- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6951

Exploring High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As we approach the end of 2024, global markets have experienced a mix of moderate gains and setbacks, with U.S. consumer confidence falling in December and key indices like the Nasdaq Composite showing resilience despite a mid-week decline. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to changing economic conditions, which are crucial factors given the current market sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

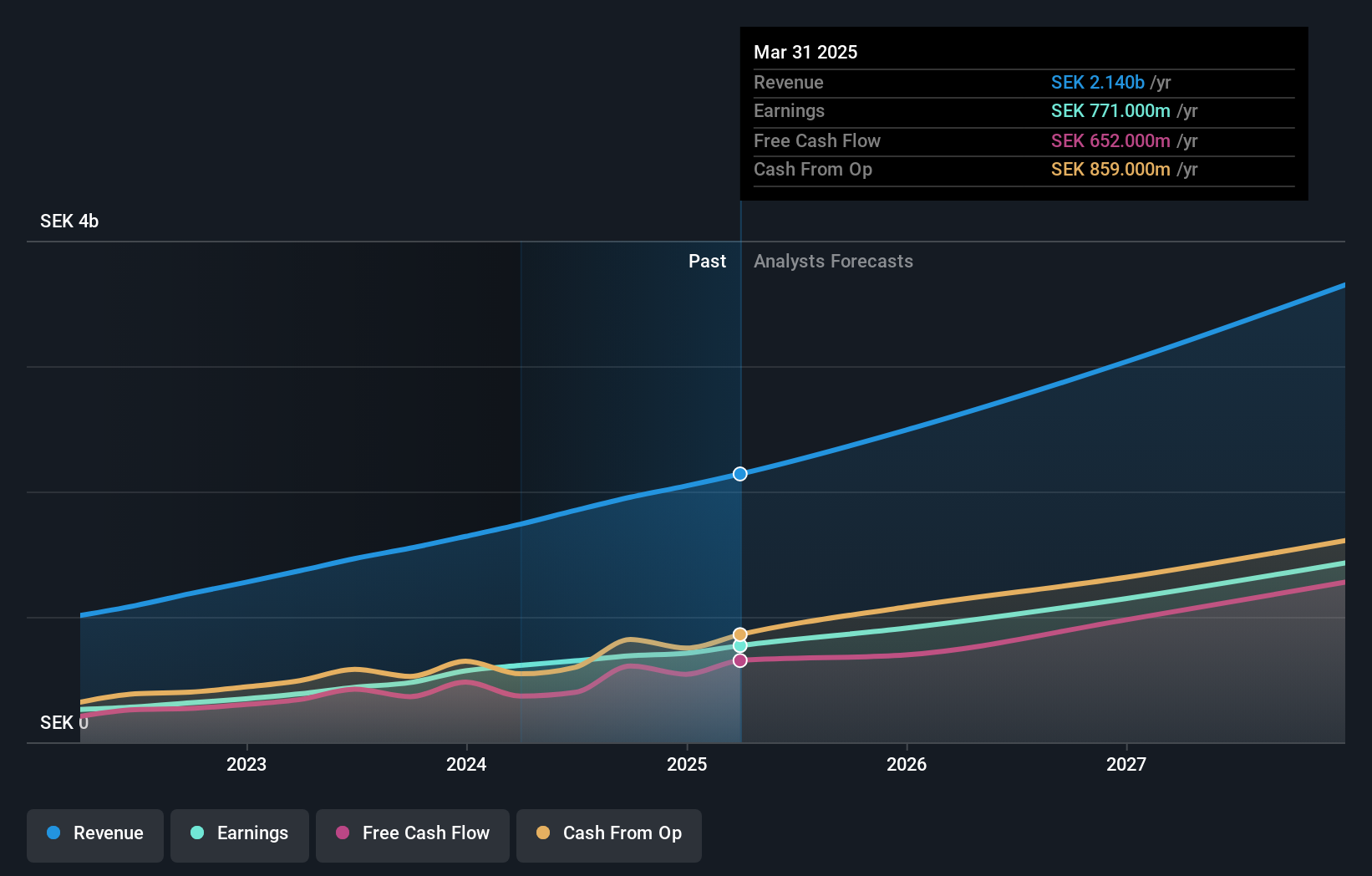

Overview: Fortnox AB (publ) offers financial and administrative software solutions tailored for small to medium-sized businesses, accounting firms, and organizations, with a market cap of approximately SEK43.98 billion.

Operations: Fortnox AB (publ) generates revenue primarily from Core Products, Businesses, and Accounting Firms, with Core Products contributing SEK768 million. The company focuses on providing integrated financial and administrative software solutions.

Fortnox's recent earnings report showcases robust growth, with third-quarter revenue climbing to SEK 530 million from SEK 424 million year-over-year and net income rising to SEK 189 million from SEK 149 million. This performance underscores a consistent upward trajectory in both top-line and bottom-line metrics. Notably, Fortnox's annualized revenue and earnings growth rates stand at 18.7% and 22.8%, respectively, outpacing the broader Swedish market indices which are considerably lower at 1.2% for revenue and 14.8% for earnings growth. The company’s investment in innovation is evident from its R&D spending trends, aligning with its strategic focus on expanding its software solutions portfolio, thereby solidifying its market position against competitors in the tech sector.

- Get an in-depth perspective on Fortnox's performance by reading our health report here.

Evaluate Fortnox's historical performance by accessing our past performance report.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

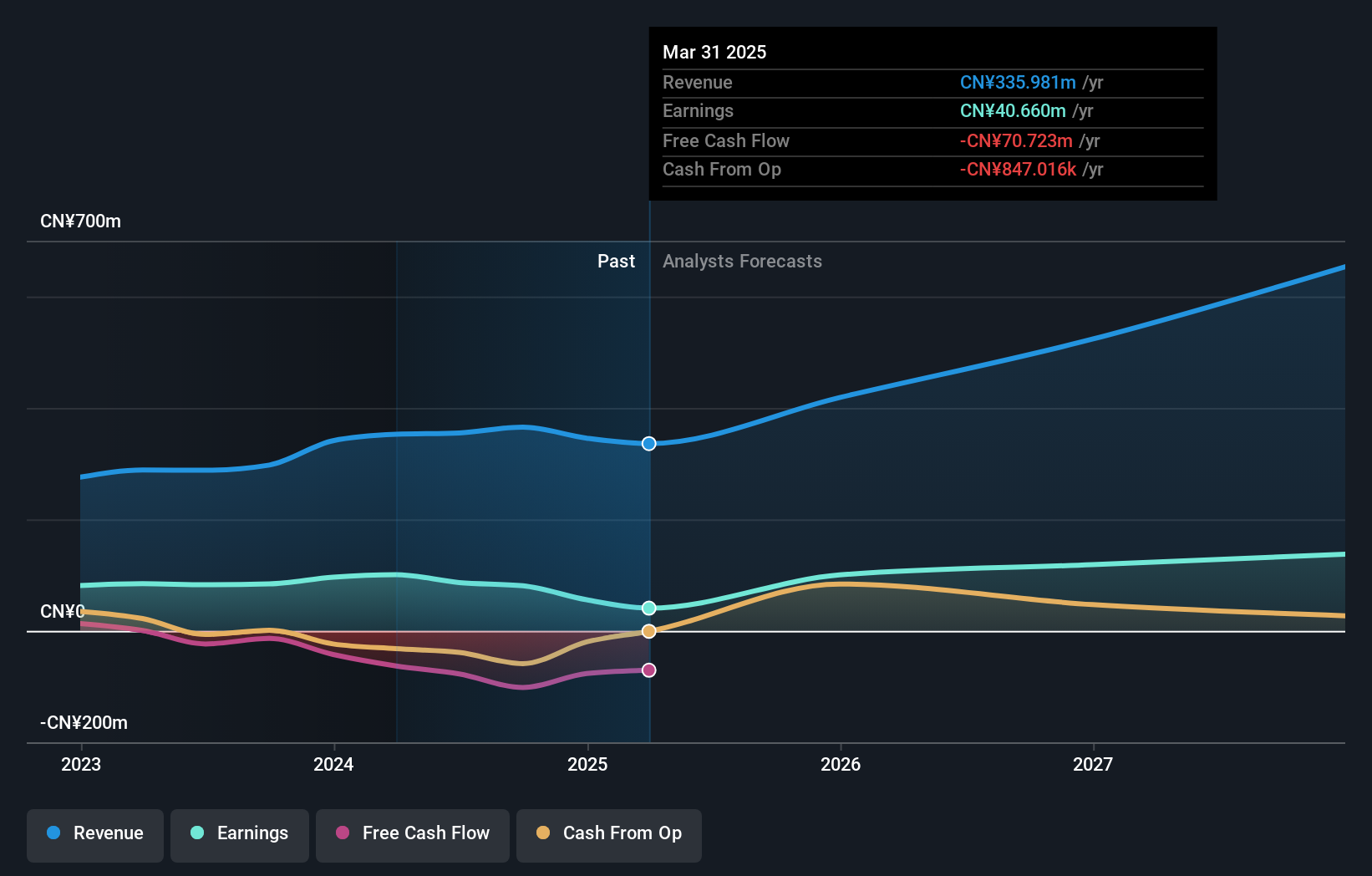

Overview: NanJing GOVA Technology Co., Ltd. specializes in the research, design, development, production, and sale of sensors and sensor network systems in China with a market cap of CN¥4.81 billion.

Operations: The company generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥365.35 million. It focuses on the development and sale of advanced sensor technologies within China.

NanJing GOVA Technology has demonstrated a notable performance in the tech sector, with its revenue growing at an annualized rate of 27.8%, significantly outpacing the CN market average of 13.7%. Despite a recent dip in net income from CNY 60.68 million to CNY 45.22 million, the company's strategic R&D investments and recent share repurchases highlight its commitment to innovation and shareholder value. These efforts are reflected in its projected earnings growth of 35.9% per year, promising robust future prospects despite current challenges.

JEOL (TSE:6951)

Simply Wall St Growth Rating: ★★★★☆☆

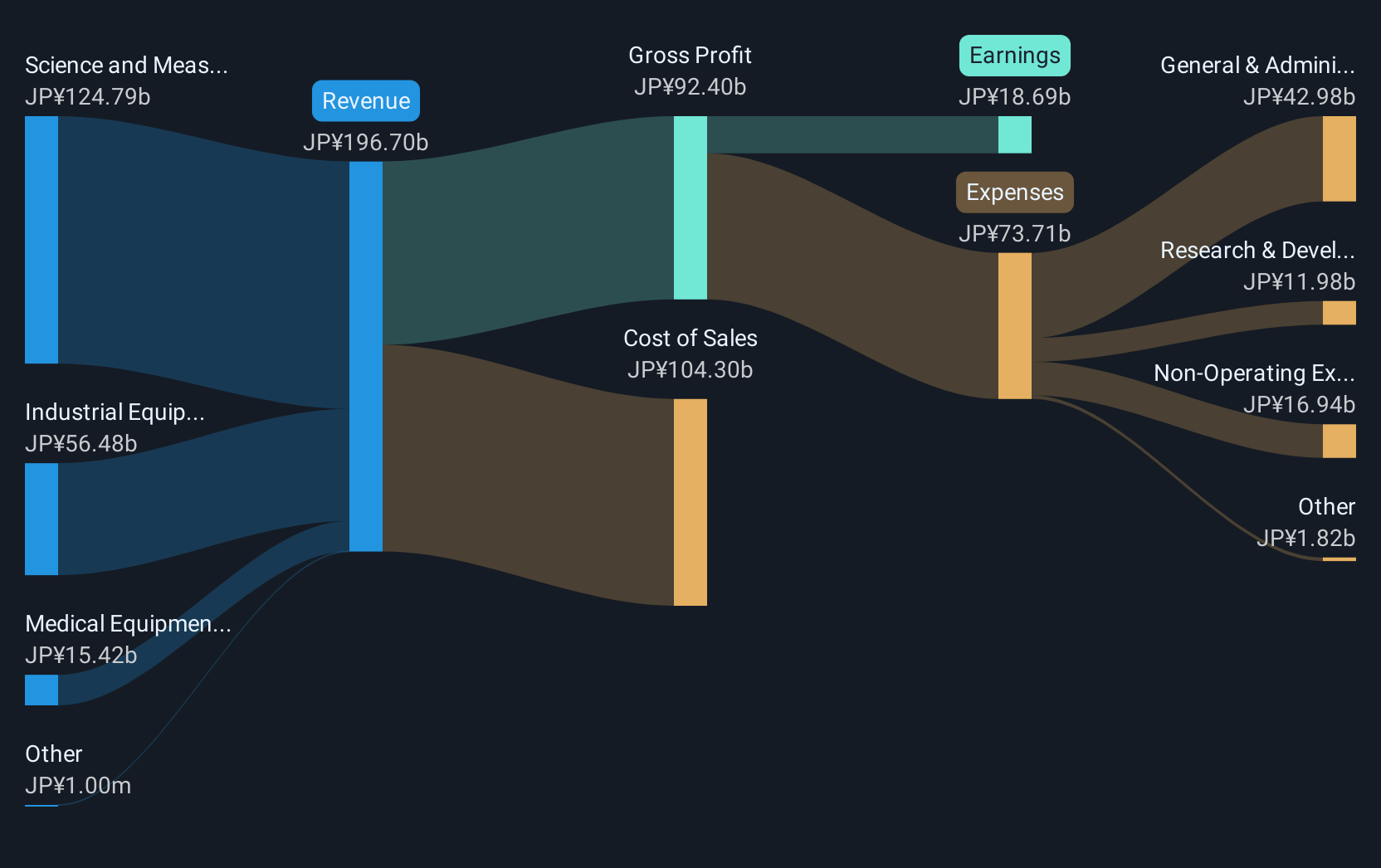

Overview: JEOL Ltd. is a global company involved in the research, development, manufacture, and marketing of scientific and metrology instruments, semiconductor and industrial equipment, and medical equipment with a market cap of ¥288.22 billion.

Operations: JEOL Ltd. generates revenue primarily from its Science and Measurement Equipment Business, contributing ¥128.06 billion, followed by the Industrial Equipment Business at ¥50.43 billion, and the Medical Equipment Business at ¥14.37 billion.

JEOL Ltd. has shown resilience and adaptability in the tech sector, with a robust half-year performance reporting JPY 87.23 billion in sales and net income of JPY 10.92 billion, reflecting a solid earnings per share of JPY 213.6. This financial uplift is supported by JEOL's aggressive participation in global industry events such as SEMICON EUROPA and BATTERY JAPAN, signaling its commitment to maintaining a strong presence in cutting-edge technology discussions worldwide. Moreover, with an anticipated annual revenue growth rate of 4.9% outpacing the Japanese market's 4.2%, coupled with an expected earnings increase of approximately 9.8% annually, JEOL is strategically positioning itself for sustained growth amidst dynamic market conditions.

- Unlock comprehensive insights into our analysis of JEOL stock in this health report.

Understand JEOL's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 1269 High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6951

JEOL

Engages in the research, development, manufacture, and marketing of scientific and metrology instruments, semiconductor and industrial equipment, and medical equipment worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives