- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A108490

3 Asian Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by trade negotiations and economic uncertainties, Asian equities have shown resilience, with key indices in China and Japan posting gains amid positive trade developments. In such an environment, growth companies with strong insider ownership can be particularly appealing, as high insider stakes often indicate confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 31.9% | 40.5% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Below we spotlight a couple of our favorites from our exclusive screener.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a global manufacturer and seller of molecular diagnostics products, with a market cap of ₩1.44 trillion.

Operations: The company's revenue is primarily derived from its diagnostic kits and equipment segment, which generated ₩414.25 billion.

Insider Ownership: 33.1%

Earnings Growth Forecast: 67.8% p.a.

Seegene, a growth-focused company with significant insider ownership, is trading at 41.9% below its estimated fair value and is expected to become profitable within three years, outperforming market growth. Despite a low forecasted return on equity of 9.7%, Seegene's revenue is projected to grow faster than the Korean market at 15.3% annually. The company is advancing innovation in laboratory automation with its CURECA™ system, aiming for full PCR testing automation and reducing human error risks in laboratories.

- Navigate through the intricacies of Seegene with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Seegene's shares may be trading at a discount.

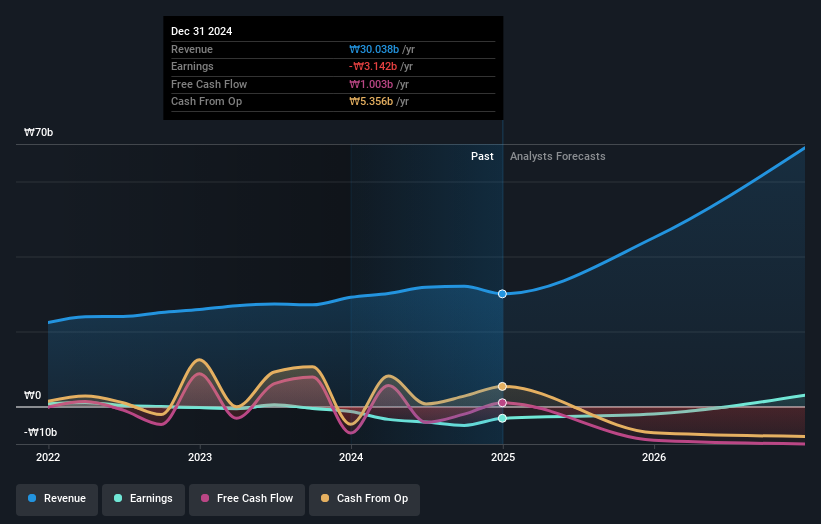

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. offers robotic solutions in South Korea and has a market cap of ₩718.12 billion.

Operations: The company generates revenue primarily through the development, manufacturing, and sale of personal robots, amounting to ₩30.04 billion.

Insider Ownership: 26.1%

Earnings Growth Forecast: 113.2% p.a.

ROBOTIS, with significant insider ownership, is projected to achieve profitability in three years, surpassing average market growth. Its revenue is expected to grow at 40.6% annually, significantly outpacing the Korean market's 7.4%. Despite this strong growth outlook, the company's return on equity is forecasted to be low at 3.4%, and its share price has experienced high volatility recently. No substantial insider trading activity was recorded over the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of ROBOTIS.

- Our comprehensive valuation report raises the possibility that ROBOTIS is priced higher than what may be justified by its financials.

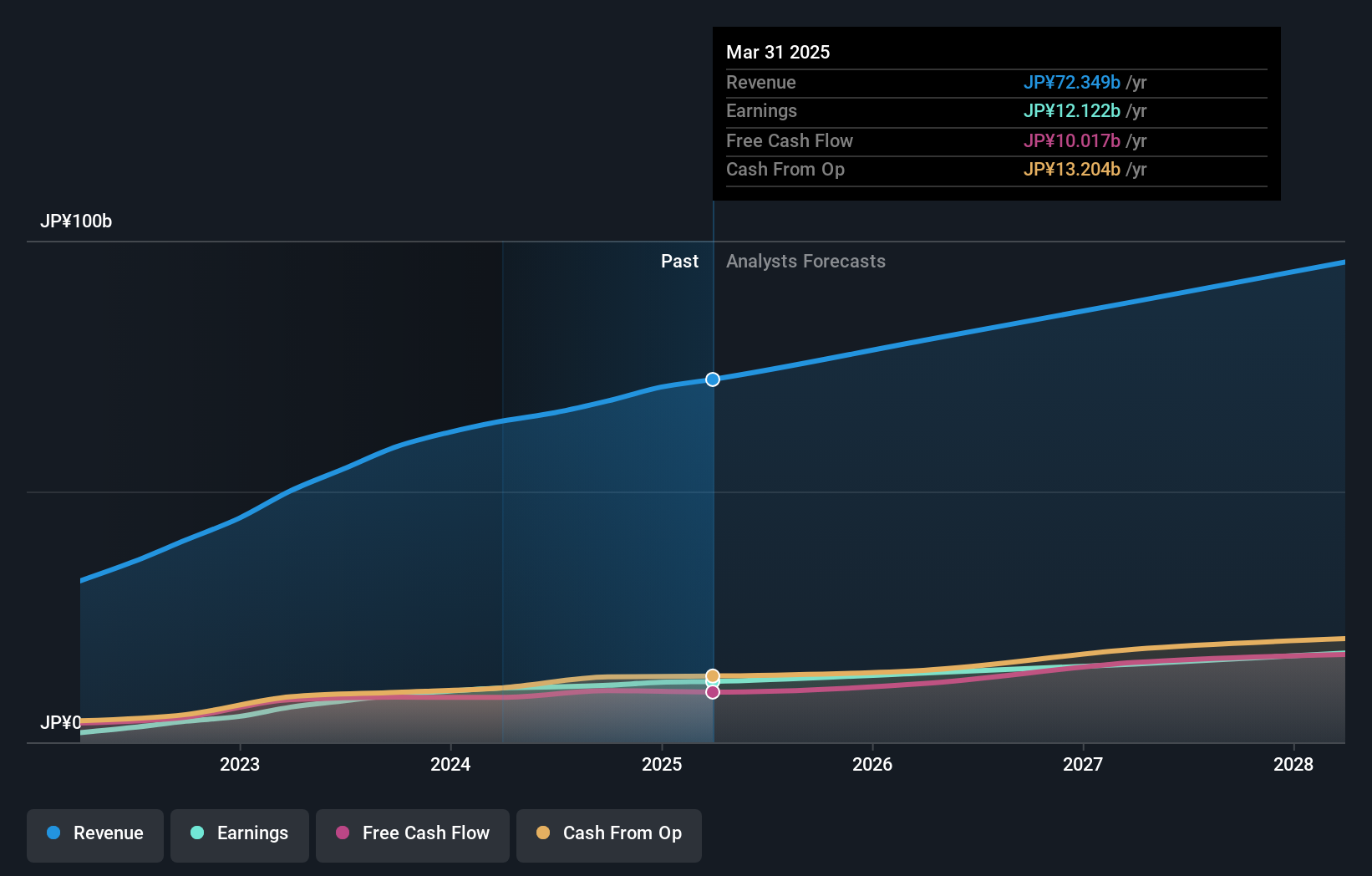

Kotobuki Spirits (TSE:2222)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kotobuki Spirits Co., Ltd. produces and sells sweets in Japan, with a market cap of ¥359.87 billion.

Operations: Kotobuki Spirits generates its revenue from the production and sale of sweets in Japan.

Insider Ownership: 29.3%

Earnings Growth Forecast: 11.6% p.a.

Kotobuki Spirits is trading at 22.1% below its estimated fair value, with earnings forecasted to grow at 11.6% annually, outpacing the Japanese market's average. Despite slower revenue growth of 7.4% per year, it remains above the market average. Recent board meetings discussed introducing a restricted shares remuneration system and revised dividend guidance to ¥32 per share for fiscal year-end 2025, reflecting a commitment to shareholder returns without substantial insider trading activity reported recently.

- Click to explore a detailed breakdown of our findings in Kotobuki Spirits' earnings growth report.

- According our valuation report, there's an indication that Kotobuki Spirits' share price might be on the expensive side.

Make It Happen

- Explore the 617 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade ROBOTIS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108490

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives