- Japan

- /

- Capital Markets

- /

- TSE:8601

Daiwa Securities Group (TSE:8601): Is the Market Correct on Its Valuation After Recent Share Gains?

Reviewed by Kshitija Bhandaru

Daiwa Securities Group (TSE:8601) stock has seen some movement recently, sparking interest among investors who are looking at the broader trends in Japan’s financial sector. Over the past month, shares gained 3% after a steady climb this quarter.

See our latest analysis for Daiwa Securities Group.

Looking at the bigger picture, Daiwa Securities Group’s momentum remains positive, with the 1-year total shareholder return reaching nearly 19%. While the latest share price sits at ¥1,179.5, steady gains over the past quarter reflect a market that is starting to recognize underlying strengths, even amid a relatively quiet period for major headlines.

If you’re curious where else investors are spotting growth, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares up this year and solid financials in play, the key question for investors is whether Daiwa Securities Group is trading below its true value or if the market has already anticipated all that future growth.

Most Popular Narrative: 3.9% Overvalued

The prevailing narrative places Daiwa Securities Group’s fair value just below its last closing price, raising deeper questions about whether market optimism is overreaching short-term catalysts.

Expansion and deepening of international business activities, strategic investments (like Global X in the U.S.), and focus on cross-border asset flows position Daiwa to capitalize on the globalization of capital markets and diversifying sources of fee income. This should support future revenue and profit growth while reducing domestic market dependence.

Curious what growth engines justify this bold valuation call? The narrative’s confidence leans heavily on international ambitions and the promise of recurring, high-margin revenues. But do those underlying projections really back up the current price? Dive into the full narrative to reveal the assumptions shaping this view.

Result: Fair Value of ¥1,135.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high costs and heavy reliance on Japan’s aging market could limit Daiwa Securities Group’s growth. This may challenge the resilience behind the bullish view.

Find out about the key risks to this Daiwa Securities Group narrative.

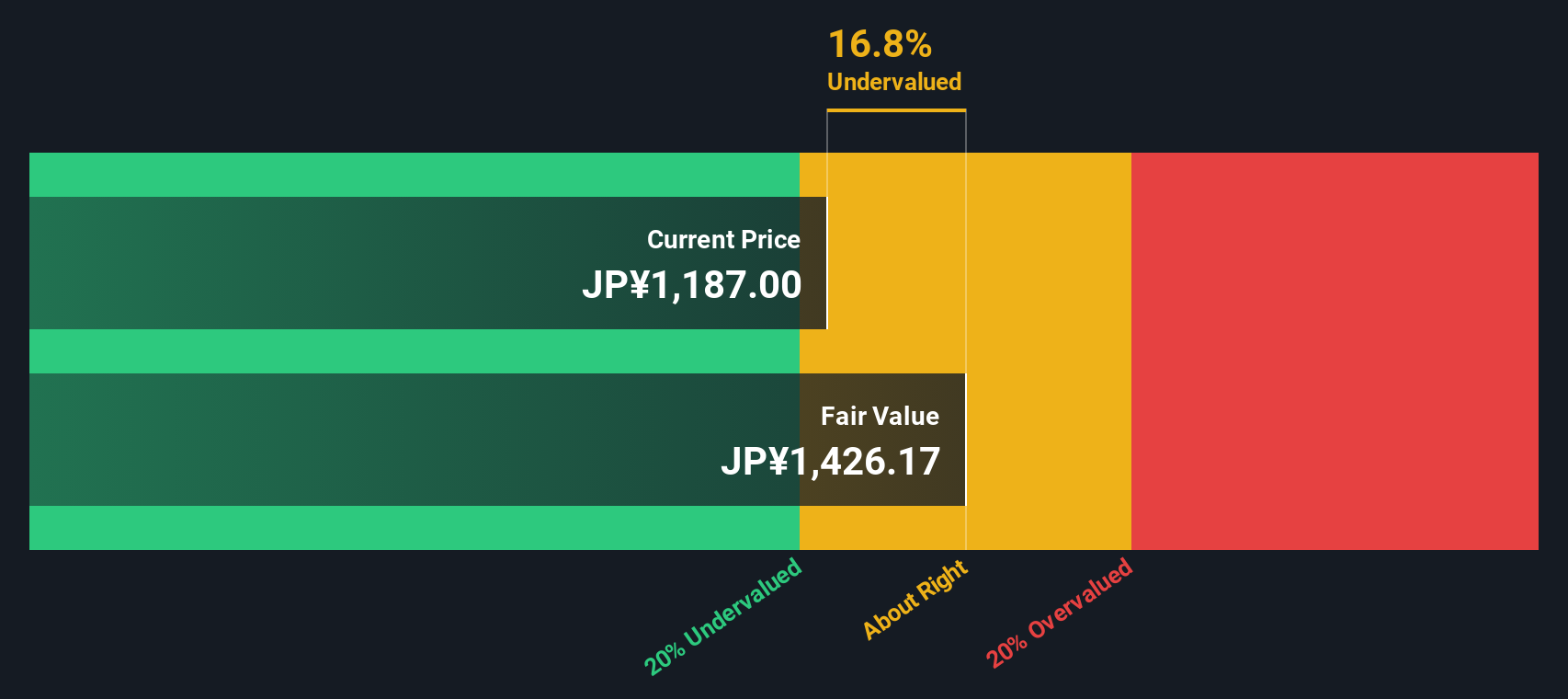

Another View: SWS DCF Model Sees Undervaluation

While multiples suggest Daiwa Securities Group is slightly overvalued, the SWS DCF model estimates fair value at ¥1,427.12, which is 17% above the current share price. This approach points to hidden value that markets may be overlooking. Which version tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daiwa Securities Group Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Daiwa Securities Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your strategy to just one stock. Unlock your potential by scanning the market for stocks poised for breakout moments and long-term financial reward.

- Boost your portfolio’s yield and tap into cash flow opportunities through these 19 dividend stocks with yields > 3% which offers attractive returns above 3%.

- Capitalize on the rapid growth of healthcare innovation by checking out these 31 healthcare AI stocks that is making waves in medicine and diagnostics.

- Ride the momentum of next-generation money by seizing possibilities with these 78 cryptocurrency and blockchain stocks with a focus on blockchain breakthroughs and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8601

Daiwa Securities Group

Operates in the financial and capital markets in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives