- Japan

- /

- Diversified Financial

- /

- TSE:7198

3 Stocks That May Be Priced Below Their Estimated Worth In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of trade policies and technological advancements, major indices like the S&P 500 have reached new heights, buoyed by optimism around potential tariff reductions and AI developments. Despite this upward momentum, discerning investors are on the lookout for stocks that may be undervalued amidst these market dynamics. Identifying such stocks involves assessing factors like intrinsic value compared to current market price, which can reveal opportunities even when broader market sentiment is high.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Subros (BSE:517168) | ₹600.55 | ₹1196.98 | 49.8% |

| Round One (TSE:4680) | ¥1302.00 | ¥2590.44 | 49.7% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.14 | 50% |

| GlobalData (AIM:DATA) | £1.785 | £3.57 | 49.9% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.93 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37697.69 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €6.76 | €13.46 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.01 | 49.8% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.86 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

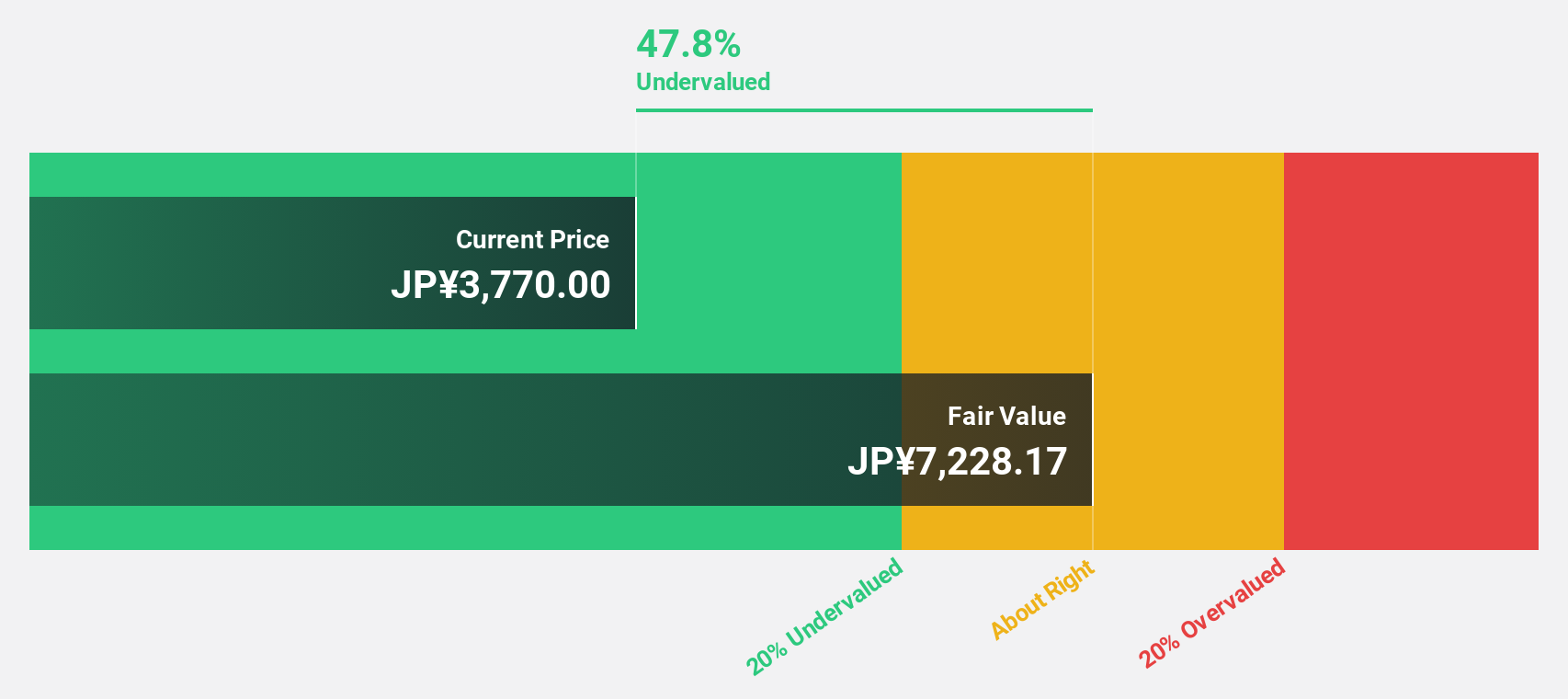

Strike CompanyLimited (TSE:6196)

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥70.95 billion.

Operations: The company generates revenue through its mergers and acquisitions brokerage services targeted at small and medium-sized enterprises in Japan.

Estimated Discount To Fair Value: 48.8%

Strike Company Limited is trading at ¥3,695, significantly below its estimated fair value of ¥7,217.70. Despite recent share price volatility, earnings grew by 28.2% last year and are forecast to grow 13.74% annually, outpacing the JP market's 8.1%. The company has increased its dividend from ¥51 to ¥91 per share and projects further growth to ¥102 next year. Revenue is expected to rise faster than the market at 16.5% annually.

- The growth report we've compiled suggests that Strike CompanyLimited's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Strike CompanyLimited's balance sheet health report.

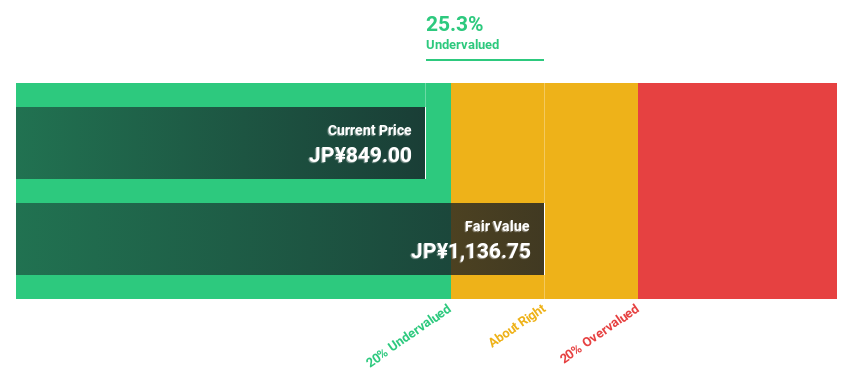

SBI ARUHI (TSE:7198)

Overview: SBI ARUHI Corporation operates as a mortgage bank in Japan with a market cap of ¥39.54 billion.

Operations: The company generates revenue from its housing loan related business, amounting to ¥22.27 billion.

Estimated Discount To Fair Value: 41.9%

SBI ARUHI is trading at ¥892, significantly below its estimated fair value of ¥1,536.48, suggesting it is undervalued based on cash flows. Despite this, debt coverage by operating cash flow remains a concern. Earnings are forecast to grow significantly at 20.2% annually, outpacing the JP market's 8.1%, though revenue growth is slower at 12.3%. The dividend yield of 4.48% isn't well supported by free cash flows despite recent affirmations of stability.

- Our comprehensive growth report raises the possibility that SBI ARUHI is poised for substantial financial growth.

- Take a closer look at SBI ARUHI's balance sheet health here in our report.

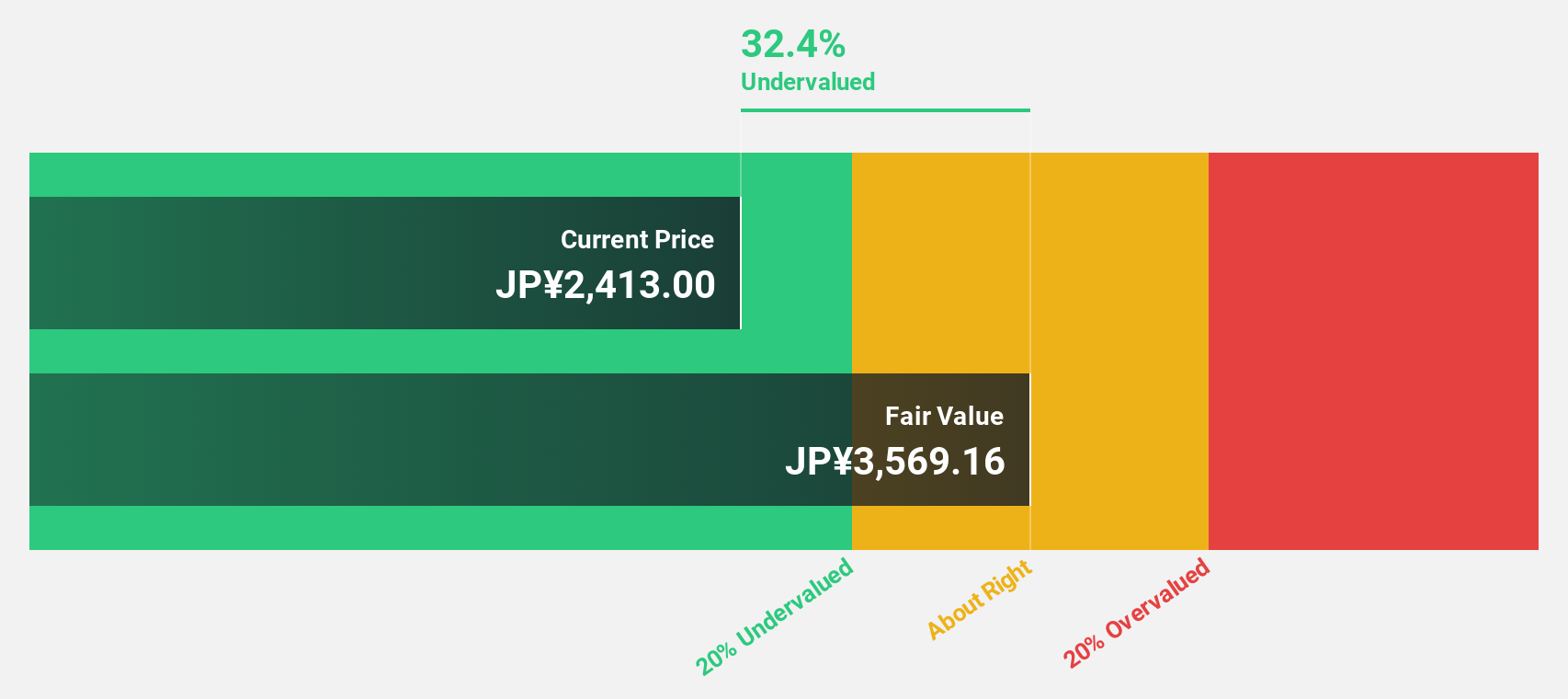

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan with a market cap of ¥174.14 billion.

Operations: The company generates revenue by acquiring, renovating, and selling pre-owned residential properties to consumers in Japan.

Estimated Discount To Fair Value: 36.8%

KATITAS is trading at ¥2227, well below its estimated fair value of ¥3525.97, indicating undervaluation based on cash flows. Earnings grew by 76.9% last year and are expected to grow annually at 9.7%, surpassing the JP market's growth rate of 8.1%. Revenue is forecast to grow faster than the market but remains below high-growth benchmarks. Despite recent dividend increases, the company's dividend track record lacks stability, which could be a concern for income-focused investors.

- The analysis detailed in our KATITAS growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of KATITAS.

Make It Happen

- Explore the 896 names from our Undervalued Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7198

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives