As global markets continue to experience fluctuations, with U.S. stocks nearing record highs amid AI enthusiasm and potential tariff reductions, investors are keenly observing the economic landscape for opportunities. In this environment of cautious optimism, identifying stocks that may be trading below their estimated value can offer a strategic advantage for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.86 | TRY77.57 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.58 | £13.12 | 49.9% |

| Atea (OB:ATEA) | NOK139.40 | NOK278.37 | 49.9% |

| PDS (NSEI:PDSL) | ₹492.20 | ₹983.09 | 49.9% |

| East Side Games Group (TSX:EAGR) | CA$0.57 | CA$1.14 | 50% |

| Kinaxis (TSX:KXS) | CA$170.04 | CA$339.70 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.03 | 49.8% |

| IDP Education (ASX:IEL) | A$13.18 | A$26.30 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5856.00 | ¥11685.73 | 49.9% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.88 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

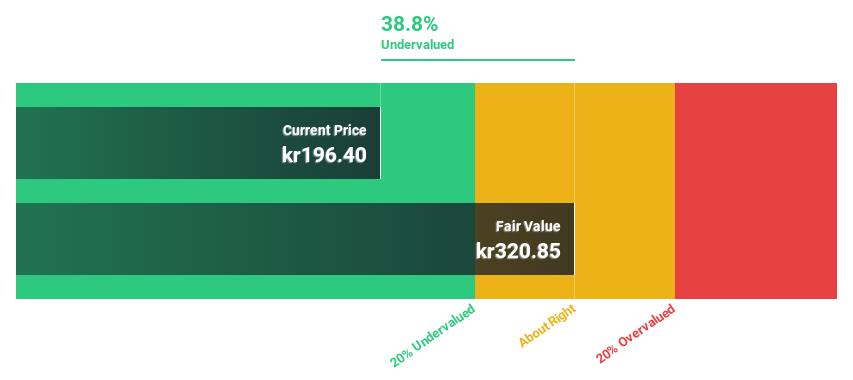

Borregaard (OB:BRG)

Overview: Borregaard ASA is a company focused on the development, production, and marketing of specialized biomaterials and biochemicals globally, with a market cap of NOK19.63 billion.

Operations: The company's revenue segments consist of Bio Materials at NOK2.54 billion, Bio Solutions at NOK4.14 billion, and Fine Chemicals at NOK841 million.

Estimated Discount To Fair Value: 31.3%

Borregaard ASA appears undervalued, trading at NOK 197.2 against an estimated fair value of NOK 287.03. Recent earnings show a slight dip in annual net income to NOK 823 million, yet cash flow remains strong with steady revenue growth outpacing the Norwegian market at 6.1% annually. The company has completed a share buyback and extended its credit facility, linking margins to sustainability targets, which may enhance long-term financial health and operational efficiency.

- In light of our recent growth report, it seems possible that Borregaard's financial performance will exceed current levels.

- Get an in-depth perspective on Borregaard's balance sheet by reading our health report here.

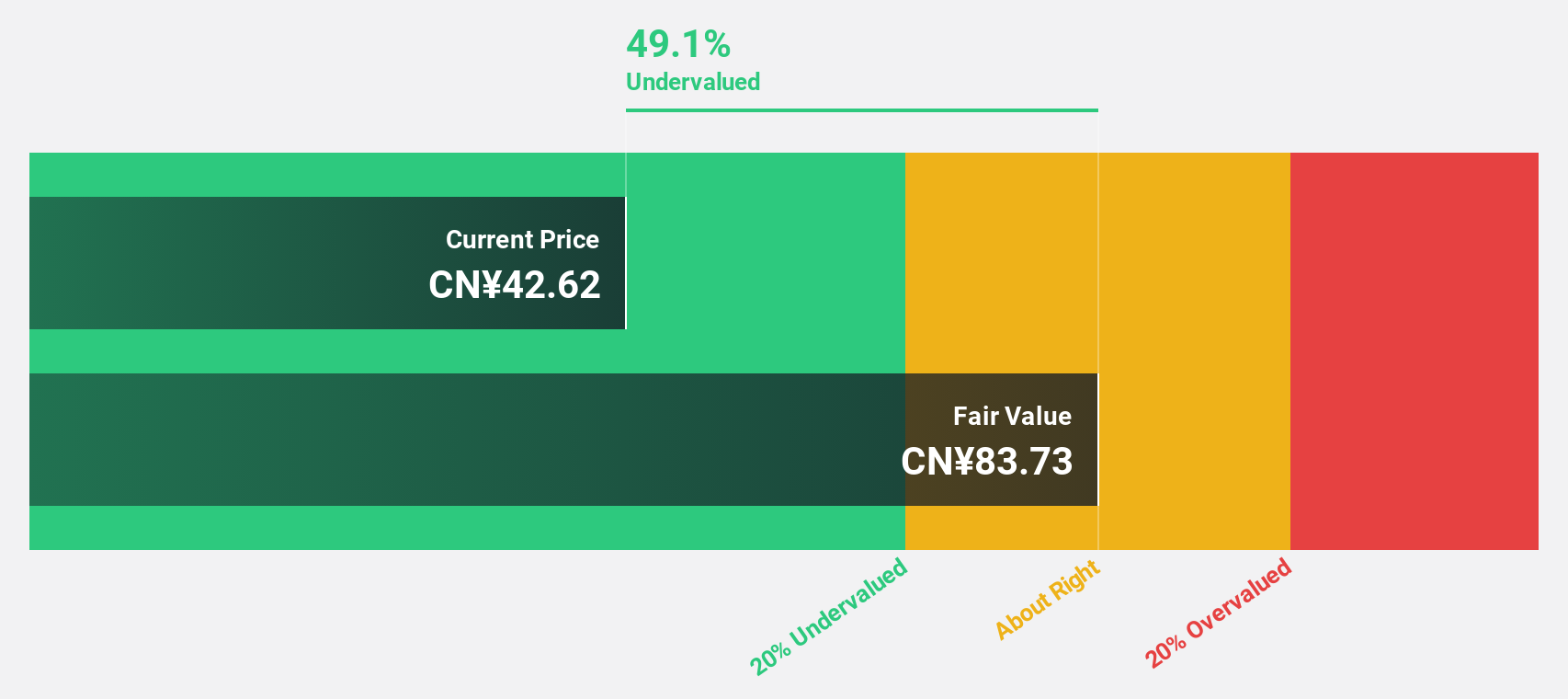

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. is involved in the research, development, design, production, sale, and service of cosmetics in China with a market cap of CN¥13.23 billion.

Operations: The company's revenue is primarily generated from its Personal Products segment, amounting to CN¥2.64 billion.

Estimated Discount To Fair Value: 18.9%

Guangdong Marubi Biotechnology is trading at CN¥32.99, below its estimated fair value of CN¥40.7, suggesting it may be undervalued based on cash flows. Despite a dividend yield of 1.52% not well covered by earnings, the company shows strong potential with forecasted earnings growth of 25.1% annually over three years and revenue growth outpacing the Chinese market at 22%. However, large one-off items have impacted recent financial results.

- According our earnings growth report, there's an indication that Guangdong Marubi Biotechnology might be ready to expand.

- Take a closer look at Guangdong Marubi Biotechnology's balance sheet health here in our report.

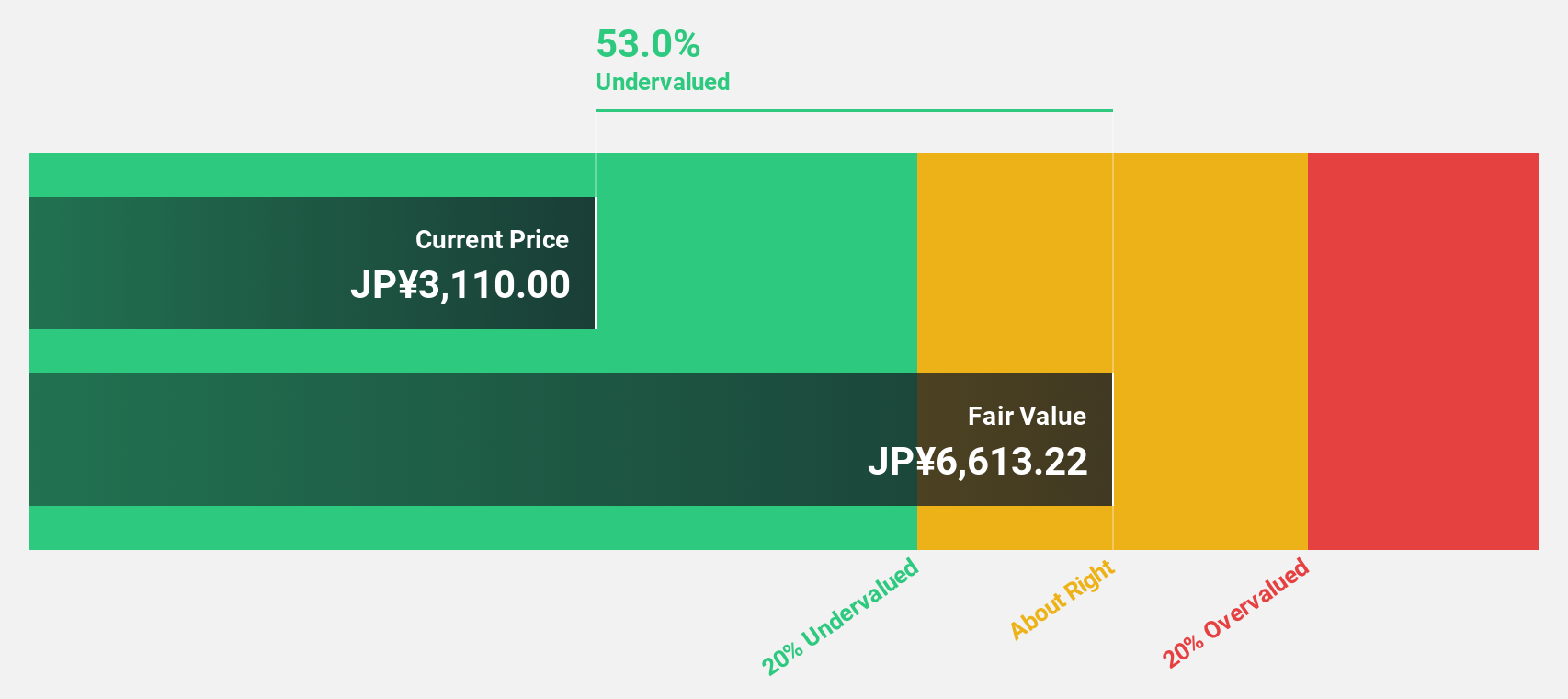

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms focused on recruitment and medical businesses in Japan and the United States, with a market cap of ¥132.86 billion.

Operations: The company's revenue is primarily derived from its Human Resource Platform Business, which generated ¥19.45 billion, followed by the Medical Platform Business at ¥6.52 billion and New Services contributing ¥713 million.

Estimated Discount To Fair Value: 22.2%

Medley is trading at ¥4090, below its estimated fair value of ¥5259.24, indicating potential undervaluation based on cash flows. The company forecasts significant earnings growth of 27.3% annually over the next three years, outpacing the Japanese market's average. Recent strategic moves include acquiring AxisRoot Holdings and forming an alliance with Alfresa Corporation, which may bolster future revenue expected to grow over 20% per year despite recent share price volatility and large one-off financial impacts.

- Insights from our recent growth report point to a promising forecast for Medley's business outlook.

- Click here to discover the nuances of Medley with our detailed financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 893 Undervalued Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borregaard might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BRG

Borregaard

Engages in the development, production, and marketing of specialized biomaterials and biochemicals in Norway, rest of Europe, the United States, Asia, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives