3 Japanese Exchange Stocks Estimated To Be Trading At Up To 39.1% Discount

Reviewed by Simply Wall St

Japan’s stock markets have shown strong performance recently, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weakening yen following the U.S. Federal Reserve's significant rate cut. Amid this favorable market environment, identifying undervalued stocks can offer investors potential opportunities for growth. In this article, we will explore three Japanese exchange stocks that are estimated to be trading at up to a 39.1% discount, providing insights into what makes them compelling choices in today's market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3545.00 | ¥6793.71 | 47.8% |

| Stella Chemifa (TSE:4109) | ¥4105.00 | ¥8107.70 | 49.4% |

| Avant Group (TSE:3836) | ¥2150.00 | ¥3969.33 | 45.8% |

| I-PEX (TSE:6640) | ¥1580.00 | ¥2913.66 | 45.8% |

| West Holdings (TSE:1407) | ¥2533.00 | ¥5017.80 | 49.5% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2179.00 | ¥4152.44 | 47.5% |

| SaizeriyaLtd (TSE:7581) | ¥5350.00 | ¥10078.17 | 46.9% |

| Kadokawa (TSE:9468) | ¥3020.00 | ¥5574.56 | 45.8% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3185.00 | ¥5945.82 | 46.4% |

| Visional (TSE:4194) | ¥8510.00 | ¥16907.93 | 49.7% |

We'll examine a selection from our screener results.

Nihon M&A Center Holdings (TSE:2127)

Overview: Nihon M&A Center Holdings Inc. provides mergers and acquisition (M&A) related services in Japan and internationally, with a market cap of ¥212.69 billion.

Operations: The company generates revenue primarily through its M&A Consulting Business, which amounted to ¥43.53 billion.

Estimated Discount To Fair Value: 23.9%

Nihon M&A Center Holdings is trading at ¥670.6, which is 23.9% below the estimated fair value of ¥880.8 based on discounted cash flow analysis, indicating it may be undervalued. The company’s earnings are forecast to grow at 9.7% per year, outpacing the Japanese market's average of 8.6%. Additionally, its revenue growth rate of 9.5% per year surpasses the JP market's 4.3%, reinforcing its potential as an undervalued investment based on cash flows.

- Our expertly prepared growth report on Nihon M&A Center Holdings implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Nihon M&A Center Holdings.

THK (TSE:6481)

Overview: THK Co., Ltd. manufactures and sells mechanical components globally, with a market cap of ¥311.62 billion.

Operations: THK Co., Ltd. generates revenue from various regions, including ¥60.45 billion from China, ¥162.26 billion from Japan, ¥71.28 billion from Europe, and ¥94.66 billion from the Americas.

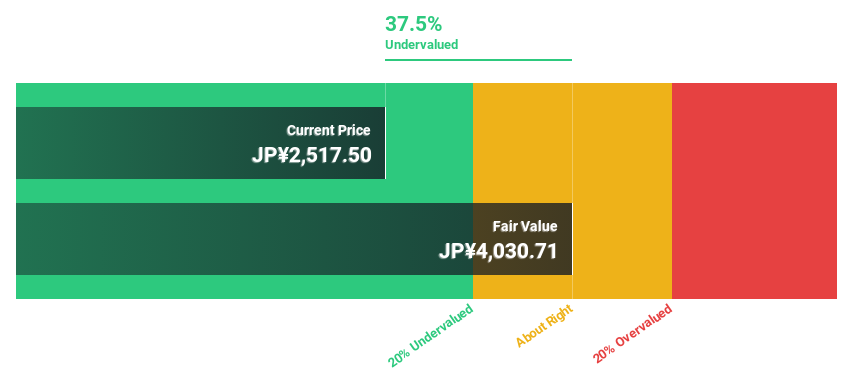

Estimated Discount To Fair Value: 39.1%

THK Co., Ltd. is trading at ¥2541.5, significantly below its estimated fair value of ¥4172.05 based on discounted cash flow analysis, suggesting it is undervalued. The company's revenue is expected to grow at 6% per year, outpacing the JP market's 4.3%, while earnings are projected to increase by a substantial 21% annually over the next three years. However, recent guidance indicated a reduction in dividends from JPY 30 to JPY 18 per share for Q2 2024.

