- Japan

- /

- Consumer Services

- /

- TSE:9338

Discovering oRo And 2 Other Hidden Japanese Gems

Reviewed by Simply Wall St

As Japan's stock markets show signs of resilience, with both the Nikkei 225 and TOPIX Index recovering from early-month sell-offs, investors are increasingly looking towards small-cap opportunities that may have been overlooked. In this environment, discovering stocks with strong fundamentals and growth potential becomes crucial for capitalizing on market movements. A good stock in today's Japanese market is one that not only demonstrates solid financial health but also shows promise in navigating economic shifts and leveraging unique market positions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

oRo (TSE:3983)

Simply Wall St Value Rating: ★★★★★★

Overview: oRo Co., Ltd. engages in the provision of cloud and digital transformation solutions and has a market cap of ¥36.56 billion.

Operations: Revenue streams for oRo Co., Ltd. are primarily derived from its cloud and digital transformation solutions. The company has a market cap of ¥36.56 billion.

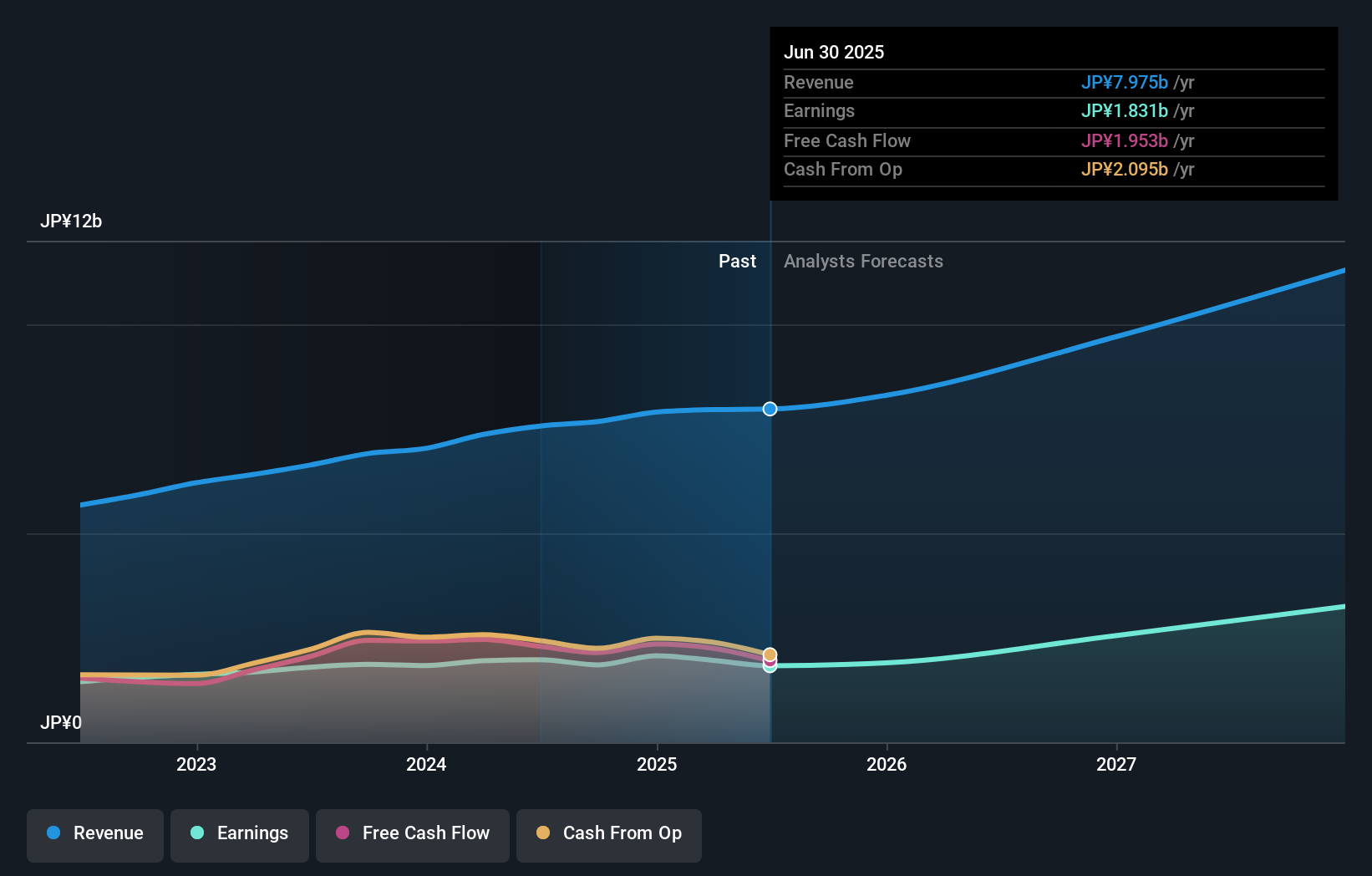

oRo, a promising player in Japan's tech sector, has shown consistent financial health. The company is debt-free and has been so for the past five years. Trading at 26.4% below its estimated fair value, it offers attractive valuation prospects. Earnings have grown 17.2% annually over the last five years, with future growth forecasted at 14.23% per year. Despite a recent earnings growth of 9.9%, slightly underperforming the IT industry’s 10.1%, oRo remains profitable with high-quality earnings and positive free cash flow (¥2,293M).

- Navigate through the intricacies of oRo with our comprehensive health report here.

Evaluate oRo's historical performance by accessing our past performance report.

GMO Financial Gate (TSE:4051)

Simply Wall St Value Rating: ★★★★★☆

Overview: GMO Financial Gate, Inc. provides cashless payment infrastructure in Japan and has a market cap of ¥62.49 billion.

Operations: GMO Financial Gate generates revenue primarily from providing cashless payment infrastructure in Japan. For the latest fiscal period, the company reported a gross profit margin of 45.67%. Operating expenses and cost of sales are significant components impacting its financial performance.

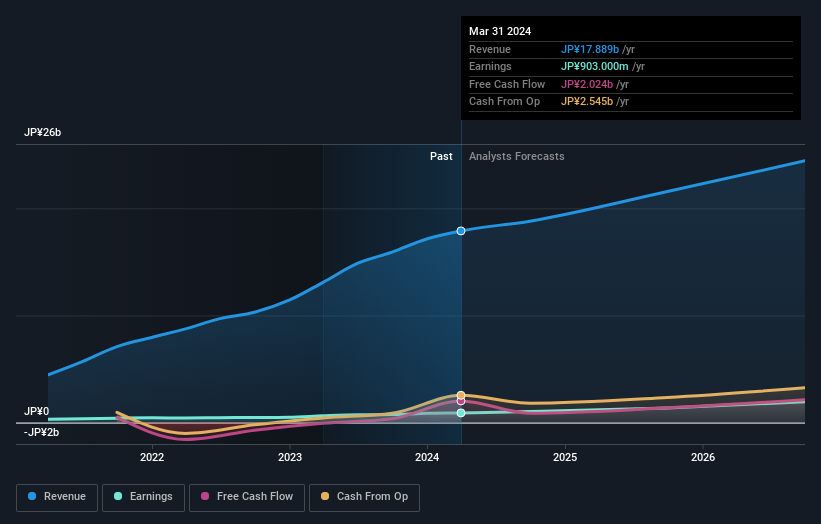

GMO Financial Gate has demonstrated robust financial health, with its interest payments well covered by EBIT at 128.1x and a notable earnings growth of 42.9% over the past year, surpassing the Diversified Financial industry’s 27.1%. Over five years, its debt to equity ratio increased from 0% to 37.5%, indicating a strategic leverage approach. The company recently provided guidance for FY2024, expecting revenue of ¥19.2 billion and operating profit of ¥1.41 billion, reflecting strong future prospects.

Inforich (TSE:9338)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inforich Inc. provides portable power bank sharing services in Japan and has a market cap of ¥36.63 billion.

Operations: Inforich Inc.'s revenue primarily comes from its portable power bank sharing services in Japan. The company reported a market cap of ¥36.63 billion.

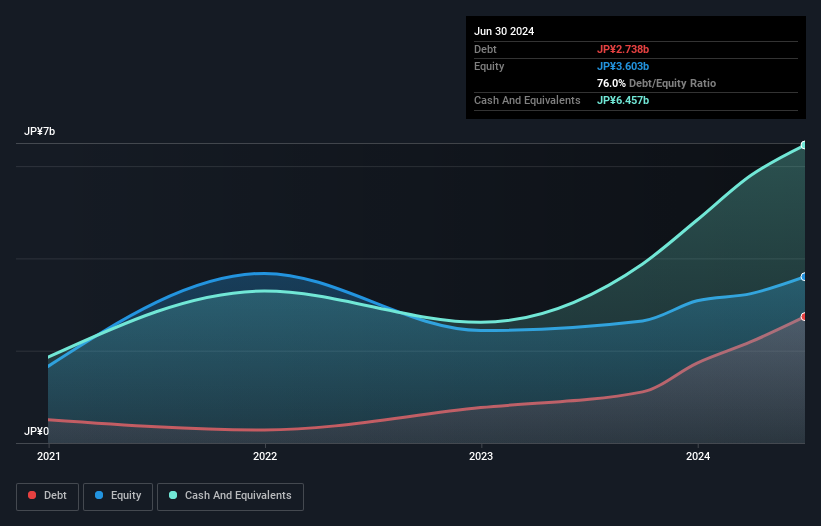

Inforich, trading at 80% below its estimated fair value, has shown significant promise by becoming profitable in the past year. Despite a large one-off loss of ¥224M impacting its latest financial results to June 30, 2024, the company's EBIT covers interest payments 11.6 times over. Recent moves include establishing INFORICH Europe Limited in London to expand its ChargeSPOT business into Europe, leveraging success in Asia and Australia. Earnings are projected to grow by 30% annually.

- Click here to discover the nuances of Inforich with our detailed analytical health report.

Assess Inforich's past performance with our detailed historical performance reports.

Next Steps

- Discover the full array of 751 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9338

Exceptional growth potential with solid track record.

Market Insights

Community Narratives