- Japan

- /

- Healthtech

- /

- TSE:4480

3 Japanese Exchange Stocks Estimated To Be Trading At Intrinsic Discounts Ranging From 19.2% To 48%

Reviewed by Simply Wall St

Amid a backdrop of global economic shifts, Japan's stock markets have recently seen significant gains, with indices like the Nikkei 225 and TOPIX reaching all-time highs. This surge is particularly noteworthy given the broader context of weakening yen and rising wage figures, setting an intriguing stage for investors looking at potentially undervalued stocks in this market. In environments like this, discerning investors often seek stocks that are trading below their intrinsic value, aiming to capitalize on adjustments when the market corrects these discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥470.00 | ¥924.81 | 49.2% |

| Hibino (TSE:2469) | ¥2600.00 | ¥5176.31 | 49.8% |

| Fujibo Holdings (TSE:3104) | ¥4795.00 | ¥9437.59 | 49.2% |

| Sumco (TSE:3436) | ¥2430.00 | ¥4605.04 | 47.2% |

| S-Pool (TSE:2471) | ¥321.00 | ¥621.02 | 48.3% |

| Medley (TSE:4480) | ¥3725.00 | ¥7103.42 | 47.6% |

| Macromill (TSE:3978) | ¥859.00 | ¥1669.38 | 48.5% |

| Yokowo (TSE:6800) | ¥2037.00 | ¥3910.10 | 47.9% |

| DKS (TSE:4461) | ¥3810.00 | ¥7263.14 | 47.5% |

| Money Forward (TSE:3994) | ¥5400.00 | ¥10386.99 | 48% |

Let's take a closer look at a couple of our picks from the screened companies

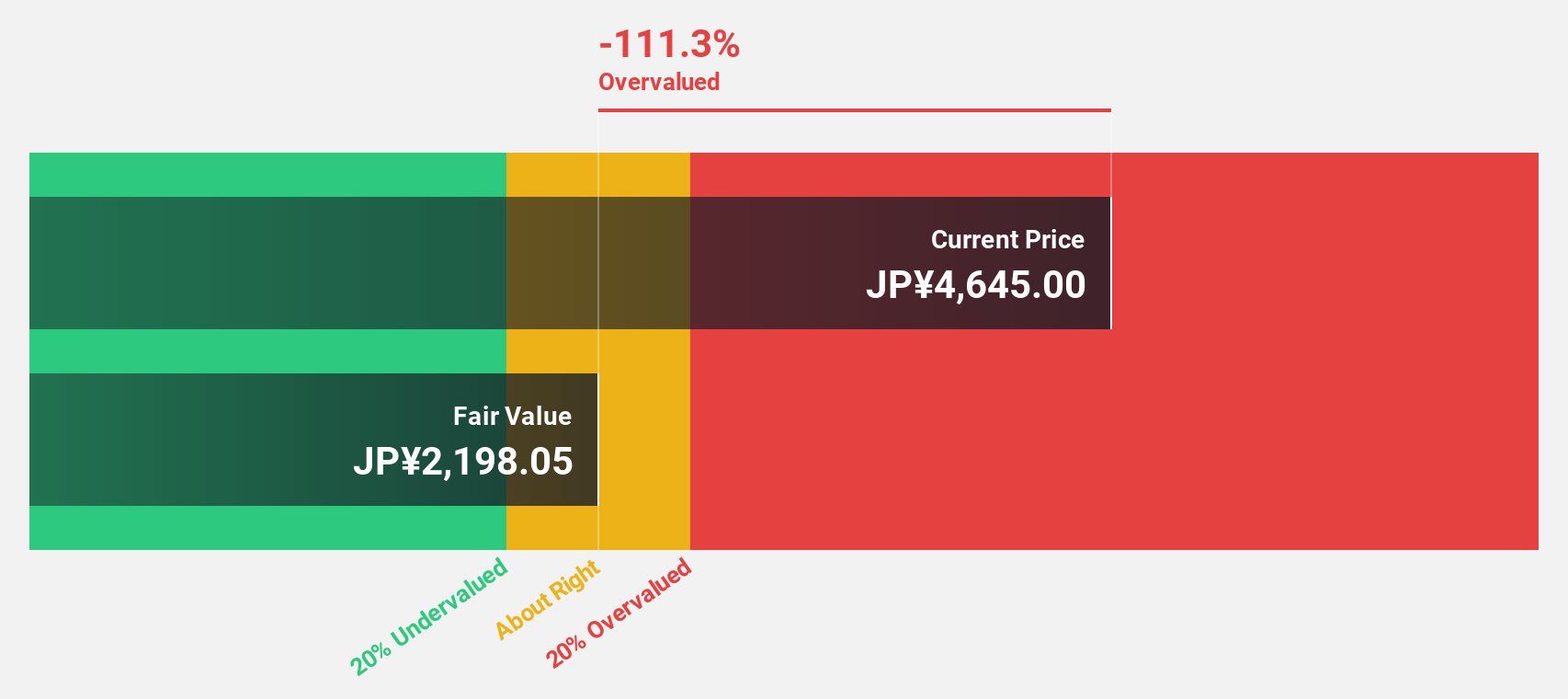

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions to individuals, financial institutions, and corporations mainly in Japan, with a market capitalization of approximately ¥294.43 billion.

Operations: The firm generates its revenue by providing financial solutions across three main segments: individuals, financial institutions, and corporations in Japan.

Estimated Discount To Fair Value: 48%

Money Forward, currently priced at ¥5400, is significantly undervalued based on cash flows with a fair value estimated at ¥10386.99, indicating a potential underpricing of 48%. The company's earnings are expected to grow by 64.54% annually, and it is forecast to become profitable within the next three years. Despite its revenue growth projection of 19.9% per year—above the Japanese market average—its share price has shown high volatility recently. Upcoming structural changes include business splits and mergers set for late 2024, which could influence future financial stability and growth trajectories.

- The analysis detailed in our Money Forward growth report hints at robust future financial performance.

- Take a closer look at Money Forward's balance sheet health here in our report.

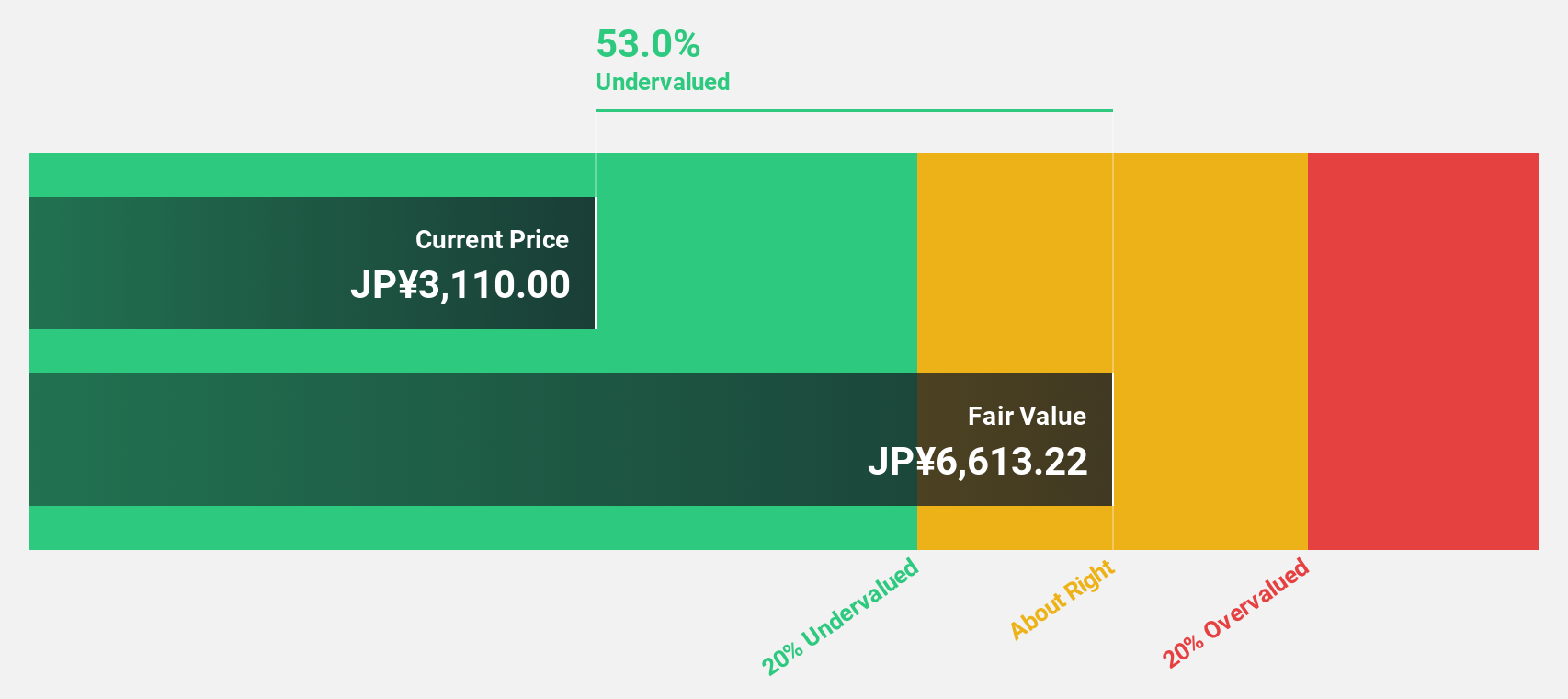

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan, with a market capitalization of approximately ¥120.86 billion.

Operations: The firm focuses on platforms targeting the recruitment and medical sectors.

Estimated Discount To Fair Value: 47.6%

Medley, trading at ¥3725, is valued significantly below its estimated fair value of ¥7103.42, presenting a 47.6% undervaluation. Despite its highly volatile share price recently, Medley's earnings have expanded by 90.3% over the past year and are projected to grow at an annual rate of 28.68%. The company forecasts robust revenue growth at 24.9% per year, outpacing the Japanese market forecast of 4.3%. Recently, Medley raised its fiscal year guidance, expecting higher profits and sales than previously anticipated.

- Our expertly prepared growth report on Medley implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Medley's balance sheet by reading our health report here.

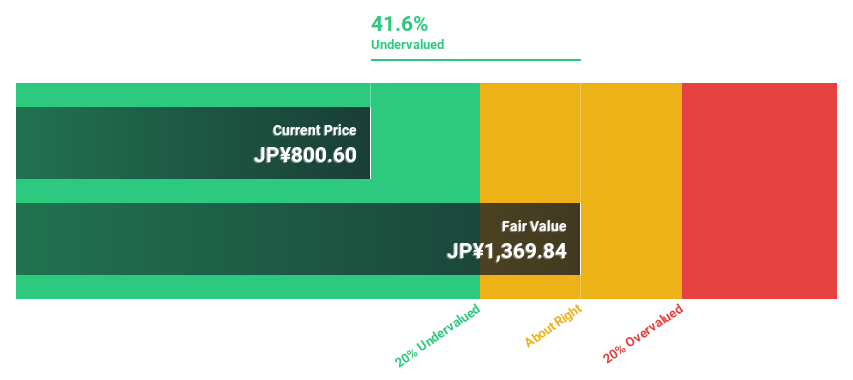

NSK (TSE:6471)

Overview: NSK Ltd. operates globally, manufacturing and selling industrial machinery bearings, automotive products, and precision machinery and parts, with a market capitalization of approximately ¥391.44 billion.

Operations: The firm's revenue is derived from the sale of industrial machinery bearings, automotive products, and precision machinery and parts across various global markets.

Estimated Discount To Fair Value: 19.2%

NSK Ltd., priced at ¥801, trades below its computed fair value of ¥991.87, indicating a potential undervaluation. While its revenue growth of 4.9% per year is modestly above the Japanese market average of 4.3%, the company's earnings are expected to surge by 27.07% annually over the next three years, outperforming the market projection of 8.9%. However, its return on equity is projected to remain low at 5.5%, and its dividend coverage is weak, reflecting financial constraints despite growth prospects.

- Our earnings growth report unveils the potential for significant increases in NSK's future results.

- Dive into the specifics of NSK here with our thorough financial health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Japanese Stocks Based On Cash Flows screener has unearthed 87 more companies for you to explore.Click here to unveil our expertly curated list of 90 Undervalued Japanese Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.