- Japan

- /

- Diversified Financial

- /

- TSE:7191

Entrust's (TSE:7191) Upcoming Dividend Will Be Larger Than Last Year's

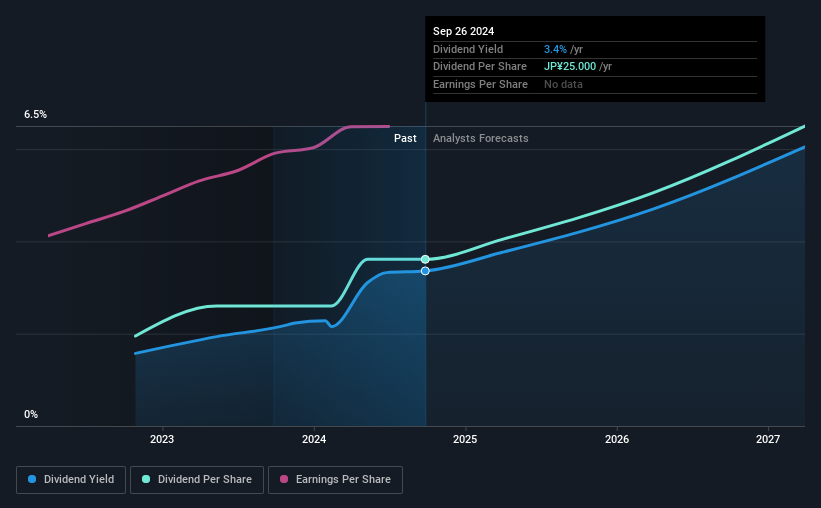

Entrust Inc.'s (TSE:7191) dividend will be increasing from last year's payment of the same period to ¥12.50 on 4th of December. This takes the annual payment to 3.4% of the current stock price, which is about average for the industry.

Check out our latest analysis for Entrust

Entrust's Payment Could Potentially Have Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Before making this announcement, Entrust was paying a whopping 378% as a dividend, but this only made up 33% of its overall earnings. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, earnings per share is forecast to rise by 11.5% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 35%, which is in the range that makes us comfortable with the sustainability of the dividend.

Entrust Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 2 years was ¥13.50 in 2022, and the most recent fiscal year payment was ¥25.00. This means that it has been growing its distributions at 36% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

We Could See Entrust's Dividend Growing

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that Entrust has grown earnings per share at 9.5% per year over the past five years. Entrust definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Entrust that investors need to be conscious of moving forward. Is Entrust not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Entrust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7191

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)