- Japan

- /

- Diversified Financial

- /

- TSE:7191

Entrust's (TSE:7191) Shareholders Will Receive A Bigger Dividend Than Last Year

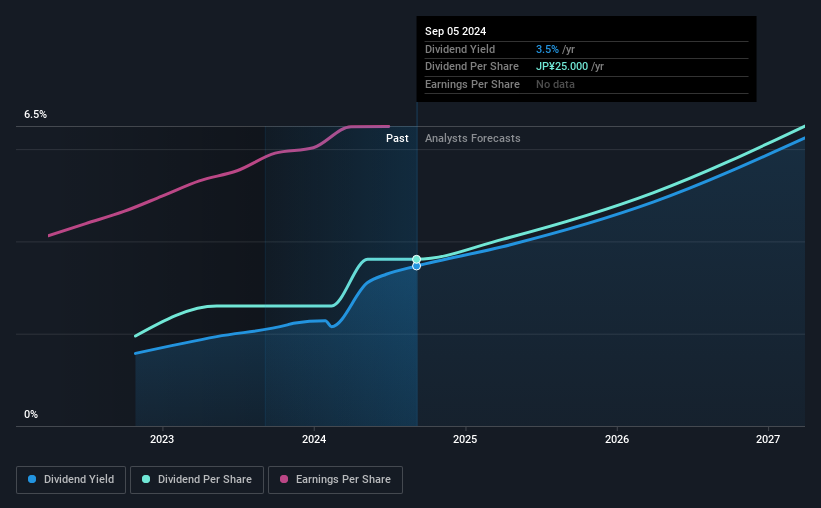

The board of Entrust Inc. (TSE:7191) has announced that it will be paying its dividend of ¥12.50 on the 4th of December, an increased payment from last year's comparable dividend. Based on this payment, the dividend yield for the company will be 3.5%, which is fairly typical for the industry.

See our latest analysis for Entrust

Entrust's Future Dividend Projections Appear Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, Entrust was paying only paying out a fraction of earnings, but the payment was a massive 378% of cash flows. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Looking forward, earnings per share is forecast to rise by 11.5% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 35% by next year, which is in a pretty sustainable range.

Entrust Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from an annual total of ¥13.50 in 2022 to the most recent total annual payment of ¥25.00. This implies that the company grew its distributions at a yearly rate of about 36% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Entrust Could Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Entrust has grown earnings per share at 9.5% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Entrust's payments are rock solid. While Entrust is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Entrust that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Entrust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7191

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)