- Japan

- /

- Capital Markets

- /

- TSE:8604

Assessing Nomura’s Value After Share Price Surge and Bank of Japan Rate Hike in 2025

Reviewed by Bailey Pemberton

If you are wondering whether to stick with Nomura Holdings or add it to your watchlist, you are not alone. Investors all over the globe are sizing up what is turning out to be one of Japan’s most interesting financial stories this year. The stock may have dropped 6.6% over the past week, but do not let short-term noise drown out the bigger narrative. Nomura is up a massive 42.1% over the last 12 months and an eye-watering 166.5% over the past five years. That is not just a recovery, but a signal that market sentiment has seen a real shift in the company’s perceived risk and potential.

Behind these sharp moves, broader market developments have played a role, particularly shifts in Japan’s monetary policy and increased foreign investor interest in Japanese equities. These trends have made market participants re-examine traditional financial institutions like Nomura, casting them in a new growth-driven light.

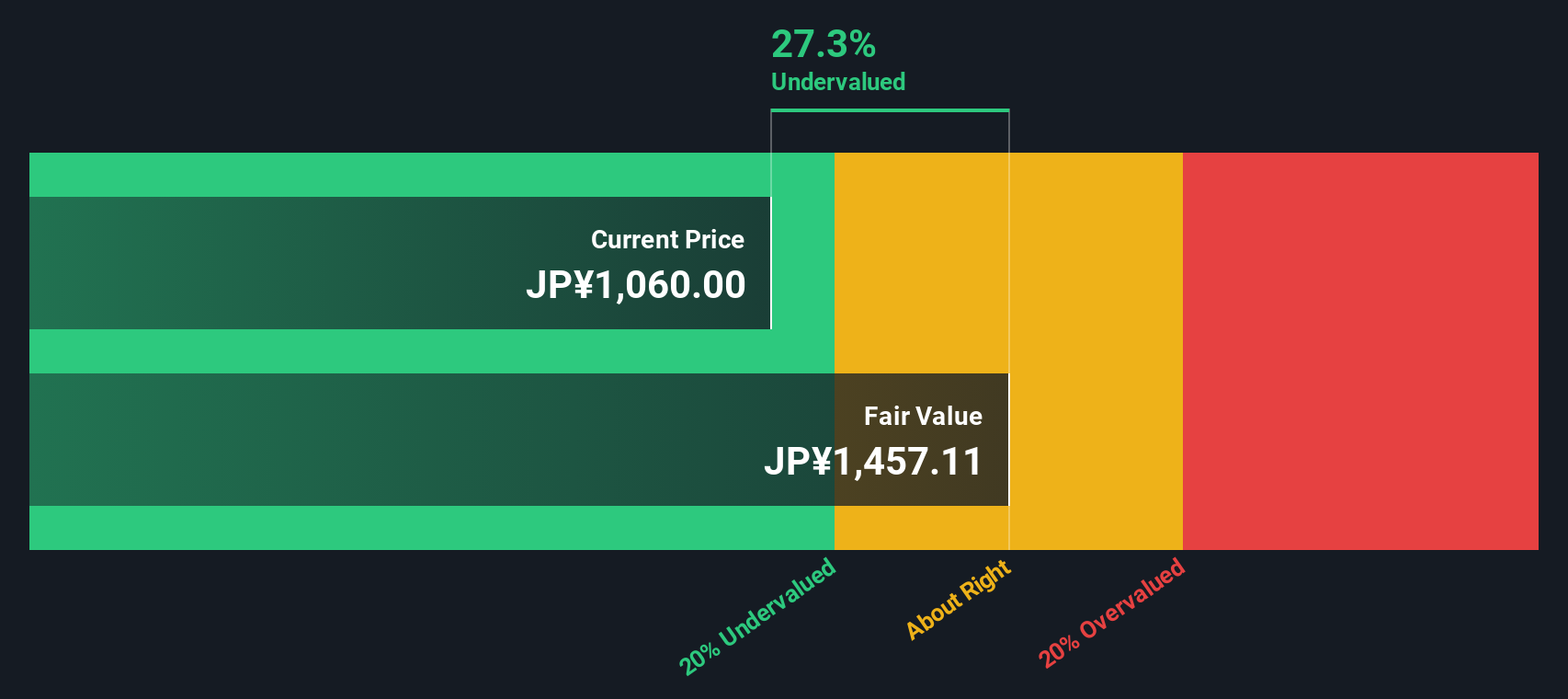

Now, before you jump in either direction, let’s put Nomura’s stock price in context. Weighing up the company’s valuation is key to making sense of those gains and understanding whether there is more room to run. Based on a detailed set of six valuation checks, Nomura scores a 5 out of 6 for being undervalued. That is a rare mark of potential, but as we will see, there are several ways to judge value, and the best one might surprise you at the end.

Approach 1: Nomura Holdings Excess Returns Analysis

The Excess Returns model looks beyond headline numbers and focuses on how effectively Nomura Holdings invests shareholder equity relative to its cost. This method centers on capturing the additional value a company generates after rewarding investors for the risk they take on. In simple terms, it calculates the profit produced above and beyond what investors could expect elsewhere at similar risk.

For Nomura, the numbers indicate an encouraging story. The company's current Book Value stands at ¥1,177.31 per share, while its projected Stable Book Value is expected to rise to ¥1,339.75 per share, based on weighted future estimates from six analysts. Nomura's Stable Earnings Per Share (EPS) is ¥117.84, paired with a Cost of Equity of ¥109.56 per share. The result is an annual Excess Return of ¥8.29 per share and an average Return on Equity of 8.80%.

Taken together, the Excess Returns model estimates that Nomura Holdings is trading at a 27.7% discount to its intrinsic value, suggesting significant undervaluation relative to its fundamentals. With these strong equity returns over cost, investors may be observing a rare opportunity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Nomura Holdings is undervalued by 27.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Nomura Holdings Price vs Earnings

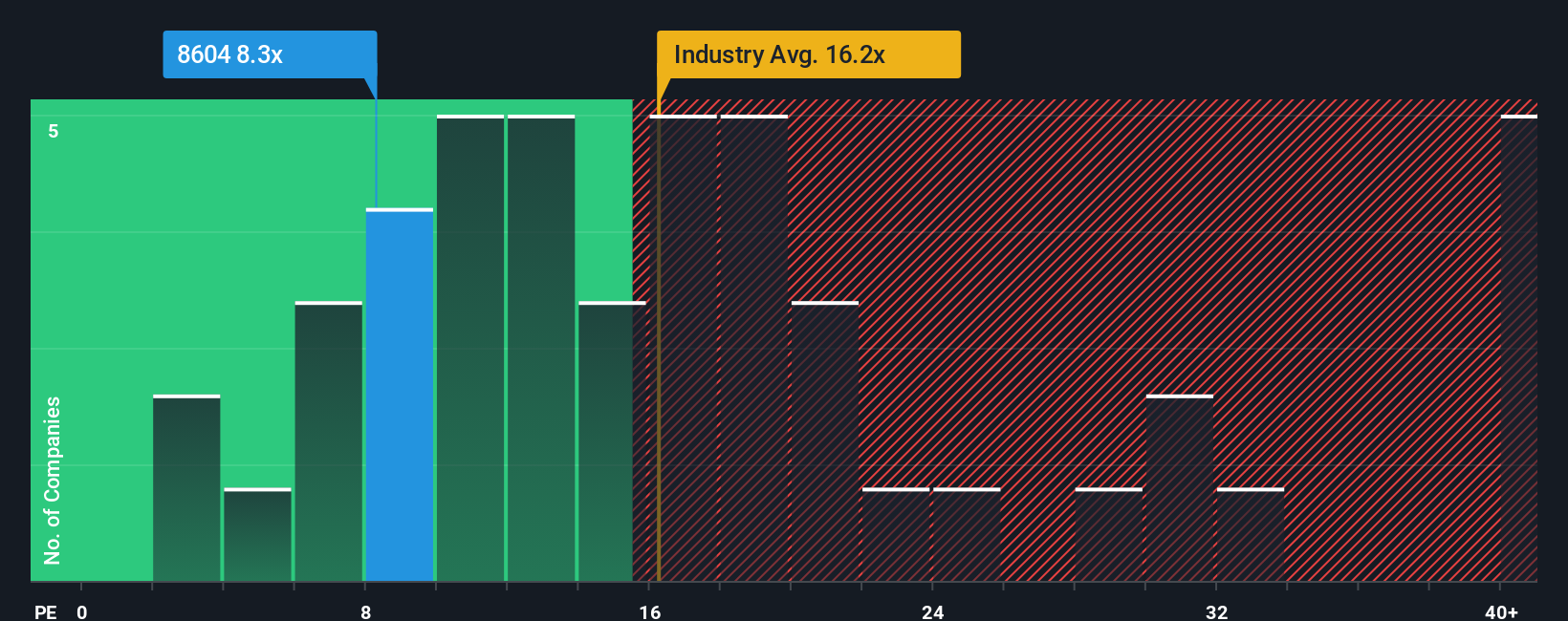

The Price-to-Earnings (PE) ratio is often regarded as the most straightforward and useful valuation multiple for profitable companies like Nomura Holdings. Since Nomura is consistently earning profits, comparing its stock price to those earnings gives a clear snapshot of how the market values its income stream. In general, companies with strong growth prospects and lower risk profiles tend to justify higher PE ratios, while those facing greater uncertainty or slower growth trade at lower multiples.

Currently, Nomura trades at a PE ratio of 8.16x. This is substantially below both the industry average of 16.09x and its peer group, which averages 14.47x. At first glance, this low multiple suggests that the market may be overlooking Nomura’s earnings power. However, simple comparisons can sometimes miss key details about company-specific prospects.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated to be 17.90x for Nomura, incorporates not just peer and industry norms but also accounts for Nomura’s unique earnings growth, profit margins, market capitalization, and risk. This bespoke metric offers a much more accurate signal than blunt benchmarks, helping investors determine a more realistic fair value for shares based on the company’s specific fundamentals.

Comparing Nomura’s actual PE ratio of 8.16x to the Fair Ratio of 17.90x, it is clear the shares are trading well below what would be expected given the company’s characteristics. This presents a compelling case for undervaluation based on the preferred multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nomura Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, accessible tool that lets you tell the story behind a company’s numbers, connecting your perspective on its business, future revenue and profit estimates, and fair value into one clear forecast. Narratives go beyond statistics and help you express the “why” behind the numbers. They instantly translate that story into a company’s projected financials and fair value, making it much easier to decide when to buy or sell by comparing your fair value to today’s price.

Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors update and share their outlooks in real time. What makes Narratives so powerful is their ability to adapt whenever new news or earnings are released, so your analysis can stay up-to-date with the latest developments. For example, one investor might believe Nomura Holdings will struggle against demographic headwinds and digital competition, suggesting a fair value near ¥990. Another sees international growth and digital innovation boosting long-term margins and fair value as high as ¥1,300. Your decision and your Narrative can be as unique as you are.

Do you think there's more to the story for Nomura Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8604

Nomura Holdings

Provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives