Morozoff (TSE:2217) Posts Q3 Loss as Margin Compression Undercuts Bullish Quality-Earnings Narrative

Reviewed by Simply Wall St

Morozoff (TSE:2217) has just posted a soft Q3 2026 print, with revenue of ¥6.1 billion and a basic EPS of -¥23.41 as net income slipped to a loss of ¥473 million. Looking across recent quarters, the company has seen revenue move from ¥5.9 billion in Q3 2025 to ¥9.0 billion in Q1 2026, before easing back to ¥7.2 billion in Q2 and ¥6.1 billion in Q3, while EPS swung from -¥6.88 to ¥52.89, then ¥13.06, ¥0.35 and now back into negative territory. For investors, the latest quarter reads as a step back for profitability, with margins clearly under pressure even as the top line holds in a relatively tight range.

See our full analysis for Morozoff.With the headline numbers on the table, the next step is to see how this latest margin picture lines up with the prevailing narratives around Morozoff, and where the story investors tell themselves might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

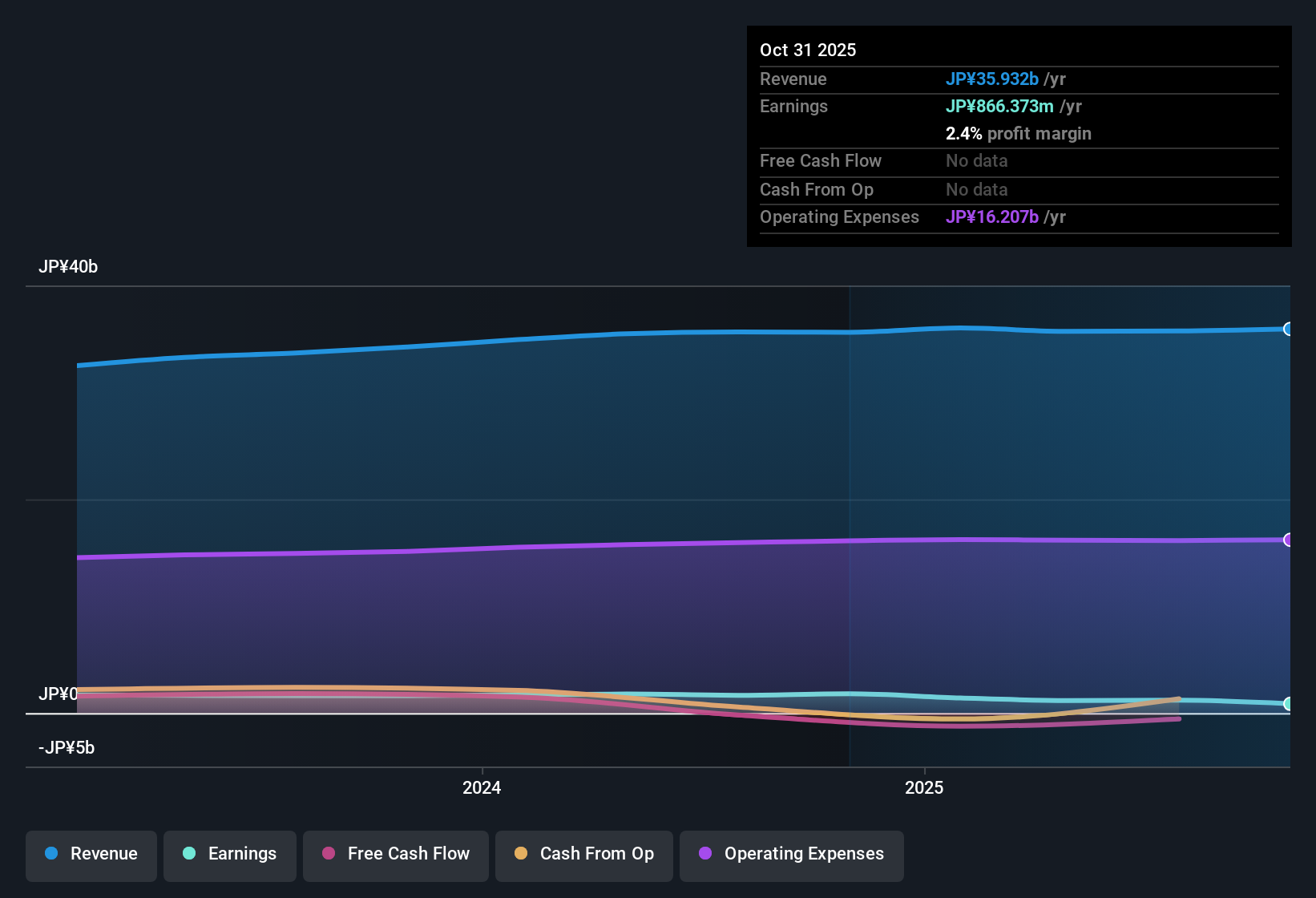

Net Margin Slides To 2.4% On Weaker Twelve Month Profits

- Over the last 12 months, net profit margin was 2.4%, down from 5.1% a year earlier, even though revenue still edged up 0.9% to about ¥36.0 billion.

- Bears point to this squeeze in profitability as a sign that Morozoff is finding it harder to turn sales into profit, yet

- the trailing 12 month net income was still ¥866 million, showing the business remained in the black over the year despite the latest loss making quarter.

- Basic EPS over the same trailing period came in at ¥42.86, which challenges a purely bearish view that earnings power has disappeared altogether.

Valuation At 34.4x P/E Versus DCF Fair Value

- The shares trade on a 34.4x trailing P/E, more than double the Japan Food industry average of 16.3x and the 12.4x peer average, while the current ¥1,488 price also sits well above the ¥324.04 DCF fair value estimate.

- Critics highlight this valuation gap as a key risk, arguing the stock price is running ahead of fundamentals, and

- the rich earnings multiple suggests the market is paying a premium despite trailing net margin falling to 2.4% from 5.1%.

- the DCF fair value of ¥324.04 indicates the market price embeds expectations that go well beyond what recent margins and modest 0.9% revenue growth alone might justify.

“High Quality” Earnings Despite Recent Volatility

- Across the latest 12 month window, Morozoff is still described as having high quality past earnings, backed by trailing EPS of ¥42.86 on about ¥35.9 billion of revenue. This is despite single quarter EPS swinging from ¥52.89 in Q4 2025 to ¥13.06 in Q1 2026 and then to ¥0.35 in Q2 and -¥23.41 in Q3.

- What is surprising for a bullish narrative that leans on brand strength and stability is how these high quality earnings coexist with pronounced short term swings, as

- net income moved from ¥1,069 million in Q4 2025 to ¥264 million in Q1 2026, then to just ¥6.98 million in Q2 and a loss of ¥473 million in Q3.

- the trailing figures still show ¥866 million of profit and 0.9% revenue growth, which heavily supports the bullish case that the underlying business can earn money over a full year even when individual quarters are bumpy.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Morozoff's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Morozoff’s shrinking margins, volatile quarterly earnings and stretched valuation versus its DCF fair value all suggest investors face meaningful downside risk at today’s price.

If you want better odds on price and fundamentals lining up, use our these 903 undervalued stocks based on cash flows to quickly find candidates where valuation looks far more compelling right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2217

Excellent balance sheet with poor track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)