- Our comprehensive growth report raises the possibility that THK is poised for substantial financial growth.

- Navigate through the intricacies of THK with our comprehensive financial health report here.

Relo Group (TSE:8876)

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥283.96 billion.

Operations: Relo Group's revenue segments include ¥25.94 billion from Welfare Program, ¥14.64 billion from Tourism Business, and ¥95.54 billion from Relocation Business.

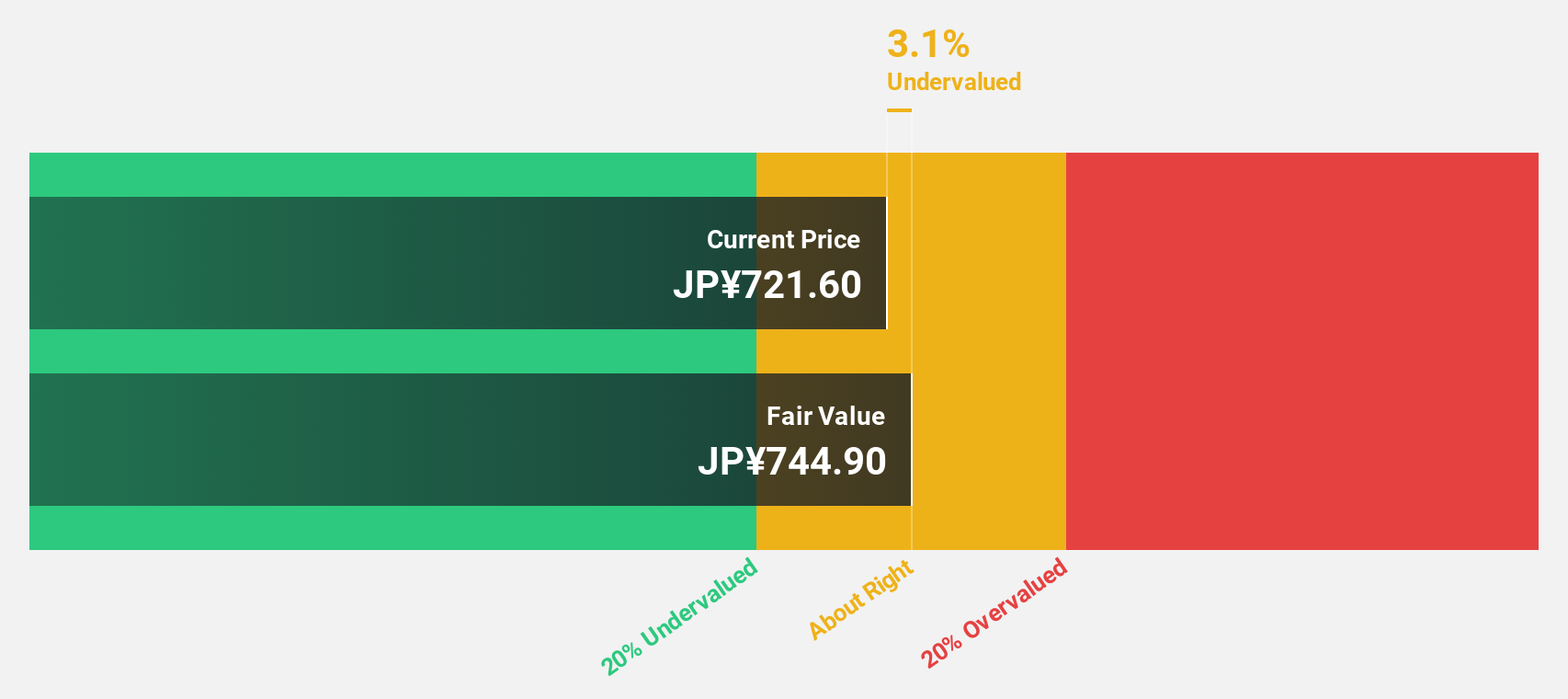

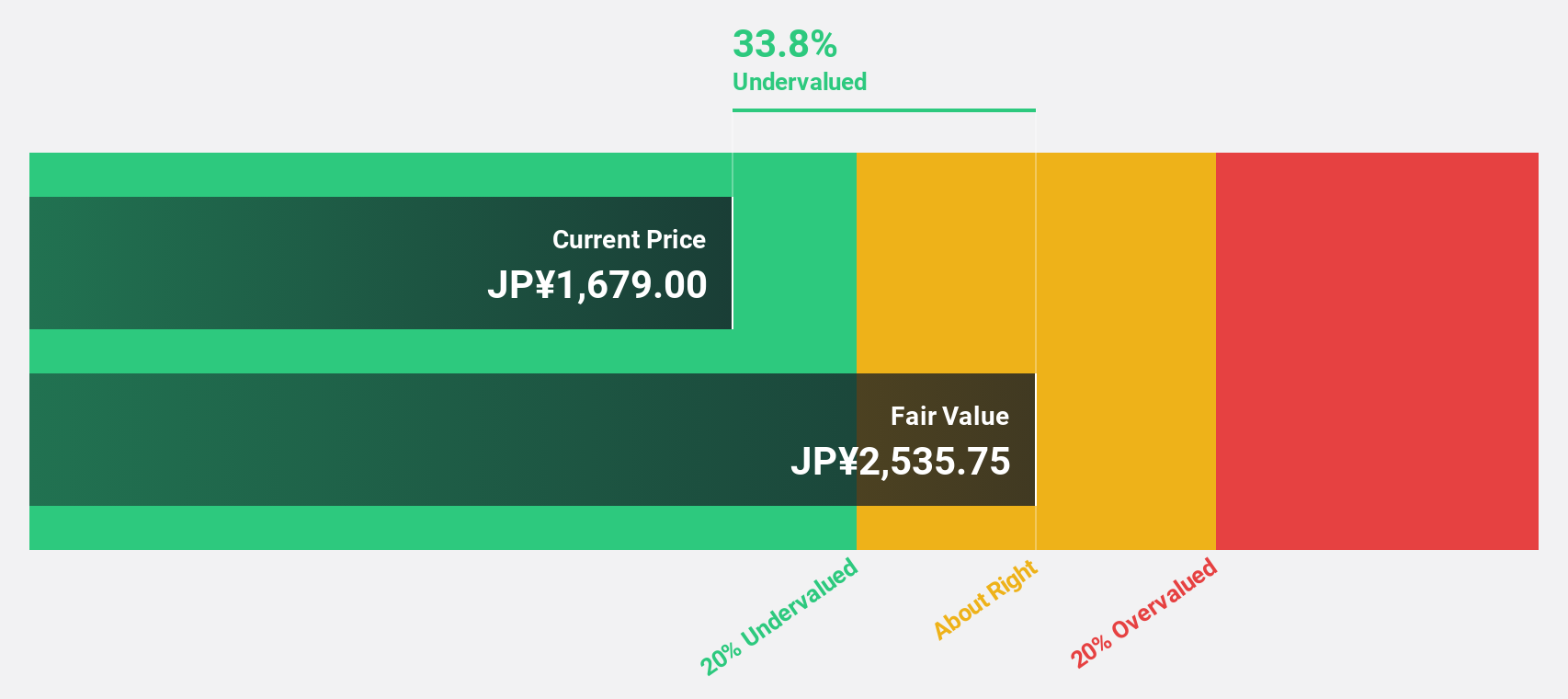

Estimated Discount To Fair Value: 23.6%

Relo Group, Inc. is trading at ¥1879, below its estimated fair value of ¥2459.67 based on discounted cash flow analysis, indicating it is undervalued by more than 20%. The company’s earnings are forecast to grow 23.29% annually, and it is expected to become profitable within three years. Recent announcements include a share repurchase program worth ¥5.5 billion for 4 million shares to improve capital efficiency and adapt to management changes.

- The growth report we've compiled suggests that Relo Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Relo Group.

Turning Ideas Into Actions

- Delve into our full catalog of 79 Undervalued Japanese Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6481

THK

Engages in the manufacture and sale of mechanical components worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives