- China

- /

- Auto Components

- /

- SHSE:603166

GUILIN FUDALtd Leads These 3 Undiscovered Gems in Asia

Reviewed by Simply Wall St

As global markets experience a shift with easing trade tensions and fluctuating economic indicators, small-cap stocks in Asia are gaining attention for their potential resilience and growth opportunities. In this dynamic environment, identifying promising companies like GUILIN FUDALtd can be crucial, as they may offer unique advantages through innovative strategies or niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Sinopower Semiconductor | NA | 2.33% | -2.02% | ★★★★★★ |

| Jih Lin Technology | 54.75% | 3.06% | 3.16% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.81% | 6.46% | 4.29% | ★★★★★★ |

| Sublime China Information | NA | 6.48% | 3.97% | ★★★★★★ |

| JHT DesignLtd | 2.19% | 33.65% | -8.51% | ★★★★★★ |

| Qingmu Tec | 0.53% | 12.87% | -12.65% | ★★★★★☆ |

| Sinotherapeutics | 0.00% | 15.14% | 3.91% | ★★★★★☆ |

| Systex | 28.43% | 11.80% | -1.76% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 106.99% | 8.34% | 40.95% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

GUILIN FUDALtd (SHSE:603166)

Simply Wall St Value Rating: ★★★★★☆

Overview: GUILIN FUDA Co., Ltd. engages in the research, development, production, and sale of auto parts and components in China, with a market capitalization of approximately CN¥9.51 billion.

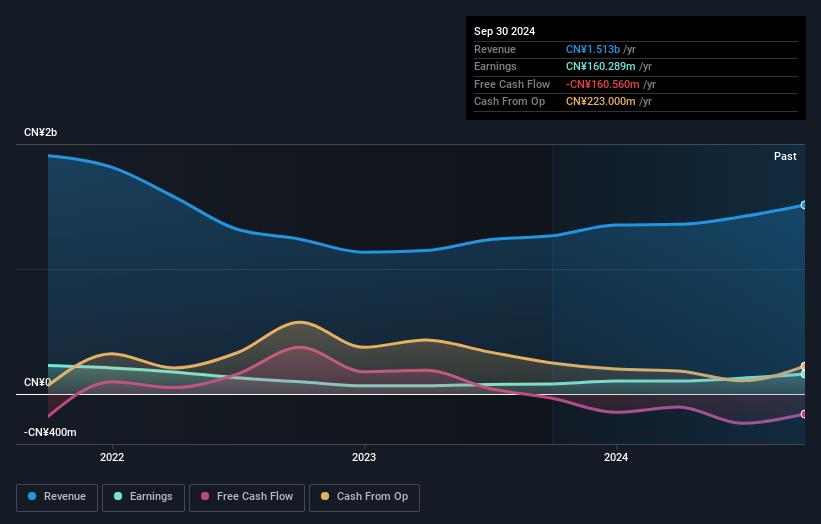

Operations: GUILIN FUDA Co., Ltd. generates revenue primarily through the sale of auto parts and components in China. The company's financial performance is reflected in its net profit margin, which shows a trend of improvement over recent periods.

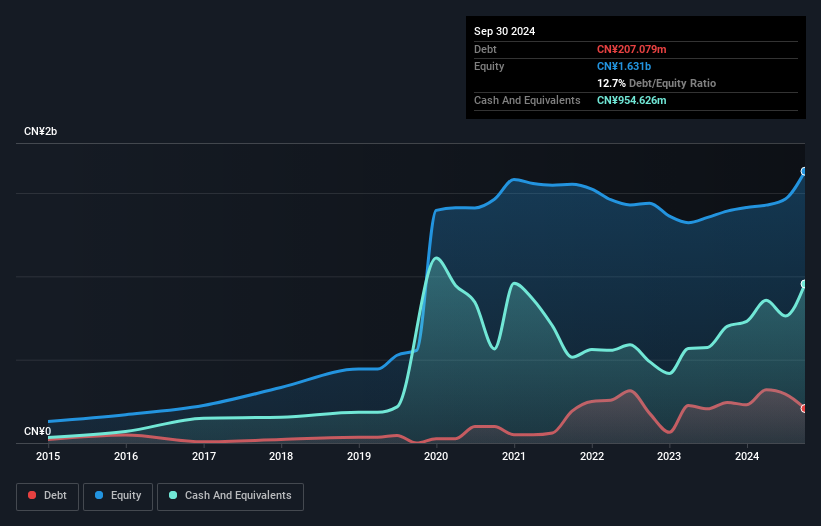

Guilin FUDA Ltd., a notable player in the auto components sector, has shown impressive earnings growth of 109.1% over the past year, significantly outpacing the industry's 7.8%. The company's net debt to equity ratio stands at a satisfactory 28.6%, highlighting prudent financial management despite an increase from 21.7% to 39.9% over five years. Recent earnings results for Q1 2025 revealed sales of CNY 471.08 million and net income of CNY 65.11 million, both showing substantial improvement compared to last year’s figures, reflecting strong operational performance amidst market volatility and positioning it well for future growth prospects with forecasted annual earnings growth of nearly 30%.

- Take a closer look at GUILIN FUDALtd's potential here in our health report.

Gain insights into GUILIN FUDALtd's past trends and performance with our Past report.

Streamax Technology (SZSE:002970)

Simply Wall St Value Rating: ★★★★★☆

Overview: Streamax Technology Co., Ltd. specializes in creating AI-powered mobile safety and industrial management solutions for commercial vehicles, with a market cap of CN¥8.85 billion.

Operations: Streamax Technology generates revenue through the sale of AI-powered solutions for mobile safety and industrial management in commercial vehicles. The company focuses on both domestic and international markets, leveraging its research and development capabilities to enhance product offerings.

Streamax Technology is demonstrating robust growth, with earnings surging 157.7% over the past year, far outpacing the Auto Components industry average of 7.8%. The company's debt-to-equity ratio has risen significantly from 1.8 to 22.1 over five years, yet it holds more cash than total debt, indicating a strong financial position. Its price-to-earnings ratio stands at an attractive 26.2x compared to the broader CN market's 36.8x, suggesting good value relative to peers and industry standards. Recent earnings reveal net income of CNY100 million for Q1 2025, a substantial increase from CNY53 million last year, reflecting solid operational performance despite share price volatility in recent months.

JAFCO Group (TSE:8595)

Simply Wall St Value Rating: ★★★★★☆

Overview: JAFCO Group Co., Ltd. is a venture capital firm that focuses on investment and management of funds, with a market capitalization of ¥131.67 billion.

Operations: JAFCO Group generates revenue primarily from its fund management segment, which contributed ¥29.69 billion. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

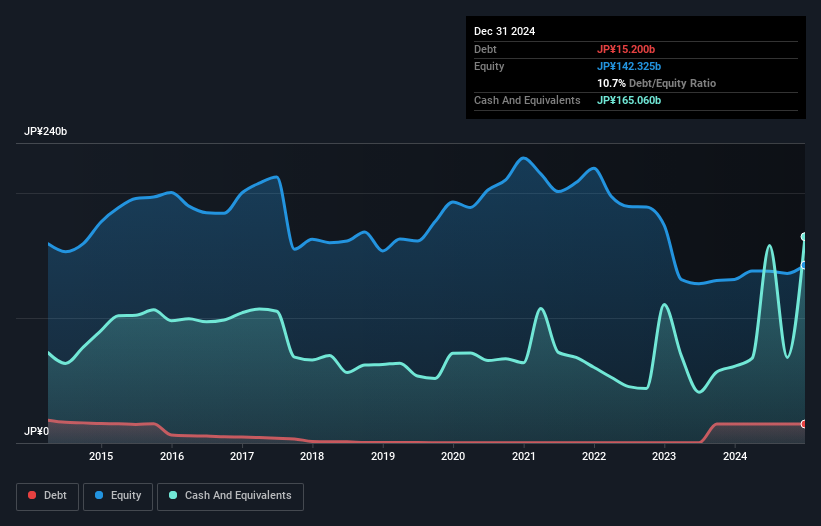

JAFCO Group, a notable player in the Asian market, shows promising potential with earnings growth of 27.8% last year, outpacing the Capital Markets industry average of 15.6%. The company trades at a significant discount of 29.1% below its estimated fair value and maintains high-quality earnings. Over the past five years, its debt to equity ratio has risen from 0.1% to 10.8%, but it still holds more cash than total debt, ensuring financial stability. Recently announced share repurchase program aims to buy back up to 3.5 million shares for ¥5 billion (approximately US$37 million), enhancing shareholder returns and corporate value.

- Unlock comprehensive insights into our analysis of JAFCO Group stock in this health report.

Examine JAFCO Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Get an in-depth perspective on all 2652 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GUILIN FUDALtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603166

GUILIN FUDALtd

Researches and develops, produces, and sells auto parts and components in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives