- Japan

- /

- Capital Markets

- /

- TSE:9225

Not Many Are Piling Into Bridge Consulting Group Inc. (TSE:9225) Just Yet

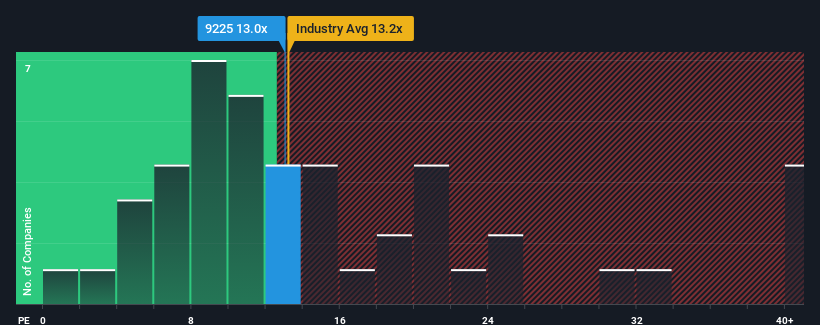

It's not a stretch to say that Bridge Consulting Group Inc.'s (TSE:9225) price-to-earnings (or "P/E") ratio of 13x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Bridge Consulting Group as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Bridge Consulting Group

Does Growth Match The P/E?

Bridge Consulting Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 57% gain to the company's bottom line. The latest three year period has also seen an excellent 100% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Bridge Consulting Group is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Bridge Consulting Group's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bridge Consulting Group currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Bridge Consulting Group you should know about.

If these risks are making you reconsider your opinion on Bridge Consulting Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bridge Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9225

Bridge Consulting Group

Provides business management consulting services focused on initial public offering (IPO) support in Japan.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion