Suntory's French Plant Closure and Production Shift Might Change The Case For Investing In Suntory Beverage & Food (TSE:2587)

Reviewed by Sasha Jovanovic

- Suntory Beverage & Food France recently confirmed plans to close its La Courneuve production facility by the end of 2026, shifting operations to other sites as part of a broader manufacturing reorganization amid falling sales.

- This restructuring reflects Suntory's efforts to adapt its French operations to changing market conditions, while offering transition support for affected employees.

- We'll examine how the factory closure and production realignment reshape Suntory's investment narrative, especially considering the focus on operational efficiency.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Suntory Beverage & Food's Investment Narrative?

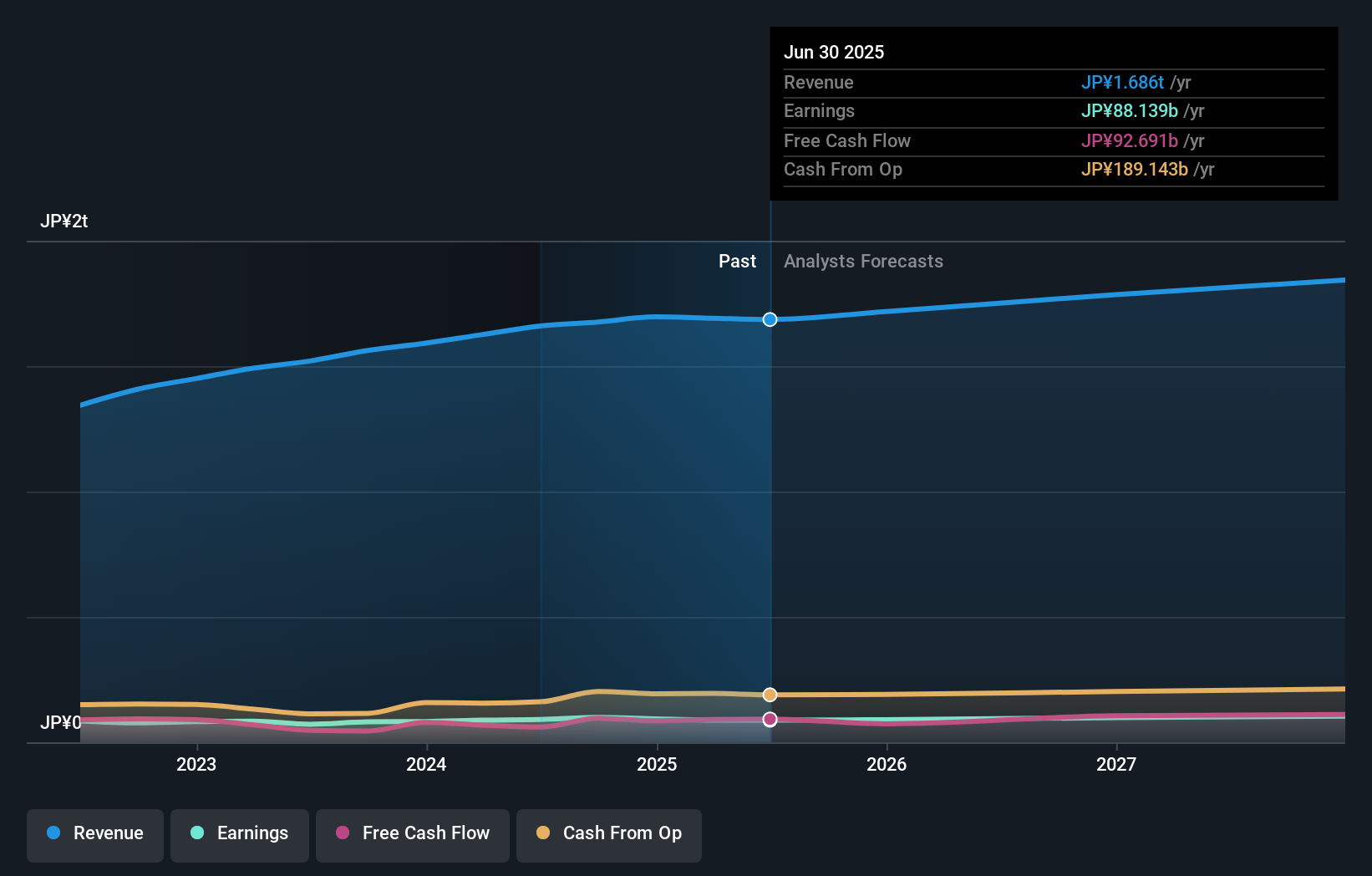

When weighing Suntory Beverage & Food as an investment opportunity, the central question is whether the company’s proven ability to pay reliable dividends and its reputation for high quality earnings can offset its slower-than-market growth and challenges in key markets like France. The recent decision to close the La Courneuve factory underscores management's focus on operational efficiency but also highlights pressure from falling sales in Europe, a region that had already seen sluggish returns. This move may sharpen short-term cost control and streamline the business, though the direct financial impact is likely modest given the phased shutdown and redeployment of production. However, the event brings heightened attention to Suntory’s execution risk as it continues to restructure, just as its board adjusts to new faces and competition stays fierce. While the shares appear undervalued compared to analyst targets, whether the ongoing transformation leads to stronger returns remains a key question.

But before looking past Suntory's stability, investors should weigh how execution risks may play out. Suntory Beverage & Food's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Suntory Beverage & Food - why the stock might be worth just ¥5268!

Build Your Own Suntory Beverage & Food Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suntory Beverage & Food research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Suntory Beverage & Food research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suntory Beverage & Food's overall financial health at a glance.

No Opportunity In Suntory Beverage & Food?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2587

Suntory Beverage & Food

Engages in manufacture and sale of alcoholic and non-alcoholic beverages, and foods in Japan, Asia-Pacific, Europe, and the Americas.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives