As Japan's stock markets gain momentum, driven by dovish commentary from the Bank of Japan and optimism surrounding China's stimulus measures, investors are increasingly looking towards high-growth tech stocks as potential opportunities. In this favorable economic climate, a good stock is often characterized by strong fundamentals, innovative technologies, and the ability to capitalize on emerging market trends.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide with a market cap of ¥1.31 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion).

OMRON, navigating through a challenging landscape, has demonstrated a commitment to innovation with R&D expenses reflecting substantial investment in future technologies. Despite being currently unprofitable, the company is on a trajectory for growth with earnings expected to surge by 46.2% annually. This forecast is significantly bolstered by its strategic focus on sectors likely to drive future industry standards and practices. Moreover, OMRON's revenue growth at 5.6% annually outpaces the Japanese market average of 4.2%, indicating robust potential in its operational strategy and market positioning. The firm's recent Q1 earnings call highlighted these advancements alongside plans for further technological integration across its product lines, setting a promising stage for upcoming fiscal periods.

- Delve into the full analysis health report here for a deeper understanding of OMRON.

Understand OMRON's track record by examining our Past report.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥383.98 billion.

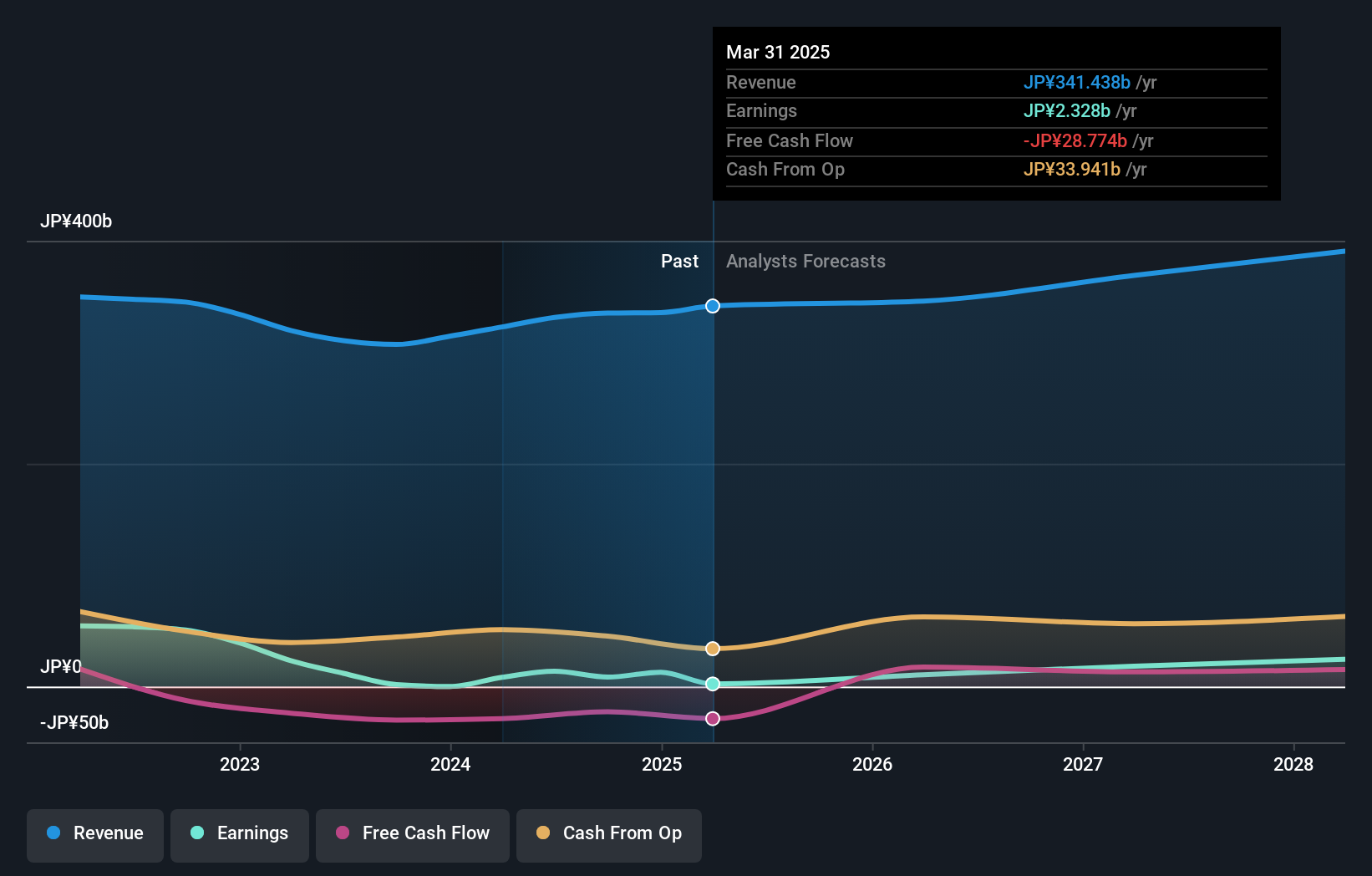

Operations: The company generates revenue primarily from its Electronic Components Business, which reported ¥331.17 billion in revenue.

Taiyo Yuden demonstrates a robust trajectory in Japan's high-tech landscape, with anticipated revenue and earnings growth outpacing the broader market. Its revenue is expected to climb by 6.7% annually, surpassing Japan's average of 4.2%, while its earnings are set to surge by an impressive 25.7% each year, significantly ahead of the market's 8.7%. This growth is underpinned by substantial R&D investments which not only fuel innovation but also position the company advantageously against competitors in electronic components manufacturing. Despite challenges like share price volatility and a low forecasted return on equity at 9.5%, Taiyo Yuden’s strategic focus on enhancing technological capabilities and expanding its market footprint underscores its potential in shaping industry standards and practices moving forward.

- Dive into the specifics of Taiyo Yuden here with our thorough health report.

Examine Taiyo Yuden's past performance report to understand how it has performed in the past.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

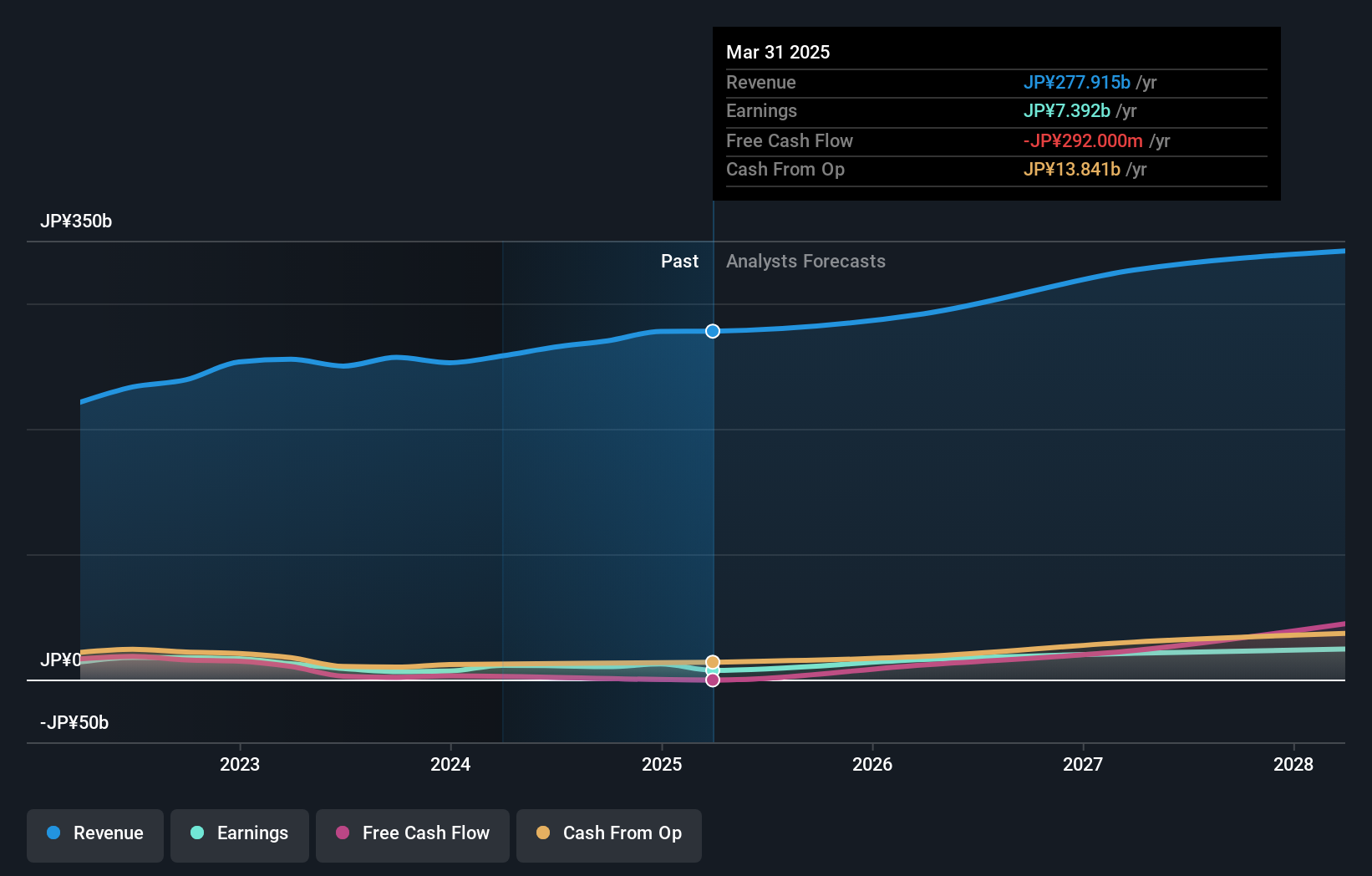

Overview: Kadokawa Corporation operates as an entertainment company in Japan, with a market cap of ¥434.99 billion.

Operations: Kadokawa Corporation generates revenue primarily from its Publication segment (¥143.28 billion), followed by Animation/Film (¥46.36 billion) and Game (¥28.63 billion). The company also has notable contributions from Web Service and Education/Edtech segments, amounting to ¥20.44 billion and ¥13.83 billion respectively.

Kadokawa stands out in Japan's tech sector with its strategic emphasis on R&D, dedicating a significant portion of its revenue to innovation. Last year, R&D expenses reached 6.7% of total revenues, reflecting a robust commitment to advancing its technological capabilities. This investment supports an expected earnings growth of 21.5% annually, markedly above the national average of 8.7%. Additionally, the company repurchased shares this past year, signaling confidence in its future prospects and potentially stabilizing stock price volatility. As Kadokawa continues to evolve within digital media and entertainment sectors—areas ripe for technological integration—it is poised to capture more market share even as it navigates competitive pressures.

- Unlock comprehensive insights into our analysis of Kadokawa stock in this health report.

Explore historical data to track Kadokawa's performance over time in our Past section.

Seize The Opportunity

- Click here to access our complete index of 122 Japanese High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.