- Japan

- /

- Capital Markets

- /

- TSE:8604

How Surging Profit Margins and Earnings Growth Could Reshape Nomura Holdings' (TSE:8604) Investment Outlook

Reviewed by Sasha Jovanovic

- Earlier this year, Nomura Holdings (TSE:9716) reported net profit margins rising to 6% from 2.3% and earnings growth of over 240% over the past twelve months, despite forecasts of an annual revenue decline and drop in earnings over the next three years.

- This strong profit expansion suggests that Nomura's reforms and international activities are having a substantial effect amid ongoing challenges.

- With profit margins more than doubling, we will explore how this financial improvement may reshape Nomura's long-term investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Nomura Holdings Investment Narrative Recap

To be a Nomura Holdings shareholder, you’d need confidence that the company’s ongoing reforms and global expansion will keep boosting profitability, even as forecasts show both revenue and earnings could decline in the coming years. The recent jump in profit margins does reinforce Nomura’s ability to weather market pressure, but it does not fundamentally change the largest short-term catalyst, continued momentum in global wealth and asset management inflows, nor does it eliminate the persistent risk of fee compression from intensifying fintech competition.

The most relevant recent announcement tied to this result is Nomura’s robust full-year earnings for FY 2024/2025, marked by both higher net income and a sharply increased annual dividend. This result connects directly to the current catalyst around margin improvement, as it came despite revenue uncertainty and indicates the firm’s cost control and international business performance are having tangible effects for shareholders.

However, against the backdrop of margin gains, investors should stay alert to risks tied to profit sustainability in the face of global fee pressures and accelerating digital disruption...

Read the full narrative on Nomura Holdings (it's free!)

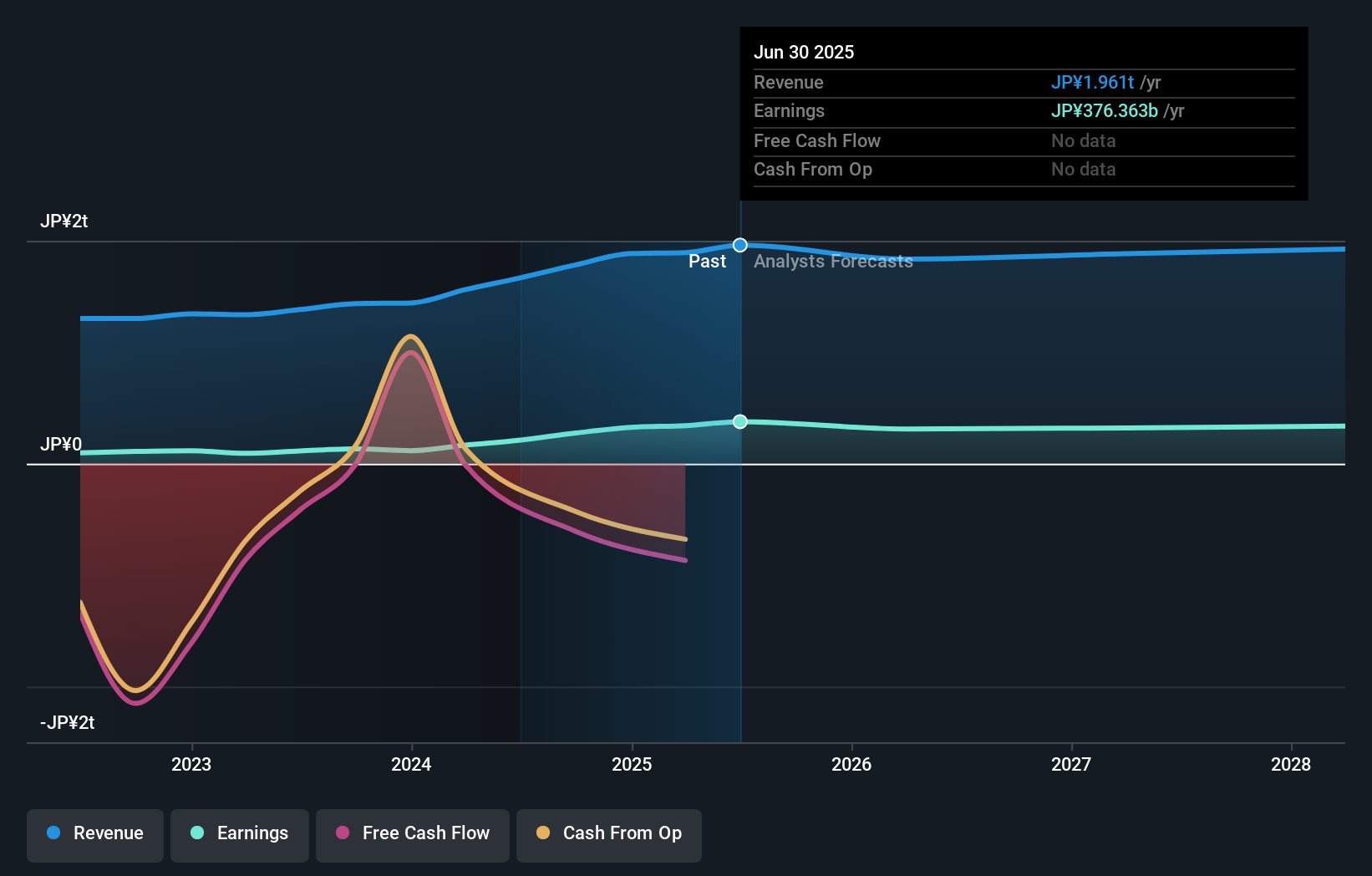

Nomura Holdings' narrative projects ¥1,964.2 billion revenue and ¥334.2 billion earnings by 2028. This implies a 0.0% annual revenue decline and a decrease of ¥42.2 billion in earnings from the current ¥376.4 billion.

Uncover how Nomura Holdings' forecasts yield a ¥1083 fair value, in line with its current price.

Exploring Other Perspectives

Three private investors in the Simply Wall St Community put fair values between ¥995 and ¥1,457 for Nomura Holdings. Some believe rising global asset management inflows could help offset headwinds, but you’ll find widely differing forecasts among your peers.

Explore 3 other fair value estimates on Nomura Holdings - why the stock might be worth 6% less than the current price!

Build Your Own Nomura Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nomura Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nomura Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nomura Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8604

Nomura Holdings

Provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives