- Japan

- /

- Capital Markets

- /

- TSE:8604

With EPS Growth And More, Nomura Holdings (TSE:8604) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Nomura Holdings (TSE:8604). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Nomura Holdings

Nomura Holdings' Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Impressively, Nomura Holdings' EPS catapulted from JP¥30.86 to JP¥56.13, over the last year. It's a rarity to see 82% year-on-year growth like that.

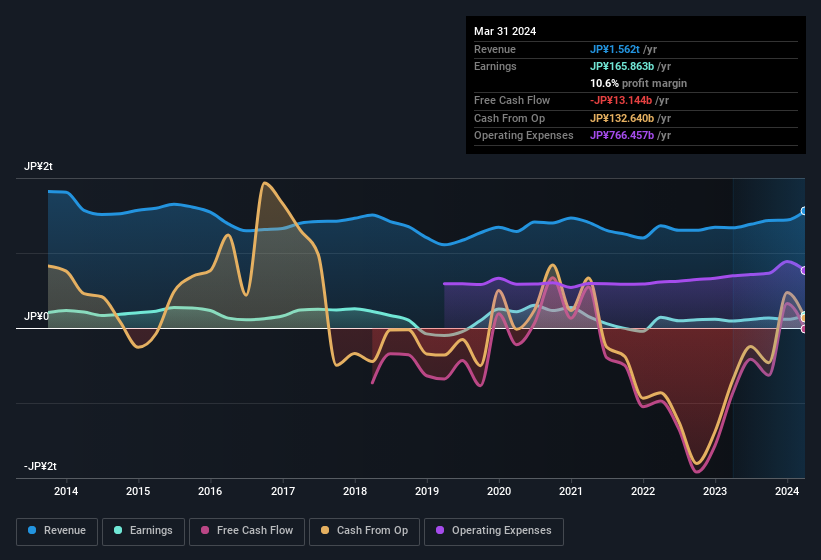

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Nomura Holdings' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Nomura Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to JP¥1.6t. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Nomura Holdings?

Are Nomura Holdings Insiders Aligned With All Shareholders?

Since Nomura Holdings has a market capitalisation of JP¥2.8t, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold JP¥2.1b worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.08% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Nomura Holdings Deserve A Spot On Your Watchlist?

Nomura Holdings' earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Nomura Holdings is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Nomura Holdings , and understanding it should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Japanese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8604

Nomura Holdings

Engages in the provision of investment, financing, and related services to individual, institutional, and government clients worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026