will be reported on August 9, 2024.

- Unlock comprehensive insights into our analysis of Micronics Japan stock in this growth report.

- Our comprehensive valuation report raises the possibility that Micronics Japan is priced lower than what may be justified by its financials.

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc., with a market cap of ¥220.33 billion, operates amusement arcades primarily under the GiGO brand in Japan through its subsidiaries.

Operations: Revenue Segments (in millions of ¥): Amusement arcades: ¥null

Insider Ownership: 19.3%

Earnings Growth Forecast: 20.9% p.a.

GENDA has shown strong revenue growth of 58.7% over the past year, though profit margins have decreased from 7.5% to 4.5%. Earnings are forecast to grow at a significant rate of 20.89% annually, outpacing the Japanese market average of 8.7%. However, the share price has been highly volatile recently and insider ownership is not significantly changing based on recent activity. A follow-on equity offering was filed in July for 6.18 million shares, potentially impacting shareholder value further.

- Dive into the specifics of GENDA here with our thorough growth forecast report.

- The valuation report we've compiled suggests that GENDA's current price could be inflated.

Summing It All Up

- Access the full spectrum of 100 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.